ETFGI reports assets in the global ETFs and ETPs industry broke through the US$ 9 trillion milestone at the end of May 2021

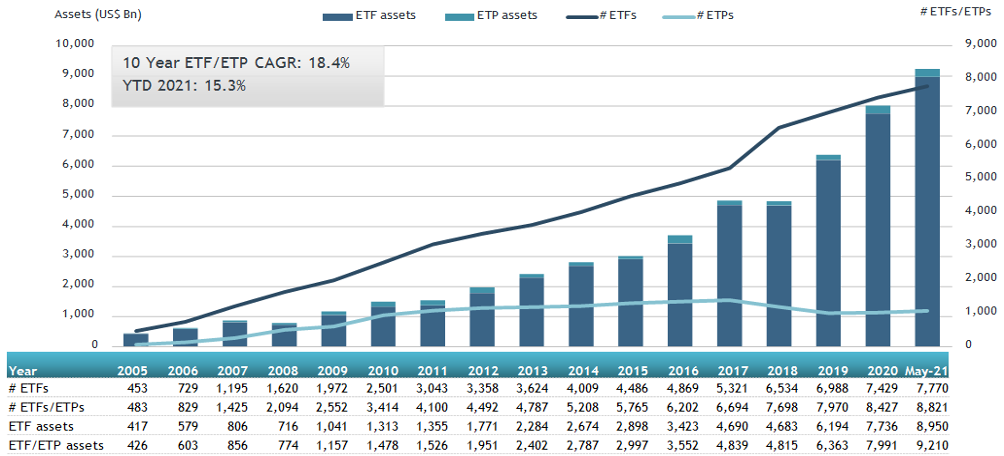

LONDON —June 16, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in the global ETFs and ETPs industry broke through the US$ 9 trillion milestone at the end of May 2021. ETFs and ETPs listed globally gathered net inflows of US$97.08 billion during May, bringing year-to-date net inflows to a record US$559.48 billion which is higher than the prior record of US$229.34 billion gathered at this point last year. Assets invested in the global ETFs and ETPs industry increased by 2.8% from US$8.96 trillion at the end of April 2021, to a record US$9.21 trillion at the end of May, according to ETFGI's May 2021 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the global ETFs and ETPs industry break through the $9 trillion milestone.

- Record $9.21 trillion invested in ETFs and ETPs listed globally at the end of May.

- Record YTD net inflows of $559.48 Bn beating the prior record of $229.34 Bn gathered YTD in 2020.

- 24 consecutive months of net inflows into global ETFs and ETPs

- Equity ETFs and ETPs attracted the majority of net inflows in May and YTD.

“The S&P 500 gained 0.7% in May and 12.62% YTD, with positive figures for four consecutive months. Developed markets ex-U.S. gained 3.11% in May. Austria 8.29% and Luxembourg 8.12% were the leaders for the month while New Zealand lost the most at 3.92%. Emerging markets were up 2.58% at the end of May. Hungary (up 15.54%) and Poland (up 13.98%) were the leaders, whilst Egypt (down 3.86%), Chile (down 3.64%), and Malaysia (down 2.79%) were down the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of May 2021

The Global ETFs and ETPs industry had 8,821 products with 17,920 listings, assets of $9.210 trillion, from 550 providers listed on 78 exchanges in 63 countries at the end of May.

During May, ETFs and ETPs gathered net inflows of $97.08 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $63.06 Bn in May, bringing net inflows for 2021 to $396.94 Bn, which is much greater than the $72.91 Bn in net inflows equity products attracted YTD in 2020. Fixed Income ETFs/ETPs listed globally reported net inflows of $20.66 Bn during May, bringing net inflows for 2021 to $85.69 Bn, higher than the $65.86 Bn in net inflows fixed income products attracted YTD in 2020. Commodity ETFs/ETPs listed globally gathered net inflows of $3.83 Bn, bringing net outflows for 2021 to $3.59 Bn, significantly lower than the $48.93 Bn in net inflows commodity products had attracted over the same period in 2020. Active ETFs/ETPs reported $12.08 Bn in net inflows, bringing net inflows for 2021 to $74.03 Bn, significantly higher than the $19.47 Bn in net inflows active products attracted YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $35.37 Bn during May. Vanguard S&P 500 ETF (VOO US) gathered $3.58 Bn the largest indviual net inflow.

Top 20 ETFs by net new inflows May 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

|

VOO US |

225,706.38 |

24,178.69 |

3,576.05 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

243,653.31 |

16,853.58 |

2,703.27 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

|

511990 CH |

29,302.37 |

10,938.94 |

2,653.93 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

96,942.43 |

3,825.55 |

2,103.42 |

|

JPMorgan BetaBuilders Europe ETF |

|

BBEU US |

8,616.93 |

4,564.37 |

2,077.81 |

|

Vanguard Value ETF |

|

VTV US |

81,905.63 |

8,988.94 |

2,026.87 |

|

Vanguard Short-Term Bond ETF |

|

BSV US |

34,132.40 |

4,774.76 |

1,884.66 |

|

Huatai-Pinebridge CSI 300 ETF |

|

510300 CH |

8,852.29 |

1,352.41 |

1,850.41 |

|

Financial Select Sector SPDR Fund |

|

XLF US |

44,835.00 |

11,151.17 |

1,587.63 |

|

iShares Global Financials ETF |

|

IXG US |

2,669.70 |

2,195.59 |

1,584.87 |

|

Health Care Select Sector SPDR Fund |

|

XLV US |

27,714.79 |

(60.59) |

1,583.26 |

|

Invesco S&P 500 Equal Weight ETF |

|

RSP US |

28,680.03 |

6,678.31 |

1,550.49 |

|

iShares Commodities Select Strategy ETF |

|

COMT US |

2,059.02 |

1,755.12 |

1,344.38 |

|

Vanguard FTSE Europe ETF |

|

VGK US |

18,941.27 |

2,495.98 |

1,329.83 |

|

Vanguard Real Estate ETF |

|

VNQ US |

39,986.46 |

3,281.29 |

1,312.81 |

|

Yuanta/P-shares Taiwan Top 50 ETF |

|

0050 TT |

6,205.31 |

1,423.54 |

1,295.84 |

|

Materials Select Sector SPDR Trust |

|

XLB US |

9,733.26 |

3,258.06 |

1,242.23 |

|

iShares Core Total USD Bond Market ETF |

|

IUSB US |

13,967.88 |

8,168.36 |

1,236.31 |

|

iShares TIPS Bond ETF |

|

TIP US |

28,405.49 |

1,914.97 |

1,223.17 |

|

Vanguard Total Bond Market ETF |

|

BND US |

75,150.70 |

9,498.59 |

1,200.35 |

The top 10 ETPs by net new assets collectively gathered $4.41 Bn over May. SPDR Gold Shares (GLD US) gathered $1.57 Bn the largest indviual net inflow.

Top 10 ETPs by net new inflows May 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

|

GLD US |

62,558.36 |

(7,037.55) |

1,570.75 |

|

iShares Physical Gold ETC - Acc |

|

SGLN LN |

14,452.86 |

118.42 |

510.09 |

|

Invesco Physical Gold ETC - Acc |

|

SGLD LN |

13,694.89 |

(289.59) |

383.03 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

|

XGDU LN |

1,924.67 |

1,557.26 |

365.52 |

|

Xetra Gold EUR - Acc |

|

4GLD GY |

14,211.72 |

881.16 |

343.94 |

|

iShares Gold Trust |

|

IAU US |

30,570.66 |

(1,305.46) |

295.95 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

|

GOLD FP |

3,850.60 |

541.05 |

286.79 |

|

iShares Silver Trust |

|

SLV US |

15,927.55 |

671.52 |

263.40 |

|

Xtrackers IE Physical Gold ETC Securities - EUR Hdg Acc |

|

XGDE GY |

776.16 |

581.29 |

223.15 |

|

Invesco DB Commodity Index Tracking Fund |

|

DBC US |

2,484.20 |

734.97 |

164.59 |

Investors have tended to invest in Equity ETFs and ETPs during May.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

####

Register now for the ETFGI Global ETFs Insights Summits:

2nd Annual Europe & MEA, September 15th & 16th Register Here

2nd Annual Asia Pacific, November 2nd & 3rd Register Here

3rd Annual Canada, December 1st & 2nd Register Here

The summits are designed as educational events for institutional investors and financial advisors to provide substantive and in-depth discussion on the regulatory, trading, and technological developments impacting the use, selection and trading of ETFs. Exciting line up of speakers in fireside chats and panel discussions on timely and relevant topics with sponsor booths and virtual networking!

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

ETF TV News #78 David Mazza of Direxion discusses new leveraged 5G and Travel and Vacation ETFs with Deborah Fuhr #PressPlay https://bit.ly/2UcloIl

ETF TV News #78 David Mazza of Direxion discusses new leveraged 5G and Travel and Vacation ETFs with Deborah Fuhr #PressPlay https://bit.ly/2UcloIl

ETF TV News is sponsored by Syntax Advisors https://www.syntaxadvisors.com/. Syntax Advisors offers a family of Syntax Stratified ETFs that aim to deliver a diversified return by providing investors with rules-based exposure to business risks.

ETF TV News is sponsored by Syntax Advisors https://www.syntaxadvisors.com/. Syntax Advisors offers a family of Syntax Stratified ETFs that aim to deliver a diversified return by providing investors with rules-based exposure to business risks.

ETF TV News is a weekly new show which provides insights for investors into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view prior episodes. Please email relevant Press Releases and related stories to press@ETFtv.net For more information on ETF TV Oliver@ETFtv.net, Deborah.Fuhr@ETFtv.net

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()