ETFGI reports assets invested in Active ETFs and ETPs reached a record US$ 358 billion at the end of May 2021

LONDON — June 30, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in Active ETFs and ETPs reached a record US$358 billion at the end of May. Active ETFs and ETPs gathered net inflows of US$12.08 billion during May, bringing year-to-date net inflows to a record US$74.03 billion. Assets invested in active ETFs and ETPs finished the month up to 2.5%, from US$349 billion at the end of April to US$358 billion, according to ETFGI's May 2021 Active ETF and ETP industry landscape insights report, the monthly report which is part an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Active ETFs and ETPs reach a new record $358 Billion at end of May.

- Record YTD net inflows of $74.03 Bn beating the prior record of $19.47 Bn gathered YTD in 2020.

- Fourteenth month of consecutive net inflows

“The S&P 500 gained 0.7% in May and 12.62% YTD, with positive figures for four consecutive months. Developed markets ex-U.S. gained 3.11% in May. Austria 8.29% and Luxembourg 8.12% were the leaders of the month while New Zealand lost 3.92%. Emerging markets were up 2.58% at the end of May. Hungary (up 15.54%) and Poland (up 13.98%) were the leaders, whilst Egypt (down 3.86%), Chile (down 3.64%), and Malaysia (down 2.79%) were down the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

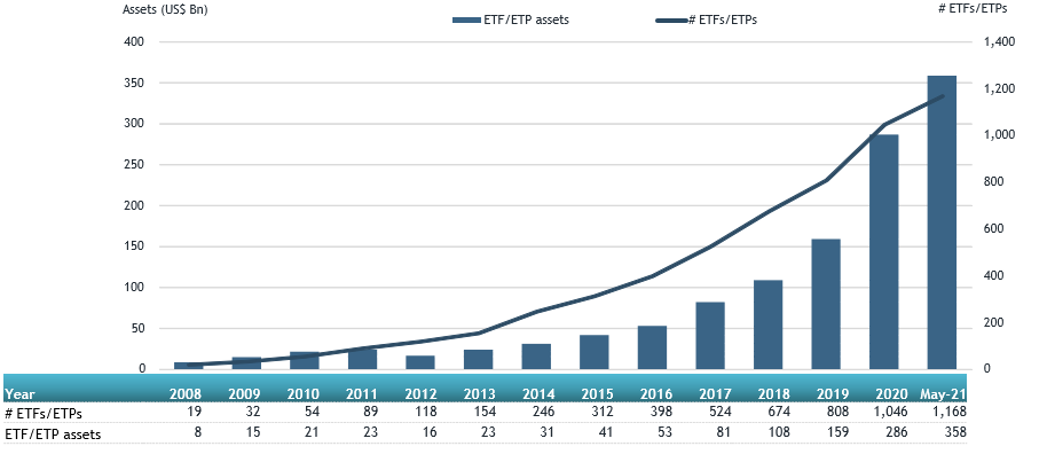

Growth in actively managed ETF and ETP assets as of the end of May 2021

Active ETFs and ETPs gathered net inflows of $12.08 billion during May. Fixed Income focused Active ETFs/ETPs listed globally gathered net inflows of $6.84 Bn during May, bringing net inflows YTD 2021 to $32.42 Bn, more than the $9.50 Bn in net inflows gathered YTD in 2020. Equity focused Active ETFs/ETPs listed globally attracted net inflows of $1.68 Bn during May, bringing net inflows YTD to $33.38 Bn, much greater than the $8.38 Bn in net inflows YTD in 2020.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered $9.66 Bn during May. Hwabao WP Cash Tianyi Listed Money Market Fund (511990 CH) gathered the largest net inflow $2.65 Bn.

Top 20 Active ETFs and ETPs by net new assets May 2021

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

29,302.37 |

10,938.94 |

2,653.93 |

|

iShares Commodities Select Strategy ETF |

COMT US |

2,059.02 |

1,755.12 |

1,344.38 |

|

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF |

PDBC US |

5,923.37 |

2,274.14 |

932.60 |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

5,058.25 |

732.34 |

698.00 |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

5,313.01 |

3,036.87 |

559.71 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

1,551.47 |

1,330.73 |

465.16 |

|

First Trust Global Tactical Commodity Strategy Fund |

FTGC US |

1,468.68 |

1,101.66 |

331.24 |

|

Vanguard Ultra Short-Term Bond ETF |

VUSB US |

706.41 |

710.67 |

297.95 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

3,239.67 |

2,242.77 |

295.64 |

|

First Trust Low Duration Mortgage Opportunities ETF |

LMBS US |

7,168.93 |

668.88 |

247.32 |

|

Desjardins Alt Long/Short Equity Market Neutral ETF |

DANC CN |

610.10 |

422.57 |

230.20 |

|

Innovator S&P 500 Power Buffer ETF-May |

PMAY US |

271.74 |

202.09 |

196.19 |

|

Avantis International Small Cap Value ETF |

AVDV US |

870.69 |

387.22 |

193.49 |

|

First Trust Preferred Securities and Income Fund |

FPE US |

6,656.98 |

709.54 |

193.10 |

|

JPMorgan EUR Ultra-Short Income UCITS ETF |

JSET LN |

1,182.45 |

331.07 |

186.96 |

|

Horizon Kinetics Inflation Beneficiaries ETF |

INFL US |

538.35 |

511.66 |

184.58 |

|

First Trust Senior Loan ETF |

FTSL US |

2,180.02 |

849.25 |

176.93 |

|

JPMorgan US Research Enhanced Index Equity UCITS ETF - Acc |

JREU LN |

331.14 |

136.89 |

172.56 |

|

Fidelity Limited Term Bond ETF |

FLTB US |

448.50 |

228.02 |

154.51 |

|

Adaptive Growth Opportunities ETF |

AGOX US |

153.20 |

150.07 |

150.07 |

Investors have tended to invest in Fixed Income active ETFs and ETPs during May.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Recent Active ETF interviews on ETF tv

ETF TV News #68 Jim Atkinson discusses converting first US mutual funds into ETFs with Deborah Fuhr #PressPlay https://bit.ly/39O6SLx

ETF TV News #68 Jim Atkinson discusses converting first US mutual funds into ETFs with Deborah Fuhr #PressPlay https://bit.ly/39O6SLx

ETF TV NEWS #60 Greg Friedman, Head of ETF Management and Strategy at Fidelity Investments discusses listing the Fidelity Magellan ETF with Deborah Fuhr ETFGI #PressPlay https://bit.ly/2LCl3KQ

ETF TV NEWS #60 Greg Friedman, Head of ETF Management and Strategy at Fidelity Investments discusses listing the Fidelity Magellan ETF with Deborah Fuhr ETFGI #PressPlay https://bit.ly/2LCl3KQ

ETF TV News www.ETFtv.net is sponsored by Syntax Advisors https://www.syntaxadvisors.com/.

ETF TV News www.ETFtv.net is sponsored by Syntax Advisors https://www.syntaxadvisors.com/.

For more information on ETF TV contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net

Register now for the 2nd Annual ETFGI Global ETFs Insights Summit - Europe & MEA (virtual), September 14 - 16.

Our summits are designed to provide the opportunity for institutional investors, RIAs and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others around the impact that market structure and regulations have on ETF product development for ESG and non-transparent active, due diligence, suitability, the use and trading, and technological developments of ETFs.

Topics Include:

- Panel sessions providing an overview of the ETF Landscape in South Africa, Africa, Saudi Arabia, Qatar and United Arab Emirates

- Regulatory Issues Impacting ETF Trading and Market Structure

- Creating Better Trading Systems and Tools for ETFs

- How a Consolidated Tape Could Contribute to the Development of ETFs in the EU

- Understanding Benchmark and Sustainable Finance Disclosure Regulations

- The Evolving Role of Index Providers

- Trends in Fixed Income Indices and ETFs

- Trends in ESG Indices

- Trends in Crypto Indices

- Active ETFs

- European Regulatory Initiatives Impacting ETFs

- US Regulatory Initiatives Impacting ETFs

- Macro Investment Outlook

- How Investors Are Implementing ESG Into Their Portfolios

- Responsible Investment and ESG Integration

- Investing in Digital Assets

- How Are Institutions and Financial Advisors Using ETFs?

- Women in ETFs – Managing Career Transitions

- ETF Landscape in Israel

- Trends That Will Drive the ETF and Financial Industry in 2021 and beyond

Visit the ETFGI website to see further updates as we continue building up the event agenda.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

Register now for the 2nd Annual ETFGI Global ETFs Insights Summit - Asia Pacific (virtual), November 2 - 3.

Our summits are designed to provide the opportunity for institutional investors, RIAs and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others around the impact that market structure and regulations have on ETF product development for ESG and non-transparent active, due diligence, suitability, the use and trading, and technological developments of ETFs.

Topics Include:

- Introduction to ETF Landscape in Asia Pacific

- Fireside Chat on an Update on Global and Local Regulatory Initiatives Impacting ETFs

- Update on Hong Kong ETF Market

- Best Practices When Trading US, European and Asia Listed ETFs from Asia

- Update on Singapore ETF Market

- Update on Trends in the US ETF Industry

- Update on the Mainland China ETF Market

- European ETF Industry Outlook

- How Regulators View ESG, Crypto and Digital Assets

- Global Macro Outlook

- Best Practices When Using ETFs in Portfolio Construction

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()