ETFGI reports assets invested in ETFs and ETPs listed in Japan reached a record US$556 billion at the end of May 2021

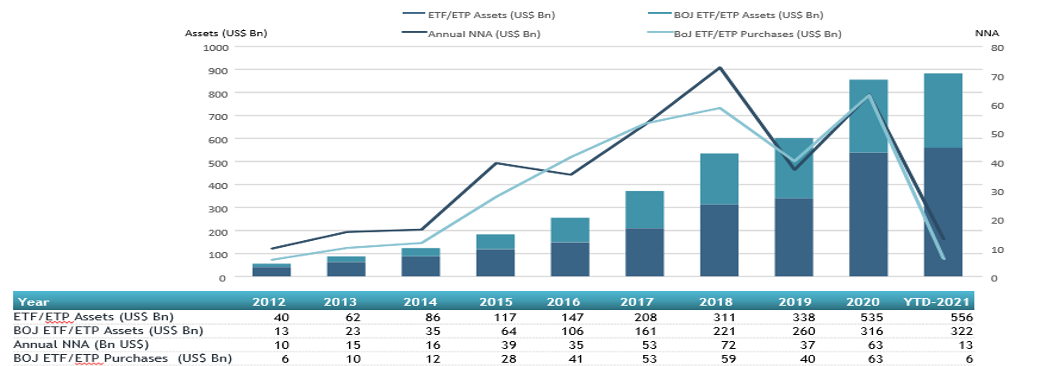

LONDON — June 29, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in ETFs and ETPs listed in Japan reached a record US$556 billion at the end of May. ETFs and ETPs listed in Japan gathered net inflows of US$3.25 billion during May, bringing year-to-date net inflows to US$13.42 billion. Assets invested in the Japanese ETFs/ETPs industry have increased by 1.7%, from US$545 billion at the end of April, to US$556 billion, according to ETFGI's May 2021 Japanese ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $556 Billion invested in ETFs and ETPs listed in Japan at the end of May.

- Bank of Japan owns $322 Billion or 60% of total assets invested in Japanese ETFs and ETPs.

- ETFs/ETPs listed in Japan attracted $13.42 Bn in year-to-date net inflows.

“The S&P 500 gained 0.7% in May and 12.62% YTD, with positive figures for four consecutive months. Developed markets ex-U.S. gained 3.11% in May. Austria 8.29% and Luxembourg 8.12% were the leaders for the month while New Zealand lost the most at 3.92%. Emerging markets were up 2.58% at the end of May. Hungary (up 15.54%) and Poland (up 13.98%) were the leaders, whilst Egypt (down 3.86%), Chile (down 3.64%), and Malaysia (down 2.79%) were down the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The Japanese ETF/ETP industry had 235 ETFs/ETPs, with 269 listings, assets of $556 Bn, from 20 providers on 2 exchanges at the end of May 2021.

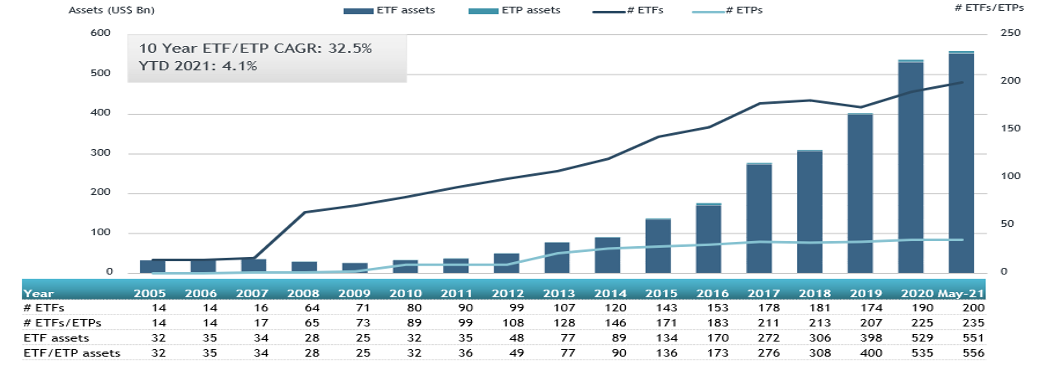

Japan ETF and ETP asset growth as at the end of May 2021

Equity ETFs/ETPs listed in Japan had net inflows of $3.74 Bn during May, bringing net inflows for the year to May 2021 to $16.59 Bn, lower than the $36.10 Bn in net inflows equity products had YTD in 2020. Fixed income ETFs/ETPs listed in Japan gathered net inflows of $89 Mn during May, bringing net inflows for the year to May 2021 to $501 Mn, much greater than the $71 Mn in net outflows fixed income products reported YTD in 2020. Commodities ETFs /ETPs listed in Japan suffered net outflows of $142 Mn during May 2021, taking net outflows for the year to May 2021 to $622 Mn, much lower than the $2.14 Bn in net inflows commodities products attracted in the same period last year.

The Bank of Japan reported owning $322 Bn in ETFs at the end of May. During May 2021, the Bank of Japan did not make ant ETF/ETP purchases.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $4.55 Bn during May, the MAXIS NIKKEI225 ETF (1346 JP) gathered the largest net inflows $644 Mn.

Top 20 ETFs by net new assets May 2021: Japan

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

MAXIS NIKKEI225 ETF |

1346 JP |

18,465.70 |

917.13 |

643.78 |

|

Daiwa ETF NIKKEI 225 |

1320 JP |

35,656.24 |

1,352.04 |

561.77 |

|

Daiwa ETF TOPIX |

1305 JP |

66,736.49 |

1,148.22 |

488.53 |

|

NEXT FUNDS TOPIX Exchange Traded Fund |

1306 JP |

145,069.30 |

3,444.00 |

442.20 |

|

Listed Index Fund 225 |

1330 JP |

35,436.19 |

485.42 |

385.74 |

|

SMDAM NIKKEI225 ETF |

1397 JP |

1,310.87 |

590.24 |

380.10 |

|

iShares Core Nikkei 225 ETF |

1329 JP |

7,891.80 |

759.19 |

262.78 |

|

Listed Index Fund TOPIX |

1308 JP |

67,871.12 |

2,155.05 |

237.86 |

|

NZAM ETF Nikkei 225 |

2525 JP |

1,796.41 |

1,281.95 |

173.03 |

|

One ETF TOPIX – Acc |

1473 JP |

3,483.52 |

549.19 |

156.64 |

|

MAXIS TOPIX ETF |

1348 JP |

19,861.37 |

560.64 |

108.14 |

|

Daiwa ETF Tokyo Stock Exchange REIT Index - Acc |

1488 JP |

1,598.37 |

35.31 |

105.33 |

|

NEXT FUNDS Nikkei 225 Exchange Traded Fund |

1321 JP |

75,129.08 |

495.88 |

99.36 |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

1570 JP |

3,482.48 |

(1,476.39) |

89.84 |

|

iShares Core TOPIX ETF |

1475 JP |

5,760.17 |

643.92 |

89.41 |

|

SMDAM REIT Index ETF |

1398 JP |

988.84 |

79.72 |

84.26 |

|

NEXT FUNDS Japan Bond NOMURA-BPI Exchange Traded Fund |

2510 JP |

207.96 |

177.09 |

71.06 |

|

Listed Index Fund US Equity Dow Average Currency Hedged |

2562 JP |

140.36 |

35.72 |

68.60 |

|

Listed Index Fund US Equity NASDAQ100 Currency Hedge - JPY Hdg |

2569 JP |

265.37 |

180.34 |

49.64 |

|

MAXIS J-REIT ETF - Acc |

1597 JP |

1,579.88 |

6.91 |

47.11 |

Investors have tended to invest in Equity ETFs/ETPs during May.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register now for the 2nd Annual ETFGI Global ETFs Insights Summit - Asia Pacific (virtual), November 2 - 3.

Our summits are designed to provide the opportunity for institutional investors, RIAs and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others around the impact that market structure and regulations have on ETF product development for ESG and non-transparent active, due diligence, suitability, the use and trading, and technological developments of ETFs.

Topics Include:

- Introduction to ETF Landscape in Asia Pacific

- Fireside Chat on an Update on Global and Local Regulatory Initiatives Impacting ETFs

- Update on Hong Kong ETF Market

- Best Practices When Trading US, European and Asia Listed ETFs from Asia

- Update on Singapore ETF Market

- Update on Trends in the US ETF Industry

- Update on the Mainland China ETF Market

- European ETF Industry Outlook

- How Regulators View ESG, Crypto and Digital Assets

- Global Macro Outlook

- Best Practices When Using ETFs in Portfolio Construction

![]() Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()