ETFGI reports assets invested in Leveraged and Inverse ETFs and ETPs listed globally reached a record US$106.7 billion at the end of May 2021

LONDON — June 30, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in Leveraged and Inverse ETFs and ETPs listed globally reached a record US$106.7 billion US Dollars the end of May. Leveraged and Inverse ETFs and ETPs suffered net outflows of US$4.14 billion during May bringing year to date net outflows to US$199 million. Total assets invested in leveraged and inverse ETFs and ETPs increased from US$102.4 billion at the end of April to US$106.7 billion, according to ETFGI’s May 2021 Leveraged and Inverse ETF and ETP industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $106.7 billion invested in Leveraged and Inverse ETFs and ETPs listed globally at end of May.

- Leveraged and inverse ETFs and ETPs listed globally suffered net outflows of $4.14 Bn during May.

- Year to date leveraged and inverse ETFs and ETPs listed globally have suffered net outflows of $199 Mn.

The S&P 500 gained 0.7% in May and 12.62% YTD, with positive figures for four consecutive months. Developed markets ex-U.S. gained 3.11% in May. Austria 8.29% and Luxembourg 8.12% were the leaders of the month while New Zealand lost 3.92%. Emerging markets were up 2.58% at the end of May. Hungary (up 15.54%) and Poland (up 13.98%) were the leaders, whilst Egypt (down 3.86%), Chile (down 3.64%), and Malaysia (down 2.79%) were down the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

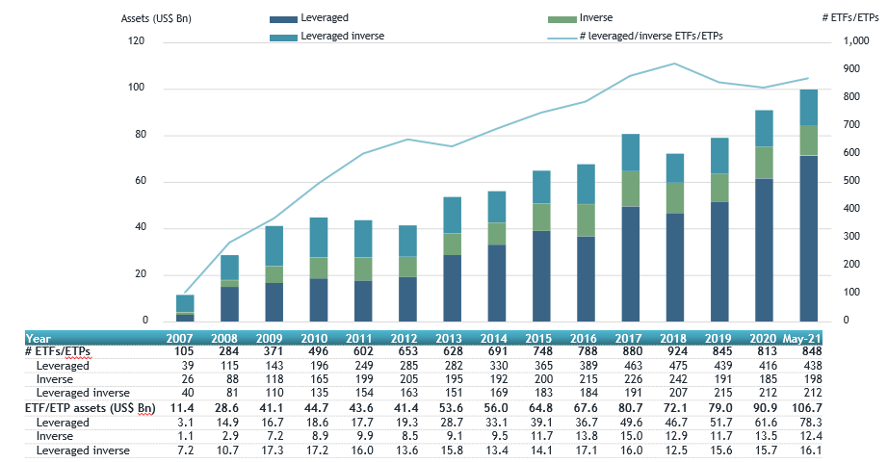

Global leveraged/inverse ETF and ETP asset growth at the of end of May 2021

The Global leveraged and inverse ETFs and ETPs industry had 864 products at the end of May. The majority of assets - $78.21 Bn - were invested in Leveraged ETFs and ETPs, followed by $16.05 Bn invested in Leveraged Inverse products and $12.38 Bn invested in Inverse products. The largest market for leveraged and inverse ETFs and ETPs was in the United States, which, at the end of May 2021, had assets of $71.0 Bn invested in 210 ETFs/ETPs.

The top 20 leveraged and inverse ETFs and ETPs by Year-to-Date net new assets collectively gathered $9.86 Bn year-to-date to May 2021. The Direxion Daily Semiconductors Bull 3x Shares (SOXL US) gathered $2.01 Bn alone, the largest net inflow year-to-date to May.

Top 20 ETFs/ETPs by YTD net new assets May 2021: Leveraged and Inverse

|

Name |

Country Listed |

Ticker |

Assets |

NNA |

Leverage |

|

Direxion Daily Semiconductors Bull 3x Shares |

US |

SOXL US |

4,872.28 |

2,010.98 |

Leveraged |

|

ProShares Ultra VIX Short-Term Futures |

US |

UVXY US |

820.95 |

981.16 |

Leveraged |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

US |

VXX US |

1,089.78 |

903.84 |

Leveraged |

|

ProShares UltraPro Short QQQ |

US |

SQQQ US |

1,733.56 |

778.39 |

Leveraged Inverse |

|

ProShares UltraShort 20+ Year Treasury |

US |

TBT US |

1,415.22 |

762.16 |

Leveraged Inverse |

|

MicroSectors FANG+ Index 3X Leveraged ETNs due January 8, 2038 |

US |

FNGU US |

1,518.54 |

708.07 |

Leveraged |

|

Direxion Daily S&P Biotech Bull 3X Shares |

US |

LABU US |

747.64 |

677.64 |

Leveraged |

|

KB KBSTAR KTB 3Y Futures Inverse ETF - Acc |

South Korea |

282000 KS |

588.87 |

530.80 |

Inverse |

|

Samsung KODEX 200 Futures Inverse 2X ETF - Acc |

South Korea |

252670 KS |

1,849.77 |

419.24 |

Leveraged Inverse |

|

ProShares Short 20+ Year Treasury |

US |

TBF US |

592.32 |

289.19 |

Inverse |

|

Yuanta/P-shares CSI 300 2X Bull ETF - Acc |

Taiwan |

00637L TT |

891.88 |

265.39 |

Leveraged |

|

Samsung KODEX Inverse ETF |

South Korea |

114800 KS |

992.10 |

238.91 |

Inverse |

|

ProShares UltraPro QQQ |

US |

TQQQ US |

12,149.67 |

206.21 |

Leveraged |

|

Lyxor UCITS ETF DAILY DOUBLE SHORT BUND - Acc |

France |

DSB FP |

464.68 |

204.79 |

Leveraged Inverse |

|

CSOP Hang Seng TECH Index Daily 2X Leveraged Product |

Hong Kong |

7226 HK |

186.80 |

195.41 |

Leveraged |

|

Cathay US Treasury 20+ YR Inv 1X ETF - Acc |

Taiwan |

00689R TT |

170.37 |

144.53 |

Inverse |

|

Direxion Daily Small Cap Bear 3x Shares |

US |

TZA US |

340.71 |

143.75 |

Leveraged Inverse |

|

Lyxor UCITS ETF CAC 40 DAILY DOUBLE SHORT - Acc |

France |

BX4 FP |

306.87 |

140.39 |

Leveraged Inverse |

|

ProShares Short QQQ |

US |

PSQ US |

595.58 |

134.64 |

Inverse |

|

Direxion Daily FTSE China Bull 3x Shares |

US |

YINN US |

390.65 |

122.90 |

Leveraged |

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Recent leverage and inverse interviews on ETF tv.

ETF TV News #78 David Mazza of Direxion discusses new leveraged 5G and Travel and Vacation ETFs with Deborah Fuhr PressPlay https://bit.ly/2UcloIl

ETF TV News #78 David Mazza of Direxion discusses new leveraged 5G and Travel and Vacation ETFs with Deborah Fuhr PressPlay https://bit.ly/2UcloIl

ETF TV SEC allows ETFs 200% leverage and derivatives transactions. Kevin Gustafson, general counsel and CCO and Graham Day, head of product & strategy at Innovator ETFs discuss the US Securities and Exchange Commission (SEC) derivatives risk management rule https://bit.ly/3xadLAx

ETF TV SEC allows ETFs 200% leverage and derivatives transactions. Kevin Gustafson, general counsel and CCO and Graham Day, head of product & strategy at Innovator ETFs discuss the US Securities and Exchange Commission (SEC) derivatives risk management rule https://bit.ly/3xadLAx

ETF TV News www.ETFtv.net is sponsored by Syntax Advisors https://www.syntaxadvisors.com/.

ETF TV News www.ETFtv.net is sponsored by Syntax Advisors https://www.syntaxadvisors.com/.

For more information on ETF TV contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net

Register now for the 2nd Annual ETFGI Global ETFs Insights Summit - Europe & MEA (virtual), September 14 - 16.

Our summits are designed to provide the opportunity for institutional investors, RIAs and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others around the impact that market structure and regulations have on ETF product development for ESG and non-transparent active, due diligence, suitability, the use and trading, and technological developments of ETFs.

Topics Include:

- Panel sessions providing an overview of the ETF Landscape in South Africa, Africa, Saudi Arabia, Qatar and United Arab Emirates

- Regulatory Issues Impacting ETF Trading and Market Structure

- Creating Better Trading Systems and Tools for ETFs

- How a Consolidated Tape Could Contribute to the Development of ETFs in the EU

- Understanding Benchmark and Sustainable Finance Disclosure Regulations

- The Evolving Role of Index Providers

- Trends in Fixed Income Indices and ETFs

- Trends in ESG Indices

- Trends in Crypto Indices

- Active ETFs

- European Regulatory Initiatives Impacting ETFs

- US Regulatory Initiatives Impacting ETFs

- Macro Investment Outlook

- How Investors Are Implementing ESG Into Their Portfolios

- Responsible Investment and ESG Integration

- Investing in Digital Assets

- How Are Institutions and Financial Advisors Using ETFs?

- Women in ETFs – Managing Career Transitions

- ETF Landscape in Israel

- Trends That Will Drive the ETF and Financial Industry in 2021 and beyond

Visit the ETFGI website to see further updates as we continue building up the event agenda.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

Register now for the 2nd Annual ETFGI Global ETFs Insights Summit - Asia Pacific (virtual), November 2 - 3.

Our summits are designed to provide the opportunity for institutional investors, RIAs and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others around the impact that market structure and regulations have on ETF product development for ESG and non-transparent active, due diligence, suitability, the use and trading, and technological developments of ETFs.

Topics Include:

- Introduction to ETF Landscape in Asia Pacific

- Fireside Chat on an Update on Global and Local Regulatory Initiatives Impacting ETFs

- Update on Hong Kong ETF Market

- Best Practices When Trading US, European and Asia Listed ETFs from Asia

- Update on Singapore ETF Market

- Update on Trends in the US ETF Industry

- Update on the Mainland China ETF Market

- European ETF Industry Outlook

- How Regulators View ESG, Crypto and Digital Assets

- Global Macro Outlook

- Best Practices When Using ETFs in Portfolio Construction

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()