ETFGI reports record assets and net inflows in Active ETFs world-wide of US$401 billion and US$82 billion respectively at the end of H1 2021

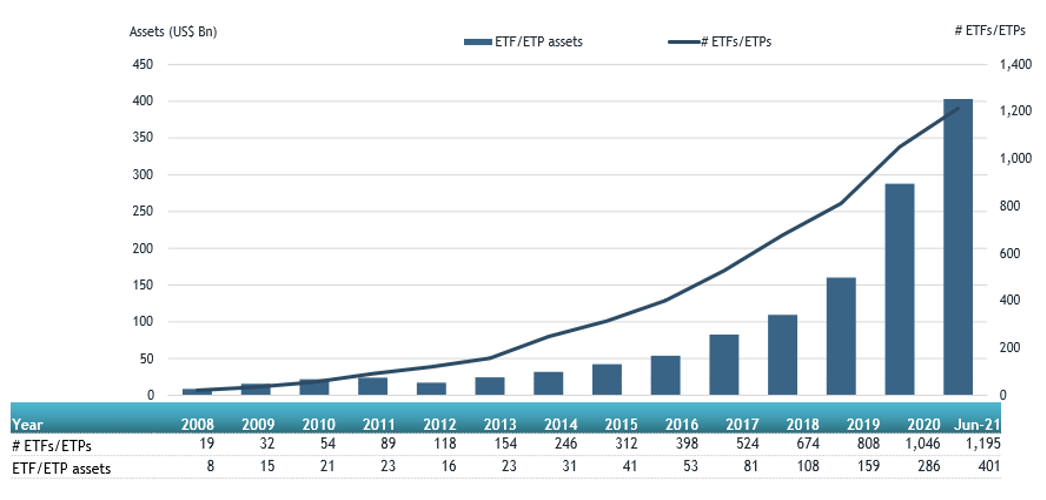

LONDON — July 23, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported record assets and net inflows in Active ETFs world-wide of US$400.77 billion and US$82.23 billion respectively at the end of H1 2021. Active ETFs and ETPs gathered net inflows of US$8.06 billion during June, bringing H1 net inflows to a record US$82.23 billion. Assets invested in Active ETFs and ETPs finished the month up to 12.0%, from US$358 billion at the end of May to US$401 billion, according to ETFGI's June 2021 Active ETF and ETP industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record $400.77 Bn invested in actively managed ETFs and ETPs industry at end of H1 2021.

- Assets have increased 40.2% in H1 going from $285.83 Bn at end of 2020 to $400.77 Bn.

- Record H1 net inflows of $82.23 Bn beating prior record of $26.06 Bn gathered in H1 2020.

- $82.23 Bn H1 net inflows are just $8.97 Bn below full year 2020 record net inflows $91.20 Bn.

- $147.37 Bn in net inflows gathered in the past 12 months.

- 15th month of consecutive net inflows

- Actively managed Equity ETFs and ETPs gathered a record $37.59 Bn in net inflows in H1 2021.

“The S&P 500 gained 2.33% in June and are up 15.25% in the first half of 2021. Developed markets ex-U.S. lost 0.82% in June but are up 9.96% in the first half. Emerging markets are up 0.47% in June and are up 9.03% in the first half.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in actively managed ETF and ETP assets as of the end of June 2021

Equity focused Active ETFs/ETPs listed globally gathered net inflows of $4.08 Bn during June, bringing net inflows for H1 to $37.59 Bn, more than the $10.33 Bn in net inflows equity products had attracted in H1 2020. Fixed Income focused Active ETFs/ETPs listed globally attracted net inflows of $2.80 Bn during June, bringing net inflows for H1 2021 to $35.22 Bn, much greater than the $13.79 Bn in net inflows fixed income products had attracted in H1 2020.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered $5.61 Bn during June. SPDR Blackstone/GSO Senior Loan ETF (SLRN US) gathered $960 Mn the largest net inflow.

Top 20 actively managed ETFs/ETPs by net new assets June 2021

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

6,295.18 |

3,996.78 |

959.91 |

|

ARK Innovation ETF |

ARKK US |

25,323.98 |

7,378.78 |

497.21 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

17,317.12 |

1,717.39 |

393.02 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

3,501.87 |

2,620.30 |

377.53 |

|

ARK Genomic Revolution Multi-Sector ETF |

ARKG US |

9,747.77 |

2,831.40 |

332.92 |

|

First Trust Preferred Securities and Income Fund |

FPE US |

7,049.65 |

1,034.27 |

324.73 |

|

iShares Commodities Select Strategy ETF |

COMT US |

2,464.45 |

2,073.65 |

318.53 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

1,889.19 |

1,635.11 |

304.38 |

|

Vanguard Ultra Short-Term Bond ETF |

VUSB US |

999.10 |

1,011.22 |

300.55 |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

5,292.01 |

967.59 |

235.25 |

|

KB KBSTAR Active Korea Total Bond Market A- ETF |

385540 KS |

308.88 |

241.00 |

224.59 |

|

BlackRock Ultra Short-Term Bond ETF |

ICSH US |

5,643.42 |

406.57 |

212.09 |

|

JPMorgan EUR Ultra-Short Income UCITS ETF |

JSET LN |

1,315.22 |

504.33 |

173.26 |

|

ARK Web x.O ETF |

ARKW US |

6,354.09 |

1,175.20 |

159.41 |

|

First Trust Senior Loan ETF |

FTSL US |

2,327.90 |

997.95 |

148.71 |

|

First Trust Global Tactical Commodity Strategy Fund |

FTGC US |

1,627.15 |

1,247.00 |

145.33 |

|

Avantis U.S. Small Cap Value ETF |

AVUV US |

1,398.85 |

629.77 |

143.03 |

|

Innovator S&P 500 Power Buffer ETF - June |

PJUN US |

201.00 |

104.42 |

137.78 |

|

Horizons Cash Maximizer ETF - Acc |

HSAV CN |

858.31 |

38.48 |

111.29 |

|

PGIM Ultra Short Bond ETF |

PULS US |

1,579.89 |

361.06 |

110.72 |

Investors have tended to invest in Active Equity ETFs and ETPs during June.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register now for the 2nd Annual ETFGI Global ETFs Insights Summit - Europe & MEA (virtual), September 14 - 16.

The summit is designed to facilitate a substantive and in-depth discussion on the impact that ETFs have on markets and market structure, and the regulatory, trading, and technological developments impacting the use of ETFs.

Visit the ETFGI website to see the full list of speakers, topics, and more updates as we continue building up the event agenda.

SPEAKERS INCLUDE:

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings. Please contact us if you are interested in sponsoring or speaking at any of the upcoming events.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings. Please contact us if you are interested in sponsoring or speaking at any of the upcoming events.

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

ETF TV News #83 Nirujan Kana, Vice President, ETF Strategy at CI Global Asset Management discusses the growing demand for Active ETFs in Canada with Margareta Hricova and Deborah Fuhr #PressPlay https://bit.ly/2Tm8bMK

ETF TV News #83 Nirujan Kana, Vice President, ETF Strategy at CI Global Asset Management discusses the growing demand for Active ETFs in Canada with Margareta Hricova and Deborah Fuhr #PressPlay https://bit.ly/2Tm8bMK

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()