ETFGI reports record assets and net inflows in ESG ETFs world-wide of US$293 billion and US$83 billion respectively at the end of H1 2021

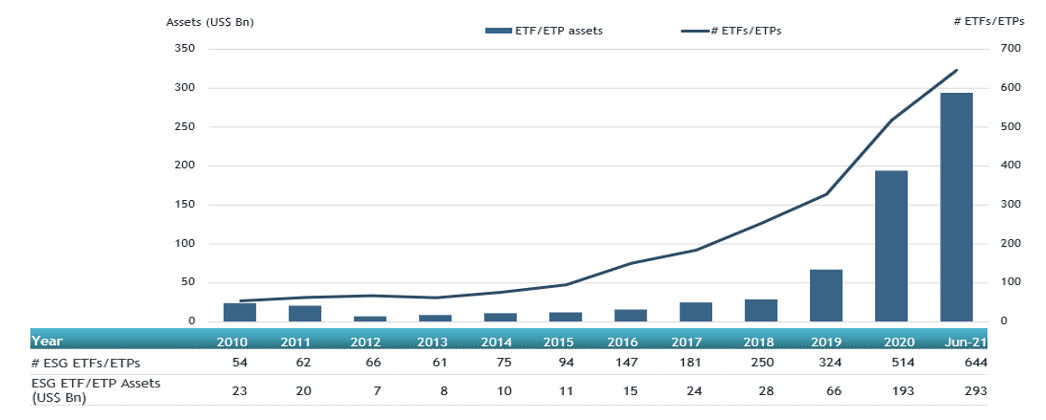

LONDON — July 29, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today record assets and net inflows in ESG (Environmental, Social, and Governance) ETFs and ETPs listed globally of US$293 billion and US$83 billion respectively at the end of H1 2021. ESG ETFs gathered net inflows of US$9.09 billion during June, bringing year-to-date net inflows to a record US$83.04 billion which is much higher than the US$29.49 billion gathered at this point last year. Total assets invested in ESG ETFs and ETPs increased by 4.6% from US$280 billion at the end of May 2021 to US$293 billion, according to ETFGI’s June 2021 ETF and ETP ESG industry landscape insights report, is a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record $293 Bn invested in global ESG ETFs and ETPs industry at end of H1 2021.

- Assets have increased 51.6% in H1 going from $193 Bn at end of 2020 to $293 Bn at end of H1 2021.

- Record H1 net inflows of $83.04 Bn beating prior record of $29.49 Bn gathered in H1 2020.

- $83.04 Bn H1 net inflows are just $5.91 Bn below full year 2020 record net inflows $88.95 Bn.

- $199.35 Bn in net inflows gathered in the past 12 months.

- 64th month of consecutive net inflows

- Equity ETFs and ETPs listed in Europe gathered a record $59.61 Bn in net inflows in H1 2021.

“The S&P 500 gained 2.33% in June and are up 15.25% in the first half of 2021. Developed markets ex-U.S. lost 0.82% in June but are up 9.96% in the first half. Emerging markets are up 0.47% in June and are up 9.03% in the first half.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The Global ESG ETF/ETP had 644 ETFs/ETPs, with 1,899 listings, assets of US$293 Bn, from 145 providers on 37 exchanges in 30 countries. Following net inflows of $9.09 Bn and market moves during the month, assets invested in ESG ETFs/ETPs listed globally increased by 4.6% from $280 Bn at the end of May 2021 to $293 Bn at the end of June 2021.

Global ESG ETF and ETP asset growth as at end of June 2021

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily, with 644 ESG ETFs/ETPs and 1,899 listings globally at the end of June 2021.

During June, 23 new ESG ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $4.90 Bn in June. iShares Trust iShares ESG Aware MSCI USA ETF (ESGU US) gathered $616 Mn the largest net inflows.

Top 20 ESG ETFs/ETPs by net new assets June 2021

|

Name |

Ticker |

Assets (US$ Mn) Jun-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) Jun-21 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

18,417.78 |

2,900.00 |

616.44 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

BEGU39 BZ |

684.41 |

545.25 |

545.25 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

3,501.87 |

2,620.30 |

377.53 |

|

iShares ESG MSCI EM ETF |

ESGE US |

7,991.97 |

1,384.70 |

373.97 |

|

iShares ESG MSCI EAFE ETF |

ESGD US |

5,959.65 |

1,635.37 |

282.60 |

|

iShares MSCI USA ESG Screened UCITS ETF - Acc - Acc |

SASU LN |

3,631.35 |

1,296.76 |

227.94 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

2,887.86 |

944.71 |

218.38 |

|

iShares Euro Corp Bond SRI UCITS ETF |

SUOE LN |

2,566.06 |

353.16 |

218.20 |

|

Invesco Solar ETF |

TAN US |

3,568.17 |

579.26 |

217.76 |

|

Ossiam Euro Government Bonds 3-5y Carbon Reduction UCITS ETF - Acc |

OG35 GY |

489.67 |

214.91 |

209.98 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

5,753.83 |

1,597.83 |

208.98 |

|

UBS Lux Fund Solutions - MSCI Japan Socially Responsible UCITS ETF (Hedged to USD) |

JPSRU SW |

209.85 |

206.30 |

203.15 |

|

Vanguard ESG US Stock ETF |

ESGV US |

4,801.79 |

1,314.75 |

196.76 |

|

iShares MSCI EM SRI UCITS ETF - Acc |

SUES LN |

2,355.63 |

510.06 |

150.47 |

|

Xtrackers MSCI World ESG UCITS ETF - 1C - Acc |

XZW0 LN |

2,489.21 |

970.98 |

148.87 |

|

AMUNDI INDEX MSCI USA SRI - UCITS ETF DR (C) - Acc |

USRI FP |

3,760.63 |

1,563.48 |

148.78 |

|

iShares MSCI Europe SRI UCITS ETF - Dist |

ISED NA |

724.60 |

249.41 |

141.87 |

|

UBS Lux Fund Solutions - MSCI Japan Socially Responsible UCITS ETF (Hedged to EUR) |

JPSRE SW |

233.13 |

155.15 |

141.32 |

|

iShares ESG MSCI Mexico ETF |

ESGMEX MM |

1,380.64 |

431.53 |

136.05 |

|

UBS Lux Fund Solutions - MSCI Japan Socially Responsible UCITS ETF (Hedged to CHF) A-dis |

JPSRT SW |

153.56 |

141.16 |

132.26 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Register now to join us at the 2nd Annual ETFGI Global ETFs Insights Summit - Europe & MEA (virtual), September 14 - 16.

The summit is designed to facilitate a substantive and in-depth discussion on the impact that ETFs have on markets and market structure, and the regulatory, trading, and technological developments impacting the selection, use, and trading of ETFs.

Visit the ETFGI website to see the full list of speakers, topics, and more updates as we continue building up the event agenda.

FEATURED PANEL:

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, Register Here and we will send you the session recordings.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, Register Here and we will send you the session recordings.

Please contact us if you are interested in sponsoring or speaking at any of the upcoming events.

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

ETF TV News #84 Margareta Hricova and Deborah Fuhr discuss the trends in Active, ESG, thematic ETFs during the first half of 2021 based on ETFGI’s research #PressPlay https://bit.ly/3BNmE5K

ETF TV News #84 Margareta Hricova and Deborah Fuhr discuss the trends in Active, ESG, thematic ETFs during the first half of 2021 based on ETFGI’s research #PressPlay https://bit.ly/3BNmE5K

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()