ETFGI reports record assets and net inflows for ETFs and ETPs listed in Europe of US$1.484 trillion and US$112.09 billion respectively at end H1 2021

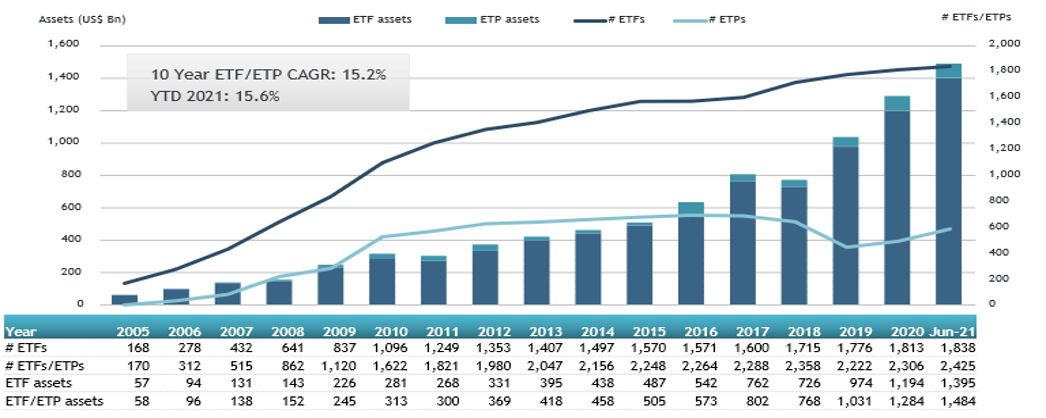

LONDON —July 16, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports record assets and net inflows for ETFs and ETPs listed in Europe of US$1.484 trillion and US$112.09 billion respectively at end H1 2021. ETFs and ETPs listed in Europe reported net inflows of US$16.78 billion during June, bringing H1 net inflows to a record US$112.09 billion. Assets invested in the European ETFs/ETPs industry have increased by 15.6% in H1 going from $1.284 Tn at the end of 2020 to $1.484 Tn, according to ETFGI's June 2021 European ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record $1.484 Bn invested in European ETFs and ETPs industry at end of H1 2021.

- Assets have increased 15.6% in H1 going from $1.284 Tn at end of 2020 to $1.484 Tn.

- Record H1 net inflows of $112.09 Bn beating prior record of $63.83 Bn gathered in H1 2017.

- $112.09 Bn H1 net inflows are just $7.83 Bn below full year 2020 record net inflows $119.92 Bn.

- $199.35 Bn in net inflows gathered in the past 12 months.

- 15th month of consecutive net inflows

- Equity ETFs and ETPs listed in Europe gathered a record $87.05 Bn in net inflows in H1 2021.

“The S&P 500 gained 2.33% in June and are up 15.25% in the first half of 2021. Developed markets ex-U.S. lost 0.82% in June but are up 9.96% in the first half. Emerging markets are up 0.47% in June and are up 9.03% in the first half.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Europe ETFs and ETPs asset growth as at the end of June 2021

The European ETFs and ETPs industry had 2,425 products, with 9,526 listings, assets of US$1.484 Tn, from 84 providers listed on 29 exchanges in 24 countries at the end of H1 2021.

Equity ETFs/ETPs listed in Europe reported net inflows of $14.31 Bn during June, bringing net inflows for H1 2021 to $87.05 Bn, much higher than the $1.05 Bn in net outflows equity products had suffered in H1 2020. Fixed income ETFs/ETPs listed in Europe had net inflows of $2.37 Bn during June, taking net inflows for H1 to $16.73 Bn, less than the $19.74 Bn in net inflows fixed income products reported in H1 2020. Commodity ETFs/ETPs reported $803 Mn in net outflows, bringing net inflows to $2.60 Bn for H1 2021, which is lower than the $15.51 Bn in net inflows gathered in H1 2020. Active ETFs/ETPs listed in Europe reported net inflows of $486 Mn, bringing net inflows for H1 2021 to $3.37 Bn, significantly higher than the $276 Mn in net outflows active products reported in H1 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $8.95 Bn during June. iShares Core MSCI World UCITS ETF - Acc (IWDA LN) gathered $1.36 Bn the largest net inflows.

Top 20 ETFs by net inflows in June 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

38,397.32 |

5,404.79 |

1,359.06 |

|

iShares Edge MSCI World Value Factor UCITS ETF - Acc |

IWVL LN |

6,789.58 |

3,008.73 |

888.92 |

|

Xtrackers MSCI Emerging Markets Index UCITS ETF - Acc |

XMME GY |

6,404.48 |

2,123.19 |

768.01 |

|

Xtrackers MSCI World Index UCITS ETF (DR) - 1C - Acc |

XWLD LN |

8,050.90 |

1,035.09 |

718.83 |

|

Vanguard S&P 500 UCITS ETF - Acc - Acc |

VUAA LN |

3,157.10 |

1,316.07 |

556.67 |

|

iShares China CNY Bond UCITS ETF - Acc |

CYBA NA |

4,298.82 |

2,150.20 |

412.67 |

|

Xtrackers Euro Stoxx 50 UCITS ETF (DR) - 1D |

XESX GY |

3,643.15 |

383.46 |

387.74 |

|

iShares Core S&P 500 UCITS ETF - Acc |

CSSPX SW |

47,124.20 |

(1,358.36) |

370.71 |

|

iShares Edge MSCI Europe Value Factor UCITS ETF |

IEFV LN |

3,938.81 |

1,723.02 |

368.04 |

|

Lyxor Core US TIPS DR UCITS ETF - D GBP - GBP Hdg - Acc |

TIPH LN |

3,183.64 |

(8.97 ) |

356.44 |

|

Xtrackers MSCI USA Swap UCITS ETF - Acc |

XMUS GY |

4,158.81 |

386.80 |

335.05 |

|

AMUNDI MSCI WORLD UCITS ETF - EUR (C) - Acc |

CW8 FP |

2,219.32 |

537.26 |

303.83 |

|

Invesco S&P 500 ETF - Acc |

SPXS LN |

10,502.23 |

317.91 |

300.98 |

|

Xtrackers MSCI World Information Technology Index UCITS ETF (DR) - Acc |

XDWT GY |

2,084.56 |

(58.91) |

290.28 |

|

iShares $ Treasury Bond 3-7yr UCITS ETF - USD D - Acc |

CSBGU7 SW |

2,254.78 |

19.48 |

272.49 |

|

iShares Core € Corp Bond UCITS ETF |

IEAA LN |

1,673.37 |

(349.09 ) |

269.19 |

|

Xtrackers II EUR High Yield Corporate Bond UCITS ETF |

XHYG GY |

922.52 |

487.50 |

266.48 |

|

AMUNDI MSCI EUROPE UCITS ETF - EUR (C) - Acc |

CEU FP |

3,461.01 |

261.69 |

258.45 |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

5,292.01 |

967.59 |

235.25 |

|

iShares MSCI Japan UCITS ETF USD (Dist) |

IJPN LN |

1,415.57 |

143.76 |

229.51 |

The top 10 ETPs by net new assets collectively gathered $742 Mn during June. Xtrackers IE Physical Gold ETC Securities - EUR Hdg Acc (XGDE GY) gathered $184 Mn the largest net inflows.

Top 10 ETPs by net inflows in June 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Xtrackers IE Physical Gold ETC Securities - EUR Hdg Acc |

XGDE GY |

872.47 |

765.63 |

184.34 |

|

WisdomTree Precious Metals - EUR Daily Hedged - Acc |

00XQ GY |

135.72 |

13.96 |

134.28 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

XGDU LN |

1881.84 |

1649.25 |

91.98 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3640.50 |

620.83 |

79.78 |

|

Xetra Gold EUR - Acc |

4GLD GY |

13,245.36 |

949.36 |

68.19 |

|

WisdomTree Industrial Metals - Acc |

AIGI LN |

556.67 |

314.19 |

50.95 |

|

WisdomTree Industrial Metals - EUR Daily Hedged - Acc |

EIMT IM |

84.89 |

80.27 |

44.16 |

|

WisdomTree Copper - Acc |

COPA LN |

818.13 |

402.46 |

31.78 |

|

iShares Physical Silver ETC - Acc |

SSLN LN |

702.59 |

112.25 |

30.33 |

|

WisdomTree Silver 3x Daily Leveraged - Acc |

3SIL LN |

91.44 |

39.21 |

25.87 |

Investors have tended to invest in Equity ETFs and ETPs during June.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

ETF TV News #82 Bryon Lake Managing Director, Head of Americas ETF Client at J.P. Morgan Asset Management discusses new ActiveBuilder ETFs as global ETFs assets reach US$9.35 trillion with Deborah Fuhr #PressPlay https://bit.ly/2UCAffb

ETF TV News #82 Bryon Lake Managing Director, Head of Americas ETF Client at J.P. Morgan Asset Management discusses new ActiveBuilder ETFs as global ETFs assets reach US$9.35 trillion with Deborah Fuhr #PressPlay https://bit.ly/2UCAffb

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

Register now for the 2nd Annual ETFGI Global ETFs Insights Summit - Europe & MEA (virtual), September 14 - 16.

Our summits are designed to provide the opportunity for institutional investors, RIAs and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others around the impact that market structure and regulations have on ETF product development for ESG and non-transparent active, due diligence, suitability, the use and trading, and technological developments of ETFs.

Visit the ETFGI website to see the list of topics and more updates as we continue building up the event agenda.

SPEAKERS INCLUDE:

- Terry Adembesa, Chief Officer - Derivatives Markets, Nairobi Securities Exchange

- Shaun Baskett, Director, Index Sales, Cboe Europe

- Tiaan Bazuin, CEO, Namibian Stock Exchange (“NSX”)

- Kopano Bolokwe, Head of Product Development, Botswana Stock Exchange

- Silvia Bosoni, Director - Head of ETFs, ETPs and open end Funds - Listing and Market Development, Borsa Italiana

- Georgia Bullitt, Partner, Willkie Farr & Gallagher LLP

- Jude Chiemeka, Divisional Head, Trading Business, Nigerian Exchange Limited

- Helena Conradie, Former CEO, Satrix

- Morgane Delledonne, Director of Research, Global X ETFs

- Anna Driggs, Director and Associate Chief Counsel, ICI Global

- Marie Dzanis, CEO, Northern Trust

- Deborah Fuhr, Managing Partner, Founder, ETFGI

- Jim Goldie, EMEA Head of Capital Markets, ETFs and Indexed Strategies, Invesco

- James Harris, Commercial Director, CryptoCompare

- Geoffroy Hermanns, Lawyer, Herbert Smith Freehills LLP

- Thomas Kettner, Chief Operating Officer, MVIS

- Tilman Lueder, Head of Unit – DG FISMA, Securities Markets, European Commission

- Fred Pye, Chairman & CEO, 3iQ Corp.

- Rick Redding, CEO, Index Industry Association

- Michael Ridley, Director, Responsible Investment, HSBC

- Sherif Salem, CIO – Public Markets, Chimera Capital

- Waqas Samad, Group Head, Investment Solutions & CEO FTSE Russell, London Stock Exchange Group (LSEG)

- Olivier Souliac, Senior Product Specialist, Index Strategy & Analytics, DWS

- Mark Webster, Director of ETF Sales, BMO Global Asset Management

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings. Please contact us if you are interested in sponsoring or speaking at any of the upcoming events.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings. Please contact us if you are interested in sponsoring or speaking at any of the upcoming events.

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()