ETFGI reports record assets and net inflows for ETFs and ETPs listed in US of US$6.51 trillion and US$472.18 billion respectively at the end H1 2021

LONDON — July 15, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports record assets and net inflows for ETFs and ETPs listed in US of US$6.51 trillion and US$472.18 billion respectively at end first half 2021. ETFs and ETPs listed in US gained net inflows of US$73.09 billion during June, bringing year-to-date net inflows to a record US$472.18 billion. Assets invested in the US ETFs/ETPs industry have increased by 19% in the first half of 2021, going from US$5.47 trillion at the end of 2020, to US$6.51 trillion, according to ETFGI's June 2021 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record $6.51 trillion invested in ETFs and ETPs listed in US at the end of H1 2021.

- Record H1 2021 net inflows of $472.18 Bn beating the prior record of $247.34 Bn gathered in H1 2017.

- $472.18 Bn H1 net inflows are just $18 Bn below full year 2020 record net inflows $490.19 Bn.

- $1.18 trillion in net inflows gathered in the past 12 months.

- Assets increased 19% in H1 2021, going from US$5.47 trillion at end of 2020, to US$6.51 trillion.

- 23rd month of consecutive net inflows

- Equity ETFs and ETPs listed in the US gathered a record $327.44 Bn in net inflows in H1 2021.

“The S&P 500 gained 2.33% in June and are up 15.25% in the first half of 2021. Developed markets ex-U.S. lost 0.82% in June but are up 9.96% in the first half. Emerging markets are up 0.47% in June and are up 9.03% in the first half. According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

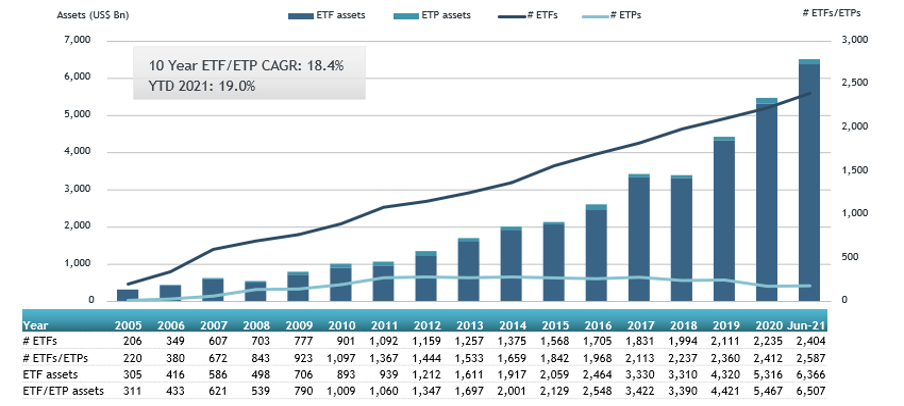

Growth in US ETF and ETP assets as of the end of June 2021

The US ETFs and ETPs industry had 2,587 products, assets of US$6.51 Tn, from 202 providers listed on 3 exchanges at the end of H1 2021.

During June 2021, ETFs/ETPs gathered net inflows of $73.09 Bn. Equity ETFs/ETPs listed in US gathered net inflows of $50.85 Bn during June, bringing H1 net inflows to $327.44 Bn, much higher than the $39.91 Bn in net inflows equity products attracted in H1 2020. Fixed income ETFs/ETPs listed in US reported net inflows of $15.65 Bn during June, bringing H1 net inflows for 2021 to $85.31 Bn, slightly above the $83.56 Bn in net inflows fixed income products had attracted in H1 2020. Commodities ETFs/ETPs reported net outflows of $270 Mn during June, bringing year to date net outflows for 2021 to $6.59 Bn, less than net inflows of $32.45 Bn commodities products attracted in H1 2020. Active ETFs/ETPs gathered net inflows of $7.60 Bn during June, bringing H1 2021 net inflows to $59.98 Bn, significantly more than the $19.66 Bn in net inflows active products had reported in H1 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $40.74 Bn during June. The Invesco QQQ Trust (QQQ US) gathered the largest net inflows $6.16 Bn.

Top 20 ETFs by net new assets June 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Invesco QQQ Trust |

QQQ US |

174,723.42 |

5,836.05 |

6,160.63 |

|

SPDR S&P 500 ETF Trust |

SPY US |

376,588.32 |

(1,981.23) |

4,884.88 |

|

Vanguard Total Stock Market ETF |

VTI US |

250,652.50 |

20,360.11 |

3,506.53 |

|

Vanguard Total Bond Market ETF |

BND US |

78,563.87 |

12,397.36 |

2,898.78 |

|

Vanguard S&P 500 ETF |

VOO US |

232,656.20 |

26,717.31 |

2,538.63 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

15,469.30 |

(2,030.56) |

2,440.54 |

|

iShares U.S. Real Estate ETF |

IYR US |

7,026.67 |

816.38 |

2,258.53 |

|

iShares Core S&P 500 ETF |

IVV US |

282,861.11 |

12,749.70 |

1,597.28 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

95,780.72 |

5,359.11 |

1,533.56 |

|

iShares MSCI Eurozone ETF |

EZU US |

8,070.13 |

2,516.45 |

1,519.30 |

|

Vanguard FTSE Developed Markets ETF |

VEA US |

100,924.56 |

5,857.54 |

1,396.71 |

|

Vanguard Value ETF |

VTV US |

38,397.32 |

10,234.10 |

1,245.16 |

|

SPDR Portfolio S&P 500 Growth ETF |

SPYG US |

81,704.88 |

1,405.25 |

1,221.76 |

|

Vanguard FTSE Europe ETF |

VGK US |

12,378.48 |

3,707.61 |

1,211.64 |

|

iShares Short-Term Corporate Bond ETF |

IGSB US |

19,663.01 |

4,521.11 |

1,163.76 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

26,693.36 |

6,302.15 |

1,159.00 |

|

Schwab US Dividend Equity ETF |

SCHD US |

48,163.44 |

6,554.07 |

1,117.53 |

|

iShares Core MSCI Emerging Markets ETF |

IEMG US |

26,038.71 |

9,227.95 |

969.11 |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

83,678.15 |

3,996.78 |

959.91 |

|

Vanguard Short-Term Corporate Bond ETF |

VCSH US |

6,295.18 |

4,314.28 |

956.18 |

The top 10 ETPs by net new assets collectively gathered $1.06 Bn during June. The iShares Gold Trust (IAU US) gathered the largest net inflows $262.04 Mn.

Top 10 ETPs by net new assets June 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Gold Trust |

IAU US |

28,611.36 |

(1,043.42) |

262.04 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

835.29 |

1193.40 |

212.24 |

|

SPDR Gold Shares |

GLD US |

58,222.02 |

(6,864.85) |

172.70 |

|

Credit Suisse Silver Shares Covered Call ETN |

SLVO US |

261.61 |

226.69 |

90.92 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

998.15 |

973.82 |

69.98 |

|

Aberdeen Standard Physical Palladium Shares ETF |

PALL US |

505.27 |

93.34 |

63.00 |

|

SPDR Gold MiniShares Trust |

GLDM US |

4,326.30 |

604.58 |

59.37 |

|

Aberdeen Standard Precious Metals Basket Trust |

GLTR US |

1,020.53 |

205.15 |

49.06 |

|

Invesco CurrencyShares Canadian Dollar Trust |

FXC US |

210.06 |

55.12 |

43.82 |

|

Invesco DB US Dollar Index Bullish Fund |

UUP US |

428.22 |

54.41 |

41.44 |

Investors have tended to invest in Equity ETFs and ETPs during June and in H1 2021.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

UPCOMING EVENTS

Register now for the 2nd Annual ETFGI Global ETFs Insights Summit - Europe & MEA (virtual), September 14 - 16.

Our summits are designed to provide the opportunity for institutional investors, RIAs and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others around the impact that market structure and regulations have on ETF product development for ESG and non-transparent active, due diligence, suitability, the use and trading, and technological developments of ETFs.

Visit the ETFGI website to see the list of speakers, topics and more updates as we continue building up the event agenda.

Please contact us if you are interested in sponsoring or speaking at any of the upcoming events.

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

Inside ETFs 2021

September 27-29, 2021, The Diplomat Beach Resort, Hollywood, Florida

Join 2,000 financial advisors, institutional investors, asset managers, hedge funds and academics at Inside ETFs 2021, the world’s leading ETFs event. Learn what’s new, what’s important and how to use the ETF ecosystem to grow your business.

Participate in top-level conversation with 170+ expert speakers and receive three days of inspirational content giving you a comprehensive look at how the wealth management industry is adapting through change and helping advisors grow in the new financial landscape.

View the agenda, full speaker line-up, and register your place here. SAVE 10% with our VIP code: FKF2296ETFGIL

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()