ETFGI reports record assets and net inflows for Smart Beta ETFs and ETPs listed in globally of US$1.24 trillion and US$102.03 billion respectively at the end H1 2021

LONDON —July 20, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reports record assets and net inflows for Smart Beta ETFs and ETPs listed in globally of US$1.24 trillion and US$102.03 billion respectively at the end H1 2021. Smart Beta ETFs and ETPs providing equity exposure listed globally gathered net inflows of US$14.27 billion during June, bringing year-to-date net inflows to a record US$102.03 billion which is higher than the US$12.36 billion gathered at this point last year. Year-to-date through the end of June 2021, Smart Beta Equity ETF/ETP assets have increased by 23.8% from US$999 billion to US$1.24 trillion, with a 5-year CAGR of 22.8%, according to ETFGI’s June 2021 ETF and ETP Smart Beta industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar vales in USD unless otherwise noted.)

Highlights

- Record $1.24 Tn invested in Smart Beta ETFs and ETPs industry at end of H1 2021.

- Assets have increased 23.8% in H1 going from $999 Bn at end of 2020 to $1.24 Tn.

- Record H1 net inflows of $102.03 Bn beating prior record of $44.77 Bn gathered in H1 2015.

- $102.03 Bn H1 net inflows are $49.71 Bn greater than the full year 2020 record net inflows $52.32 Bn.

- $142.72 Bn in net inflows gathered in the past 12 months.

- 11th month of consecutive net inflows

- Equity Smart Beta ETFs and ETPs listed gathered a record $102.03 Bn in net inflows in H1 2021.

“The S&P 500 gained 2.33% in June and are up 15.25% in the first half of 2021. Developed markets ex-U.S. lost 0.82% in June but are up 9.96% in the first half. Emerging markets are up 0.47% in June and are up 9.03% in the first half. According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

At the end of June 2021, there were 1,325 smart beta equity ETFs/ETPs, with 2,634 listings, assets of $1.24 Tn, from 194 providers listed on 45 exchanges in 37 countries.

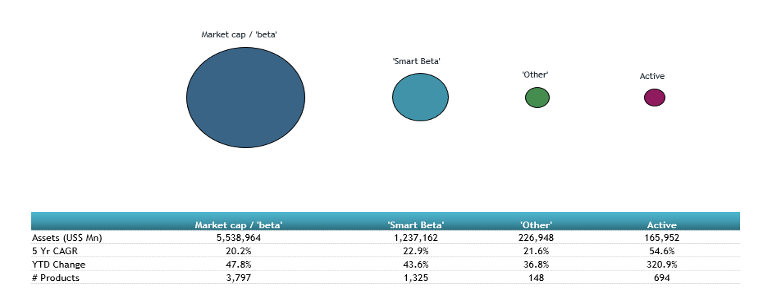

Comparison of assets in market cap, smart beta, other and active equity products

Following net inflows of $14.27 Bn and market moves during the month, assets invested in Smart Beta ETFs/ETPs listed globally increased by 1.64%, from $1.22 Tn at the end of May 2021 to $1.24 Tn. Fundamental ETFs and ETPs attracted the greatest monthly net inflows, gathering $10.16 Bn during June. Volatility ETFs and ETPs suffered the largest net outflows during the month at $433 Mn.

Substantial inflows can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $11.60 Bn during June. Vanguard Value ETF (VTV US) gathered $1.25 Bn the largest net inflow.

Top 20 Smart Beta ETFs/ETPs by net new assets June 2021

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Value ETF |

|

VTV US |

81,704.88 |

10,234.10 |

1,245.16 |

|

SPDR Portfolio S&P 500 Growth ETF |

|

SPYG US |

12,378.48 |

1,405.25 |

1,221.76 |

|

Schwab US Dividend Equity ETF |

|

SCHD US |

26,038.71 |

6,554.07 |

1,117.53 |

|

iShares Edge MSCI World Value Factor UCITS ETF - Acc |

|

IWVL LN |

6,789.58 |

3,008.73 |

888.92 |

|

iShares S&P Small-Cap 600 Value ETF |

|

IJS US |

10,103.53 |

1,759.36 |

797.02 |

|

Vanguard Growth ETF |

|

VUG US |

78,864.17 |

1,600.61 |

622.91 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

|

ESGU US |

18,417.78 |

2,900.00 |

616.44 |

|

iShares Edge MSCI USA Momentum Factor ETF |

|

MTUM US |

15,305.22 |

1,121.41 |

521.02 |

|

iShares MSCI EAFE Value ETF |

|

EFV US |

14,368.53 |

6,327.90 |

493.18 |

|

iShares Edge MSCI USA Quality Factor ETF |

|

QUAL US |

21,575.91 |

2,744.46 |

467.48 |

|

Invesco DWA Momentum ETF |

|

PDP US |

2,170.35 |

105.48 |

407.00 |

|

iShares Edge MSCI International Value Factor ETF |

|

IVLU US |

1,336.07 |

706.78 |

404.47 |

|

iShares Core Dividend Growth ETF |

|

DGRO US |

19,207.03 |

2,531.45 |

387.81 |

|

iShares ESG MSCI EM ETF |

|

ESGE US |

7,991.97 |

1,384.70 |

373.97 |

|

iShares Edge MSCI Europe Value Factor UCITS ETF |

|

IEFV LN |

3,938.81 |

1,723.02 |

368.04 |

|

First Trust Rising Dividend Achievers ETF |

|

RDVY US |

4,781.71 |

2,416.12 |

363.72 |

|

Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF |

|

GSLC US |

13,104.74 |

75.15 |

352.68 |

|

BMO Equal Weight Banks Index ETF |

|

ZEB CN |

1,651.23 |

245.17 |

331.06 |

|

Vanguard Small-Cap Value ETF |

|

VBR US |

24,590.70 |

2,585.94 |

313.67 |

|

SPDR Portfolio S&P 500 High Dividend ETF |

|

SPYD US |

4,666.57 |

1,789.30 |

304.44 |

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

ETF TV News #82 Bryon Lake Managing Director, Head of Americas ETF Client at J.P. Morgan Asset Management discusses new ActiveBuilder ETFs as global ETFs assets reach US$9.35 trillion with Deborah Fuhr #PressPlay https://bit.ly/2UCAffb

ETF TV News #82 Bryon Lake Managing Director, Head of Americas ETF Client at J.P. Morgan Asset Management discusses new ActiveBuilder ETFs as global ETFs assets reach US$9.35 trillion with Deborah Fuhr #PressPlay https://bit.ly/2UCAffb

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

Register now for the 2nd Annual ETFGI Global ETFs Insights Summit - Europe & MEA (virtual), September 14 - 16.

The summit is designed to facilitate a substantive and in-depth discussion on the impact that ETFs have on markets and market structure, and the regulatory, trading, and technological developments impacting the use of ETFs.

Visit the ETFGI website to see the full list of speakers, topics, and more updates as we continue building up the event agenda.

SPEAKERS INCLUDE:

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings. Please contact us if you are interested in sponsoring or speaking at any of the upcoming events.

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings. Please contact us if you are interested in sponsoring or speaking at any of the upcoming events.

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()