ETFGI reports assets in the Global ETFs industry reach a record US$9.46 trillion at the end of July 2021

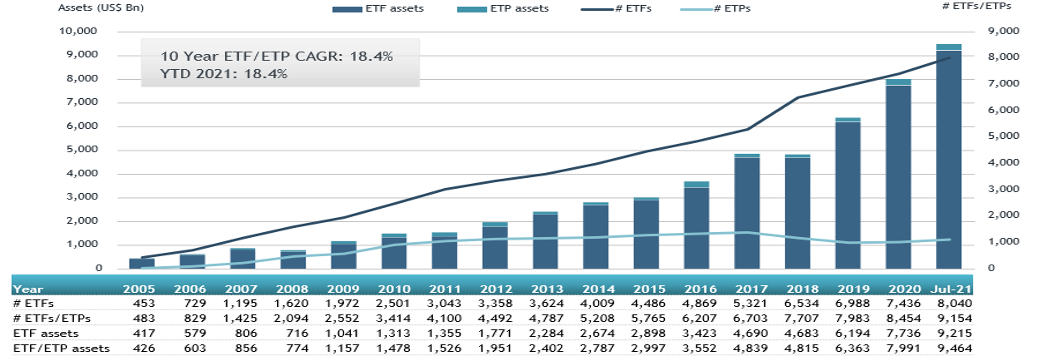

LONDON —August 31, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets in the Global ETFs industry reach a record 9.46 trillion US dollars at the end of July. ETFs and ETPs listed globally gathered net inflows of US$80.45 billion during July, bringing year-to-date net inflows to a record US$739.54 billion which is higher than the US$373.01 billion gathered at this point last year. Assets invested in the global ETFs/ETPs industry have increased by 1.2% from US$9.35 trillion at the end of June 2021, to US$9.46 trillion at the end of July, according to ETFGI's July 2021 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $9.46 trillion invested in ETFs and ETPs listed globally at the end of July 2021.

- Record YTD 2021 net inflows of $739.54 Bn beating the prior record of $390.93 Bn gathered in YTD 2017.

- $739.54 Bn YTD net inflows are just $22 Bn lower than the full year 2020 record net inflows $490.19 Bn.

- $1.13 trillion in net inflows gathered in the past 12 months.

- Assets have increased 18.4% YTD in 2021, going from $7.99 trillion at end of 2020, to $9.46 trillion.

- 26th month of consecutive net inflows

“The S&P 500 gained 2.38% in July. Developed markets ex-U.S. gained 0.40% in July. Luxembourg 8.41% and Finland 5.59% were the leaders of the month while Hong Kong suffer the biggest loss of 4.47%. Emerging markets were down by 5.59% at the end of July.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of July 2021

The Global ETFs and ETPs industry had 9,154 products, with 18,539 listings, assets of $9,464 trillion, from 563 providers listed on 78 exchanges in 62 countries at the end of July.

During July 2021, ETFs/ETPs gathered net inflows of $80.45 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $53.04 Bn during July, bringing net inflows for 2021 to $512.17 Bn, much greater than the $112.90 Bn in net inflows equity products attracted for the corresponding period in 2020. Fixed Income ETFs/ETPs listed globally reported net inflows of $21.68 Bn during July, bringing net inflows for 2021 to $133.34 Bn, lower than the $140.53 Bn in net inflows fixed income products had attracted YTD in 2020. Commodity ETFs/ETPs listed globally gathered net outflows of $1.20 Bn, bringing net outflows for 2021 to $6.13 Bn, significantly lower than the $64.44 Bn in net inflows commodity products had attracted over the same period last year. Active ETFs/ETPs reported $6.00 Bn in net inflows, bringing net inflows for 2021 to $88.23 Bn, higher than the $35.23 Bn in net inflows active products had attracted YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $43.59 Bn during July. Vanguard Short-Term Bond ETF (BSV US) gathered $6.16 Bn the largest net inflow.

Top 20 ETFs by net new inflows July 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Short-Term Bond ETF |

|

BSV US |

40,535.86 |

11,201.79 |

5,991.36 |

|

Vanguard S&P 500 ETF |

|

VOO US |

243,339.08 |

32,054.86 |

5,337.55 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

258,285.59 |

23,583.45 |

3,223.34 |

|

iShares TIPS Bond ETF |

|

TIP US |

31,543.15 |

4,438.84 |

2,599.66 |

|

Health Care Select Sector SPDR Fund |

|

XLV US |

32,230.40 |

2,491.71 |

2,574.19 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

99,091.47 |

7,713.16 |

2,354.05 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

|

ESGU US |

20,827.30 |

4,905.20 |

2,005.20 |

|

KraneShares CSI China Internet ETF |

|

KWEB US |

5,114.13 |

3,516.61 |

1,913.84 |

|

Vanguard Total World Stock ETF |

|

VT US |

23,863.05 |

4,696.46 |

1,901.04 |

|

Vanguard FTSE Developed Markets ETF |

|

VEA US |

103,424.87 |

7,674.68 |

1,817.14 |

|

iShares Core S&P 500 ETF |

|

IVV US |

291,326.63 |

14,533.83 |

1,784.12 |

|

iShares Edge MSCI USA Quality Factor ETF |

|

QUAL US |

23,966.92 |

(1,121.38) |

1,623.08 |

|

iShares MSCI USA Momentum Factor ESG UCITS ETF - Acc |

|

IUME NA |

1,497.26 |

1,455.77 |

1,455.77 |

|

Consumer Staples Select Sector SPDR Fund |

|

XLP US |

13,208.07 |

(612.48) |

1,413.63 |

|

iShares MSCI USA Value Factor ESG UCITS ETF - Acc |

|

IUVE NA |

1,425.31 |

1,413.11 |

1,413.11 |

|

iShares MSCI EAFE Growth ETF |

|

EFG US |

12,115.43 |

1,373.16 |

1,387.63 |

|

Vanguard Total International Bond ETF |

|

BNDX US |

44,726.55 |

7,835.14 |

1,278.34 |

|

iShares Core MSCI World UCITS ETF - Acc |

|

IWDA LN |

40,345.92 |

6,657.38 |

1,252.58 |

|

iShares Core S&P Total U.S. Stock Market ETF |

|

ITOT US |

41,965.61 |

4,202.12 |

1,157.23 |

|

Vanguard Total International Stock Index Fund ETF |

|

VXUS US |

48,629.22 |

7,407.76 |

1,105.61 |

The top 10 ETPs by net new assets collectively gathered $984 Mn over July. Invesco Physical Gold ETC - Acc (SGLD LN) gathered $313 Mn the largest net inflow.

Top 10 ETPs by net new inflows July 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Invesco Physical Gold ETC - Acc |

|

IAU US |

13,221.67 |

(221.86) |

313.20 |

|

Xetra Gold EUR - Acc |

|

UVXY US |

13,871.03 |

1,148.14 |

198.79 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

|

XGDE GY |

2,393.85 |

(878.39) |

72.41 |

|

Aberdeen Standard Precious Metals Basket Trust |

|

GLD US |

1,104.63 |

277.36 |

72.20 |

|

iShares Physical Gold ETC - Acc |

|

00XQ GY |

13,391.63 |

(337.90) |

63.22 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

|

XGDU LN |

3,832.96 |

681.36 |

60.53 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

|

SLVO US |

2,001.22 |

1,708.94 |

59.69 |

|

WisdomTree Physical Swiss Gold - Acc |

|

GOLD FP |

3,686.52 |

172.40 |

56.16 |

|

Invesco DB US Dollar Index Bullish Fund |

|

VXX US |

473.22 |

99.30 |

44.89 |

|

Credit Suisse Silver Shares Covered Call ETN |

|

4GLD GY |

294.78 |

270.04 |

43.35 |

Investors have tended to invest in Equity ETFs and ETPs during July.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register to join us at the 2nd Annual ETFGI Global ETFs Insights Summit - Europe & MEA, a virtual event taking place from 11:30am to 6:30pm BST on September 14th, 15th and 16th. Free registration and CPD educational credits are offered to institutional investors and financial advisors.

The summit is designed to facilitate a substantive and in-depth discussion on the impact that ETFs have on markets and market structure, and the regulatory, trading, and technological developments impacting the selection, use, and trading of ETFs.

If you cannot attend, register anyway and you will receive the session recordings.

Click here to hear about our event

Click here to see the agenda, speakers, and register

Follow us on Linkedin and Twitter for updates about the event.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

We look forward to seeing you on the 14th.

Best regards,

Deborah and Margareta

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

ETF TV News #87 Brandon Clark, Director ETF Business at Federated Hermes discusses their ETFs plans with Margareta Hricova and Deborah Fuhr #PressPlay https://bit.ly/2Wnu27I

ETF TV News #87 Brandon Clark, Director ETF Business at Federated Hermes discusses their ETFs plans with Margareta Hricova and Deborah Fuhr #PressPlay https://bit.ly/2Wnu27I

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()