ETFGI reports record assets and net inflows in Active ETFs and ETPs of US$413 billion and US$95 billion respectively at the end of August 2021

LONDON — September 30, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today record assets and net inflows in Active ETFs and ETPs listed globally of US$413 billion and US$95 billion respectively at the end of August. Actively managed ETFs and ETPs saw net inflows of US$7.00 billion during August, bringing year-to-date net inflows to US$95.21 billion. Assets invested in actively managed ETFs/ETPs finished the month up to 2.4%, from US$404 billion at the end of July to US$413 billion, according to ETFGI's August 2021 Active ETF and ETP industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record $413 Bn invested in actively managed ETFs and ETPs industry at end of August 2021.

- Assets increased 44.5% YTD in 2021 going from $285.83 Bn at end of 2020 to $413 Bn.

- Record YTD 2021 net inflows of $95.21 Bn beating prior record of $43.04 Bn gathered in YTD 2020.

- $95.21 Bn YTD net inflows are $4.10 Bn greater than the full year 2020 record net inflows $91.10 Bn.

- $143.27 Bn in net inflows gathered in the past 12 months.

- 17th month of consecutive net inflows

- Actively managed Equity ETFs and ETPs gathered a record $42.97 Bn in YTD net inflows 2021.

“At the end of August, the S&P 500 posted its 7th straight month of gains, up 3.0% in the month, benefitting from continued support from the Fed and as positive earnings. Developed ex-U.S. markets gained 1.8% in August as most countries advanced, while Korea (down 1.3%) and Hong Kong (down 0.9%) declined the most, due in part to concerns of the new announced regulatory requirements set to take effect in China. Emerging markets were up 3.0% with Thailand (up 10.8%) and the Philippines (up 10.4%) leading the gains at the end of August.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

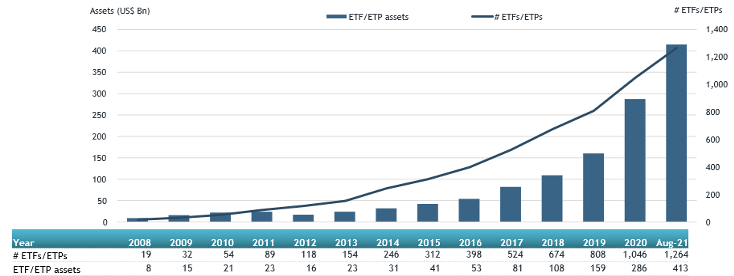

Growth in actively managed ETF and ETP assets as of the end of August 2021

The Global active ETFs and ETPs industry had 1,264 products, with 1,557 listings, assets of US$413 Bn, from 241 providers listed on 28 exchanges in 21 countries at the end oif August.

Equity focused actively managed ETFs/ETPs listed globally gathered net inflows of $2.73 Bn over August, bringing net inflows for the year to August 2021 to $42.97 Bn, more than the $14.57 Bn in net inflows equity products had attracted for the year to August 2020. Fixed Income focused actively managed ETFs/ETPs listed globally attracted net inflows of $3.84 Bn during August, bringing net inflows for the year to August 2021 to $41.46 Bn, much greater than the $25.49 Bn in net inflows fixed income products had attracted for the year to August 2020.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered

$4.84 Bn during August. SPDR Blackstone/GSO Senior Loan ETF (SRLN US) gathered $781 Mn the largest net inflows.

Top 20 actively managed ETFs/ETPs by net new assets August 2021

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

7,324.70 |

5,077.09 |

780.81 |

|

Magellan High Conviction Trust/ETF |

MHHT AU |

763.86 |

763.86 |

763.86 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

3,424.95 |

3,088.81 |

645.02 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

28,083.30 |

10,119.99 |

462.06 |

|

Vanguard Ultra Short-Term Bond ETF |

VUSB US |

1,515.83 |

1,514.62 |

237.94 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

17,737.73 |

2,138.18 |

225.58 |

|

PGIM Ultra Short Bond ETF |

PULS US |

1,876.46 |

659.29 |

212.44 |

|

JPMorgan Ultra-Short Municipal Income ETF |

JMST US |

2,110.96 |

961.90 |

173.59 |

|

Lyxor Smart Overnight Return - UCITS ETF - C-EUR - Acc |

CSH2 FP |

857.24 |

(46.27) |

165.11 |

|

First Trust Preferred Securities and Income Fund |

FPE US |

7,524.23 |

1,502.86 |

163.83 |

|

CI First Asset Global Financial Sector ETF |

FSF CN |

813.48 |

260.80 |

127.93 |

|

Blackrock Short Maturity Bond ETF |

NEAR US |

4,779.88 |

228.42 |

117.83 |

|

First Trust Senior Loan ETF |

FTSL US |

2,600.74 |

1,277.45 |

107.41 |

|

Hyperion Global Growth Companies Fund Manage Fund |

HYGG AU |

1,430.37 |

1,254.41 |

107.19 |

|

Dimensional US Core Equity 2 ETF |

DFAC US |

14,002.57 |

256.04 |

106.47 |

|

Innovator U.S. Equity Power Buffer ETF - August |

PAUG US |

182.50 |

62.31 |

105.90 |

|

Nationwide Risk-Managed Income ETF |

NUSI US |

582.30 |

404.31 |

100.01 |

|

Dimensional US Targeted Value ETF |

DFAT US |

6,138.21 |

188.19 |

82.25 |

|

PIMCO Short Term Municipal Bond Strategy Fund |

SMMU US |

545.88 |

259.65 |

79.75 |

|

USAA Core Intermediate-Term Bond ETF |

UITB US |

1,031.99 |

389.89 |

78.38 |

Investors have tended to invest in Fixed Income actively managed ETFs and ETPs during August.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register now to join the discussions on November 2nd & 3rd at our 2nd Annual ETFGI Global ETFs Insights Summit - Asia Pacific virtual event. Free registration and CPD educational credits are offered to institutional investors and financial advisors.

Exciting line up of speakers in fireside chats and panel discussions with Q&A on timely and relevant topics with sponsor booths and virtual networking!

The summit is designed to facilitate a substantive and in-depth discussion on the impact that ETFs have on markets and market structure, and the regulatory, trading, and technological developments impacting the selection, use, and trading of ETFs.

If you cannot attend, register anyway and you will receive the session recordings.

Topics include:

- Fireside Chat

- Trends in Asia Pacific ETFs - ETFGI Research

- Trading - Creating Better Trading Systems and Trading Tools

- Regulatory Issues Impacting Market Structure and ETF Trading

- Regulatory Update on Topics Impacting ETFS in Asia

- Update on the US and European ETF Industry

- ETF Landscape in Australia

- ETF Landscape in Japan

- ETF Landscape in India

- ETF Landscape in South Korea

- ETF Landscape in Singapore

- ETF Landscape in Hong Kong

- ETF Landscape in China

- Global Macro Outlook

- Trends in Thematic Indices and ETFs

- Trends in Crypto - Digital Indices and Products

- Investing in China

- How Investors are Using and Selecting ETFs

- Trends in ESG Indices and ETFs

Speakers include:

- Stewart Aldcroft, Asian Fund Management Industry Consultant

- Georgia Bullitt, Partner, Willkie Farr & Gallagher LLP

- Eva Chan, Partner, Simmons & Simmons

- Christina Choi Fung Yee, Executive Director, Investment Products, Securities and Futures Commission

- Grace Chong, Of Counsel, Simmons & Simmons

- Tom Digby, Head of ETF Capital Markets, APAC ETFs & Indexed Strategies, Invesco

- Bradley Duke, Co-Founder & CEO, ETC Group

- Michele Ferrario, Co-Founder and CEO, StashAway

- Deborah Fuhr, Managing Partner, Founder, ETFGI

- Anil Ghelani, Senior Vice President, Head of Passive Investments & Products, DSP Investment Managers

- Melody He, Managing Director, Head of Sales and Product Strategy, CSOP Asset Management

- Koei Imai, Senior Advisor of ETF Center, Nikko Asset Management

- Lakshmi Iyer, CIO-Fixed Income & Head-Products, Kotak Mahindra Asset Management Company Ltd.

- Junichi Kamitsubo, General Manager, Corporate Planning Dept, Sumitomo Mitsui Trust Asset Management Co., Ltd.

- Wei Chin Kang, Associate Director, Product Management, SGX

- Aleksey Mironenko, Managing Director, Global Head of Investment Solutions, Leo Wealth

- Ricky Mok, Director ETF & Index Fund Sales - Asia ex Japan, UBS Asset Management

- Jacqueline Pang, Head of ETF Sales, Asia Pacific, HSBC Asset Management

- Chris Pigott, Senior Vice President, Head of Hong Kong ETF Services, Brown Brothers Harriman

- Zeb Saeed, Passive Product Specialist, DWS

- David Semaya, Executive Chairman & Representative Director, Sumitomo Mitsui Trust Asset Management Co., Ltd.

- Sanjiv Shah, 'Fintech' Entrepreneur, 1 Pay

- Ben Sturgeon, Director, Equities Product Manager - Europe, Tradeweb

- Masafumi Watanabe, ETF Business Dept. Chief ETF Strategist, Nomura Asset Management Co., Ltd.

- Steve Wang, Head of ETF, Bosera Asset Management Co.

- Melody Yang, Partner, Simmons & Simmons

- Joy Yang, Global Head of Index Product Management, MV Index Solutions

- Chen Zhao, Founding Partner & Chief Global Strategist, Alpine Macro

Follow us on Linkedin and Twitter for updates about the event.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

Best regards,

Deborah and Margareta

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

ETF TV News #91 Kristof Gleich, President, Harbor Capital Advisors discusses why Harbor Capital entered the ETFs industry and shares their plans for the next year on ETF TV with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/3zY0lZ3

ETF TV News #91 Kristof Gleich, President, Harbor Capital Advisors discusses why Harbor Capital entered the ETFs industry and shares their plans for the next year on ETF TV with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/3zY0lZ3

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()