ETFGI reports that record assets and net inflows of US$9.73 trillion and US$ 834 billion in ETFs and ETPs listed globally at the end of August

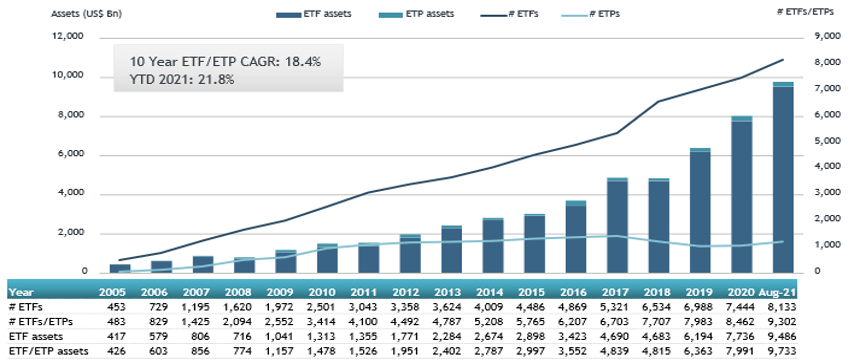

LONDON —September 10, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, ETFGI reports that record assets and net inflows of US$9.73 trillion and US$834 billion in ETFs and ETPs listed globally at the end of August. ETFs and ETPs listed globally gathered net inflows of US$94.64 billion during August, bringing year-to-date net inflows to US$834.21 billion which is higher than the US$427.56 billion gathered at this point last year and higher than the full year 2020 record net inflows US$762.77 Bn. Assets invested in the global ETFs/ETPs industry have increased by 2.8% from US$9.46 trillion at the end of July 2021, to US$9.73 trillion at the end of August, according to ETFGI's August 2021 Global ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $9.73 trillion invested in ETFs and ETPs listed globally at the end of August 2021.

- Record YTD 2021 net inflows of $834.21 Bn beating the prior record of $433.25 Bn gathered in YTD 2017.

- $834.21 Bn YTD net inflows are $344.02 Bn higher than the full year 2020 record net inflows $762.77 Bn.

- $1.78 trillion in net inflows gathered in the past 12 months.

- Assets increased 21.8% YTD in 2021, going from US$7.99 trillion at end of 2020, to US$9.73 trillion.

- 27th month of consecutive net inflows

- Equity ETFs and ETPs listed in the US gathered a record $581.25 Bn in YTD net inflows 2021.

“At the end of August, the S&P 500 posted its 7th straight month of gains, up 3.0% in the month, benefitting from continued support from the Fed and as positive earnings. Developed ex-U.S. markets gained 1.8% in August as most countries advanced, while Korea (down 1.3%) and Hong Kong (down 0.9%) declined the most, due in part to concerns of the new announced regulatory requirements set to take effect in China. Emerging markets were up 3.0% with Thailand (up 10.8%) and the Philippines (up 10.4%) leading the gains at the end of August.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of August 2021

The Global ETF/ETP industry had 9,302 ETFs/ETPs, with 18,802 listings, assets of $9.733 trillion, from 568 providers on 78 exchanges in 62 countries at the end of August.

During August 2021, ETFs/ETPs gathered net inflows of $94.64 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $69.06 Bn over August, bringing net inflows for 2021 to $581.25 Bn, much greater than the $136.96 Bn in net inflows equity products had attracted for the corresponding period through August 2020. Fixed Income ETFs/ETPs listed globally reported net inflows of $19.99 Bn during August, bringing net inflows for 2021 to $153.33 Bn, lower than the $160.43 Bn in net inflows fixed income products had attracted YTD in 2020. Commodity ETFs/ETPs listed globally gathered net outflows of $1.91 Bn, bringing net outflows for 2021 to $8.04 Bn, significantly lower than the $68.08 Bn in net inflows commodity products had attracted over the same period last year. Active ETFs/ETPs reported $6.99 Bn in net inflows, bringing net inflows for 2021 to $95.22 Bn, higher than the $43.04 Bn in net inflows active products had attracted YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $40.58 Bn during August. SPDR S&P 500 ETF Trust (SPY US) gathered $7.81 Bn largest individual net inflow.

Top 20 ETFs by net new inflows August 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

403,532.75 |

4,572.32 |

7,805.21 |

|

Vanguard S&P 500 ETF |

|

VOO US |

255,707.08 |

36,598.04 |

4,543.18 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

270,049.66 |

27,824.68 |

4,241.23 |

|

Invesco QQQ Trust |

|

QQQ US |

193,122.10 |

9,031.51 |

2,500.07 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

|

LQD US |

42,688.85 |

(11,196.24) |

2,416.99 |

|

iShares TIPS Bond ETF |

|

TIP US |

33,297.91 |

6,430.65 |

1,991.81 |

|

Financial Select Sector SPDR Fund |

|

XLF US |

43,267.33 |

9,426.38 |

1,967.42 |

|

iShares Core S&P 500 ETF |

|

IVV US |

301,884.88 |

16,237.32 |

1,703.49 |

|

iShares MSCI EAFE Small-Cap ETF |

|

SCZ US |

15,155.61 |

2,339.20 |

1,648.01 |

|

KraneShares CSI China Internet ETF |

|

KWEB US |

6,692.12 |

4,979.06 |

1,462.45 |

|

Vanguard Total Bond Market ETF |

|

BND US |

81,470.12 |

14,523.27 |

1,365.21 |

|

Vanguard Total International Stock Index Fund ETF |

|

VXUS US |

50,780.59 |

8,591.56 |

1,183.79 |

|

Samsung KODEX 200 ETF |

|

069500 KS |

4,649.02 |

(652.78) |

1,149.51 |

|

iShares Russell 2000 ETF |

|

IWM US |

68,459.30 |

1,211.76 |

1,022.22 |

|

iShares S&P/TSX 60 Index Fund |

|

XIU CN |

9,566.35 |

870.94 |

1,008.95 |

|

Utilities Select Sector SPDR Fund |

|

XLU US |

13,679.76 |

779.01 |

989.78 |

|

iShares Edge MSCI USA Quality Factor ETF |

|

QUAL US |

25,587.74 |

(196.00) |

925.39 |

|

Vanguard FTSE Developed Markets ETF |

|

VEA US |

105,813.02 |

8,596.41 |

921.73 |

|

iShares Russell 1000 Growth ETF |

|

IWF US |

75,761.84 |

(1,509.37) |

889.50 |

|

Daiwa ETF TOPIX |

|

1305 JP |

67,565.40 |

2,109.09 |

847.47 |

The top 10 ETPs by net new assets collectively gathered $1.62 Bn over August. Invesco Physical Gold ETC - Acc (SGLD LN) gathered $529 Mn largest individual net inflow.

Top 10 ETPs by net new inflows August 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Invesco Physical Gold ETC - Acc |

|

SGLD LN |

13,677.54 |

306.79 |

528.65 |

|

ProShares Ultra VIX Short-Term Futures |

|

UVXY US |

946.85 |

1,511.49 |

359.31 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

|

VXX US |

969.26 |

1,078.46 |

213.27 |

|

Xetra Gold EUR - Acc |

|

4GLD GY |

13,935.75 |

1,300.08 |

151.94 |

|

Invesco DB Commodity Index Tracking Fund |

|

DBC US |

2,521.02 |

677.03 |

81.79 |

|

SPDR Gold MiniShares Trust |

|

GLDM US |

4,560.10 |

712.01 |

80.60 |

|

ProShares VIX Short-Term Futures ETF |

|

VIXY US |

304.03 |

323.29 |

66.78 |

|

MicroSectors FANG Innovation 3X Leveraged ETN |

|

BULZ US |

52.11 |

50.99 |

50.99 |

|

iPath Bloomberg Commodity Index Total Return ETN |

|

DJP US |

821.37 |

167.28 |

49.86 |

|

ProShares UltraShort DJ-UBS Natural Gas |

|

KOLD US |

107.86 |

154.54 |

38.33 |

Investors have tended to invest in Equity ETFs and ETPs during August.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Last few days left to register to join the discussions on September 14th, 15th and 16th from 11:30am to 6:30pm BST at our 2nd Annual ETFGI Global ETFs Insights Summit - Europe & MEA virtual event. Free registration and CPD educational credits are offered to institutional investors and financial advisors.

Exciting line up of speakers in fireside chats and panel discussions with Q&A on timely and relevant topics with sponsor booths and virtual networking!

The summit is designed to facilitate a substantive and in-depth discussion on the impact that ETFs have on markets and market structure, and the regulatory, trading, and technological developments impacting the selection, use, and trading of ETFs.

If you cannot attend, register anyway and you will receive the session recordings.

Click here to see the agenda, speakers, and register

Fireside chats and panel discussions will cover the following topics:

- Trends in the Europe, Middle East and Africa ETF Landscape based on ETFGI research

- How Investors are Implementing ESG in Their Portfolios

- Regulatory Issues Impacting ETF Trading and Market Structure

- How a Consolidated Tape Could Contribute to the Development of ETFs in the EU

- Fireside Chat - Martin Gilbert

- Understanding Benchmark and Sustainable Finance Regulations

- Trends in Fixed Income Indices and ETFs

- Macro Investment Outlook

- Fireside Chat - Susanne Gahler

- How Investors are Using Thematic ETFs

- Overview of the ETF Landscape in Qatar

- Overview of the ETF Landscape in Saudi Arabia

- Overview of the ETF Landscape in South Africa

- Overview of the ETF Landscape in Africa

- Overview of the ETF Landscape in Israel

- Trends That Will Drive the ETF and Financial Industry in 2022 and Beyond

Speakers include:

- Terry Adembesa, Chief Business Officer, Nairobi Securities Exchange

- Ahmad Al Shabanah, Head of Asset Management, Falcom Financial Services

- Reem AlGhuneim, Manager of Fixed Income, Funds & Structured Product, Saudi Exchange Company

- Meshal Alumni, Asset Management, Product Development Analyst, Albilad Capital

- Raymond Backreedy, CIO, Sparrows Capital Limited

- Mehdi Balafrej, Global Head of ETF & Index Portfolio Management, Amundi

- Shaun Baskett, Director, Index Sales, Cboe Europe

- Tiaan Bazuin, CEO, Namibian Stock Exchange (“NSX”)

- Kopano Bolokwe, Head of Product Development, Botswana Stock Exchange

- Silvia Bosoni, Head of ETFs, ETPs and open end Funds, Borsa Italiana

- Georgia Bullitt, Partner, Willkie Farr & Gallagher LLP

- Liora Caplan, Head of Capital Markets Research, Bank Leumi

- Gunjan Chauhan, Global Head of SPDR ETF Capital Markets, State Street Global Advisors

- Jude Chiemeka, Divisional Head, Trading Business, Nigerian Exchange Limited

- Helena Conradie, CEO, Satrix

- Tia Counts, Managing Director, Chief Diversity Officer, MSCI

- Yaron Dayagi, CEO of Harel Mutual Funds and ETFs, Harel Insurance & Finance

- Henrietta de Salis, Partner, Willkie Farr & Gallagher LLP

- Morgane Delledonne, Director of Research, Global X ETFs

- Anna Driggs, Director, and Associate Chief Counsel, ICI Global

- Bradley Duke, Co-Founder & CEO, ETC Group

- Marie Dzanis, EVP, Head of EMEA, Chief Executive Officer, Northern Trust Global Investments

- Guy Fischer, CIO & Deputy CEO, Migdal Insurance Co

- Deborah Fuhr, Managing Partner, Founder, ETFGI

- Susanne Gahler, Manager, Asset Management Sector Team, Financial Conduct Authority

- Martin Gilbert, Chairman, AssetCo

- Anthony Ginsberg, Managing Director, Gins Global Index Funds

- Jim Goldie, EMEA Head of Capital Markets ETFs and Indexed Strategies, Invesco

- James Harris, Commercial Director, CryptoCompare

- Geoffroy Hermanns, Lawyer, Norton Rose Fulbright

- Yaniv Hirsch, Indices Marketing Manager, Tel Aviv Stock Exchange

- Paul Jackson, Global Head of Asset Allocation Research, Invesco

- John Jacobs, Executive Director, Center for Financial Markets and Policy, McDonough School of Business, Georgetown University

- William Kelly, Chief Executive Officer, CAIA Association

- Thomas Kettner, Chief Operating Officer, MV Index Solutions

- Akber Khan, Senior Director, Asset Management, Al Rayan Investment

- Christopher Langner, Head of Investment Strategy, First Abu Dhabi Bank

- Tilman Lueder, Head of Unit – DG FISMA, Securities Markets, European Commission

- Christopher Matta, President, 3iQ Digital Assets (US), 3iQ Corp.

- Julie Moret, Global Head of Sustainable Investing and Stewardship, Northern Trust Asset Management

- Duma Mxenge, Business Development Manager, Satrix

- Nick Ogbourne, Product Development Manager, Qatar Stock Exchange

- Gareth Parker, Chairman, and Chief Indexing Officer, Moorgate Benchmarks

- Mark Perchtold, Director, Omba Advisory & Investments Ltd

- Stephan Pouyat, Global Head of Capital Markets and Funds Services, Euroclear

- Rick Redding, CEO, Index Industry Association

- Valdene Reddy, Director, Capital Markets, JSE Ltd

- Michael Ridley, Director, Responsible Investment, HSBC Asset Management

- Sherif M. Salem, CIO – Public Markets, Chimera Capital

- Waqas Samad, Former Group Head, Investment Solutions & CEO FTSE, London Stock Exchange Group (LSEG)

- Talal Samhouri, Senior Portfolio Manager, Aventicum Capital Management

- Steffen Scheuble, Chief Executive Officer and Founder of Solactive AG, Solactive AG

- Patrick Shadow, President, Syntax Indices

- Olivier Souliac, Senior Product Specialist, Index Strategy & Analyst, DWS

- Allan Stewart, Vice President, ETF Sales and Relationship Managem, Clearstream

- Gregoire Theron, Chief Investment Officer, GraySwan

- Diana van Maasdijk, Co-Founder & Executive Director, Equileap

- Nerina Visser, Director, ETF Strategist and Financial Advisor, etfSA

- Jason Warr, Managing Director, EMEA Head of EII Markets, BlackRock

- Mark Webster, Director of ETF Sales, BMO Global Asset Management

- Suzanne Williams, Global Head of Product Development, HSBC Asset Management

Follow us on Linkedin and Twitter for updates about the event.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

We look forward to seeing you on the 14th.

Best regards,

Deborah and Margareta

Upcoming ETFGI Global ETFs Insights Summits (Virtual)

- 2nd Annual Europe & MEA, September 14 - 16 Register Here

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

ETF TV News #89 Julian Klymochko, Accelerate Financial Technologies discusses the relationship between Bitcoin, ESG and ETFs with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/3l8bnFR

ETF TV News #89 Julian Klymochko, Accelerate Financial Technologies discusses the relationship between Bitcoin, ESG and ETFs with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/3l8bnFR

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()