ETFGI reports ESG ETFs and ETPs listed globally gathered a record US$119 billion US of net inflows in the first 9 months of 2021

LONDON — October 29, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports ESG ETFs and ETPs listed globally gathered a record US$119 billion of net inflows in the first 9 months of 2021. Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$9.83 billion during September, bringing year-to-date net inflows to US$118.94 billion which is much higher than the US$47 billion gathered at this point last year. Total assets invested in ESG ETFs and ETPs decreased by 1.3% from US$327 billion at the end of August 2021 to US$324 billion, according to ETFGI’s September 2021 ETF and ETP ESG industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

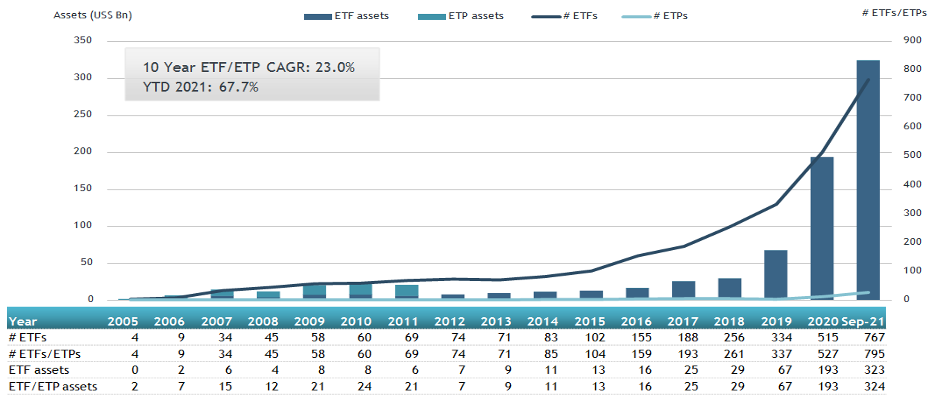

- Assets of $324 billion invested in ETFs and ETPs listed globally at the end of September are the second highest on record.

- Record YTD 2021 net inflows of $118.94 Bn beating the prior record of $47 Bn gathered YTD 2020.

- $118.94 Bn YTD net inflows are just $30.4 Bn over full year 2020 record net inflows $88.54 Bn.

- $160.48 billion in net inflows gathered in the past 12 months.

- Assets increased 67.7% YTD in 2021, going from US$193 billion at end of 2020, to US$324 trillion.

- 67th month of consecutive net inflows.

- Equity ETFs and ETPs listed globally gathered a record $88.8 Bn in YTD net inflows 2021.

“The S&P 500 declined 4.65% in September as due to fears of inflation, the ongoing Congressional budget impasse, and anticipation of a reduction in Fed liquidity provision. Developed markets ex-U.S. declined 2.99% and emerging markets were down 3.12% in September.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ESG ETF and ETP asset growth as at end of September 2021

Global there are 795 ESG ETFs/ETPs, with 2,224 listings, assets of US$324 Bn, from 168 providers on 40 exchanges in 32 countries at the end of September.

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily, with 795 ESG ETFs/ETPs and 2,224 listings globally at the end of September 2021.

During September, 41 new ESG ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$4.57 Bn in September. iShares Trust iShares ESG Aware MSCI USA ETF (ESGU US) gathered $522 Mn largest individual net inflow.

Top 20 ESG ETFs/ETPs by net new assets September 2021

|

Name |

Ticker |

Assets (US$ Mn) Sep-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) Sep-21 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

21,634.50 |

6,218.52 |

522.06 |

|

Huatai-PineBridge CSI Photovoltaic Industry ETF |

515790 CH |

1,936.16 |

(23.05) |

403.12 |

|

Invesco Global Clean Energy UCITS ETF - Acc |

GCLX LN |

33.73 |

1,109.72 |

402.33 |

|

iShares ESG MSCI EAFE ETF |

ESGD US |

6,726.28 |

2,469.01 |

259.89 |

|

AMUNDI INDEX MSCI USA SRI - UCITS ETF DR (C) - Acc |

USRI FP |

4,339.81 |

2,145.23 |

247.03 |

|

Mirae Asset TIGER China Electric Vehicle Solactive ETF |

371460 KS |

1,759.86 |

1,528.03 |

245.84 |

|

UBS Irl ETF plc - S&P 500 ESG UCITS ETF - USD - Acc |

S5ESG SW |

866.41 |

70.45 |

204.96 |

|

iShares Euro Corp Bond SRI UCITS ETF |

SUOE LN |

2,814.98 |

668.09 |

200.60 |

|

Vanguard ESG US Stock ETF |

ESGV US |

5,177.94 |

1,687.97 |

198.62 |

|

One ETF ESG - Acc |

1498 JP |

471.06 |

424.52 |

193.94 |

|

L&G ESG Emerging Markets Corporate Bond USD UCITS ETF - CHF Hdg |

EMHC SW |

183.32 |

188.87 |

188.32 |

|

KraneShares Global Carbon ETF |

KRBN US |

923.89 |

761.19 |

181.09 |

|

iShares MSCI EM IMI ESG Screened UCITS ETF - Acc - Acc |

SAEM LN |

1,746.64 |

620.22 |

179.03 |

|

iShares MSCI ACWI Low Carbon Target ETF |

CRBN US |

1,066.05 |

384.66 |

178.77 |

|

Xtrackers MSCI World ESG UCITS ETF - 1C - Acc |

XZW0 LN |

2,900.97 |

1,365.23 |

166.86 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

3,834.71 |

1,074.99 |

164.10 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

3,375.78 |

2,471.68 |

163.59 |

|

Mackenzie Global Sustainable Bond ETF |

MGSB CN |

158.03 |

157.59 |

157.59 |

|

iShares MSCI EM SRI UCITS ETF - Acc |

SUES LN |

2,772.71 |

1,115.21 |

157.45 |

|

iShares MSCI USA ESG Enhanced UCITS ETF - Acc |

EDMU GY |

3,236.57 |

1,651.10 |

155.18 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Register now to join us on November 2nd & 3rd at our 2nd annual ETFGI Global ETFs Insights Summit – Asia Pacific, a virtual event starting at 10am Hong Kong time to visit the sponsor booths in the exhibit hall and virtual networking.

The event is designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, active and trading developments impacting investors.

Speakers will include key regulators, leading ETF issuers, stock exchanges, law firms and others involved in the ETF ecosystem.

Free registration and educational credits are available for qualified institutional investors and financial advisors. Standard registration is available for everyone else. Register here

Click here to see the full list of speakers, agenda and register

Day 2 Agenda

Wednesday, November 3rd, 2021

The ETFGI Global ETFs Insights Summits are a series of events organised by ETFGI. In 2021 we have held 4 events with 2 more scheduled.

Upcoming 2021 events are:

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

Past 2021 events include:

- ESG and Active ETFs Trends, March 24th & 25th Session Recordings

- 2nd Annual Latin America, April 14th & 15th Session Recordings

- 2nd Annual USA, May 19th & 20th Session Recordings

- 2nd Annual Europe & MEA, September 14, 15th & 16th Session Recordings

If you are interested in sponsoring, supporting or speaking at our upcoming events in 2021 or 2022 or have any questions, please contact Margareta Hricova at margareta.hricova@etfgi.com and Deborah Fuhr at deborah.fuhr@etfgi.com.

Follow us on Linkedin and Twitter for updates about the event.

ETF TV News #95 Leah Wald CEO and co-founder at Valkyrie discusses Bitcoin futures ETFs with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/3Gu72GQ

ETF TV News #95 Leah Wald CEO and co-founder at Valkyrie discusses Bitcoin futures ETFs with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/3Gu72GQ

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()