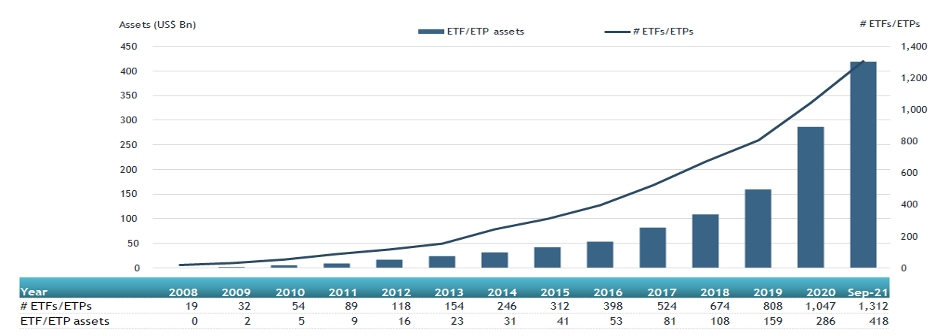

ETFGI reports record assets and net inflows in Active ETFs world-wide of US$418 billion and US$110 billion respectively at end of September 2021

LONDON — October 19, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today record assets and net inflows in Active ETFs world-wide of US$418 billion and US$110 billion respectively at end of September. Actively managed ETFs and ETPs saw net inflows of US$14.68 billion during September, bringing year-to-date net inflows to US$109.93 billion. Assets invested in actively managed ETFs/ETPs finished the month up to 1.1%, from US$413 billion at the end of August to US$418 billion, according to ETFGI's September 2021 Active ETF and ETP industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record $418 Bn invested in actively managed ETFs and ETPs industry at end of September 2021.

- Assets increased 46.1% YTD in 2021 going from $285.83 Bn at end of 2020 to $417.73 Bn.

- Record YTD 2021 net inflows of $109.93 Bn beating prior record of $51.29 Bn gathered in YTD 2020.

- $109.93 Bn YTD net inflows are $18.83 Bn greater than the full year 2020 record net inflows $91.10 Bn.

- $149.73 Bn in net inflows gathered in the past 12 months.

- 18th month of consecutive net inflows

- Actively managed Equity ETFs and ETPs gathered a record $52.73 Bn in YTD net inflows 2021.

“The S&P 500 declined 4.65% in September as due to fears of inflation, the ongoing Congressional budget impasse, and anticipation of a reduction in Fed liquidity provision. Developed markets ex-U.S. declined 2.99% and emerging markets were down 3.12% in September.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in actively managed ETF and ETP assets as of the end of September 2021

Equity focused actively managed ETFs/ETPs listed globally gathered net inflows of $9.72 Bn during September, bringing net inflows for the year to September 2021 to $52.73 Bn, more than the $16.31 Bn in net inflows equity products had attracted for the year to September 2020. Fixed Income focused actively managed ETFs/ETPs listed globally attracted net inflows of $4.33 Bn during September, bringing net inflows for the year to September 2021 to $45.79 Bn, much greater than the $30.74 Bn in net inflows fixed income products had attracted for the year to September 2020.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered $12.35 Bn during September. Dimensional World EX US Core Equity 2 ETF (DFAX US) gathered $4.71Bn the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets September 2021

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Dimensional World EX US Core Equity 2 ETF |

DFAX US |

4,505.97 |

4,706.68 |

4,706.68 |

|

Dimensional International Value ETF |

DFIV US |

3,501.12 |

3,570.70 |

3,570.70 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

18,408.77 |

2,812.35 |

674.16 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

3,814.42 |

3,655.89 |

567.08 |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

7,740.66 |

5,465.16 |

388.07 |

|

PIMCO Enhanced Short Maturity Strategy Fund |

MINT US |

14,404.06 |

100.24 |

342.62 |

|

Vanguard Ultra Short-Term Bond ETF |

VUSB US |

1,738.47 |

1,747.58 |

232.96 |

|

PIMCO Euro Short Maturity Source UCITS ETF - Acc |

PJSR GY |

1,566.40 |

211.32 |

196.67 |

|

Goldman Sachs Future Tech Leaders Equity ETF |

GTEK US |

172.04 |

179.04 |

179.04 |

|

JPMorgan EUR Ultra-Short Income UCITS ETF |

JSET LN |

1,404.22 |

627.56 |

170.02 |

|

BlackRock Ultra Short-Term Bond ETF |

ICSH US |

5,778.55 |

542.87 |

169.12 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

3,375.78 |

2,471.68 |

163.59 |

|

Mackenzie Global Sustainable Bond ETF |

MGSB CN |

158.03 |

157.59 |

157.59 |

|

Purpose US Cash ETF |

PSU/U CN |

280.91 |

112.52 |

150.02 |

|

First Trust Preferred Securities and Income Fund |

FPE US |

7,625.46 |

1,624.71 |

121.85 |

|

Dimensional US Core Equity 2 ETF |

DFAC US |

13,497.48 |

375.74 |

119.70 |

|

Principal Active High Yield ETF |

YLD US |

234.32 |

107.72 |

117.62 |

|

JPMorgan Ultra-Short Municipal Income ETF |

JMST US |

2,219.11 |

1,071.64 |

109.74 |

|

Innovator U.S. Equity Power Buffer ETF - September |

PSEP US |

278.03 |

(52.49) |

109.43 |

|

TD Canadian Long Term Federal Bond ETF |

TCLB CN |

131.88 |

130.91 |

104.04 |

Investors have tended to invest in Equity actively managed ETFs/ETPs during September.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register now for the 2nd annual ETFGI Global ETFs Insights Summit – Asia Pacific, a virtual event on November 2 & 3!

The event is designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, active and trading developments impacting investors.

Speakers will include key regulators, leading ETF issuers, stock exchanges, law firms and others involved in the ETF ecosystem.

Free registration and educational credits are available for qualified institutional investor and financial advisors. Standard registration is available for everyone else. Register here

Attendees will have the opportunity to see and hear speakers via video and audio of the keynote and panel discussions, virtual event booths where you can meet and speak with our sponsors and virtual networking with other attendees.

Click here to see the agenda, speakers, and register

Featured speakers include:

- Christina Choi, Executive Director, Investment Products, Securities and Futures Commission

- Frederick Chu, Executive Director - Head of ETF Business, Asset Management, Haitong International Securities Group Limited

- Rory Cunningham, Senior Manager, Investment Products, ASX

- Tom Digby, Head of ETF Capital Markets, APAC ETFs & Indexed Strategies, Invesco

- Hector McNeil, CEO & Co-Founder, HANetf

- Jacqueline Pang, Head of ETF Sales, Asia Pacific, HSBC Asset Management

- Brian Roberts, Head of Exchange Traded Products, HKEX

- Ben Sturgeon, Director, Equities Product Manager - Europe, Tradeweb

- Zeb Saeed, Passive Product Specialist, DWS

- Joy Yang, Global Head of Index Product Management, MV Index Solutions

Click here to see the full list of speakers, agenda and register.

Additional speakers will be added. To view the agendas, speakers, sponsors and hear recordings from our prior events in 2021, 2020 and 2019, please visit the ETFGI website.

The ETFGI Global ETFs Insights Summits are a series of events organised by ETFGI. In 2021 we have held 4 events with 2 more scheduled.

Upcoming 2021 events are:

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

Past 2021 events include:

- ESG and Active ETFs Trends, March 24th & 25th Session Recordings

- 2nd Annual Latin America, April 14th & 15th Session Recordings

- 2nd Annual USA, May 19th & 20th Session Recordings

- 2nd Annual Europe & MEA, September 14, 15th & 16th Session Recordings

The events offer an opportunity for a substantive and in-depth discussion about the liquidity, trading, technological and regulatory developments impacting ETFs in the respective jurisdictions.

Click here to register. If you can't attend on the day, register anyway and you'll receive recordings of all the sessions.

If you are interested in sponsoring, supporting or speaking at our upcoming events in 2021 or 2022 or have any questions, please contact Margareta Hricova at margareta.hricova@etfgi.com and Deborah Fuhr at deborah.fuhr@etfgi.com.

Follow us on Linkedin and Twitter for updates about the event.

ETF TV news #94 Paul Kim, CEO & Cofounder, Simplify, Victoria Wolodzko, Senior Vice President, Mission at Susan G. Komen the new actively managed Simplify Health Care ETF ticker PINK which will donate the profits - to the Susan G. Komen® organization with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/2XpTBWz

ETF TV news #94 Paul Kim, CEO & Cofounder, Simplify, Victoria Wolodzko, Senior Vice President, Mission at Susan G. Komen the new actively managed Simplify Health Care ETF ticker PINK which will donate the profits - to the Susan G. Komen® organization with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/2XpTBWz

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()