ETFGI reports record assets and net inflows into ETFs and ETPs listed in Asia Pacific (ex-Japan) of US$518 billion and US$64 billion respectively at end of September 2021

LONDON —October 22, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported record assets and net inflows into ETFs and ETPs listed in Asia Pacific (ex-Japan) of US$518 billion and US$64 billion respectively at end of September 2021. ETFs and ETPs listed in Asia Pacific (ex-Japan) saw net inflows of US$15.67 billion during September, bringing year-to-date net inflows to US$63.61 billion. Assets invested in the Asia Pacific (ex-Japan) ETFs/ETPs industry have increased by 2.2%, from US$506.96 billion at the end of August, to US$518.15 billion, according to ETFGI's September 2021 Asia Pacific (ex-Japan) ETFs and ETPs industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $518.15 billion invested in ETFs and ETPs listed in Asia Pacific (ex-Japan) at the end of September 2021

- Record YTD 2021 net inflows of $63.61 Bn beating the prior record of $32.20 Bn gathered in YTD 2020.

- $63.61 Bn YTD net inflows are $9.31 Bn over full year 2020 record net inflows $54.30 Bn.

- $85.72 billion in net inflows gathered in the past 12 months.

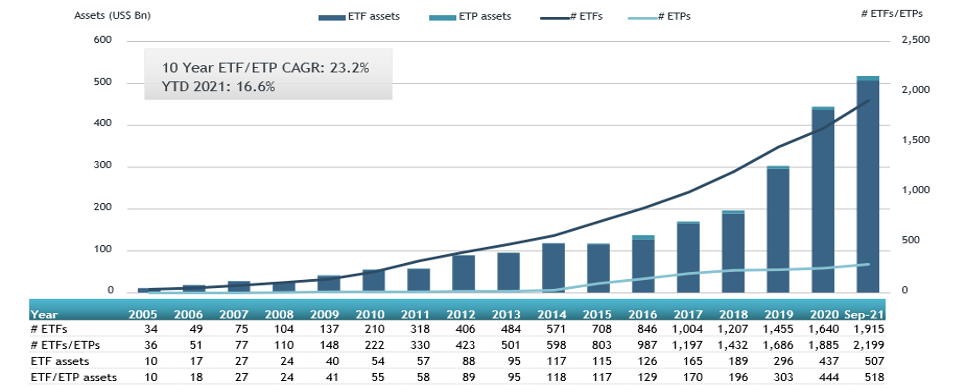

- Assets increased 16.6% YTD in 2021, going from US$444.46 billion at end of 2020, to US$518.15 billion.

- 3rd month of consecutive net inflows

- Equity ETFs and ETPs listed in the Asia Pacific (ex-Japan) gathered a record of $42.07 Bn in YTD net inflows.

“The S&P 500 declined 4.65% in September as due to fears of inflation, the ongoing Congressional budget impasse, and anticipation of a reduction in Fed liquidity provision. Developed markets ex-U.S. declined 2.99% and emerging markets were down 3.12% in September.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Asia Pacific (ex-Japan) ETF and ETP asset growth as at the end of September 2021

At the end of September 2021, the Asia Pacific (ex-Japan) ETF/ETP industry had 2,199 ETFs/ETPs, with 2,357 listings, from 211 providers on 20 exchanges in 15 countries.

Equity ETFs/ETPs listed in Asia Pacific (ex-Japan) gained net inflows of $12.80 Bn during September 2021, bringing net inflows for the year to $42.07 Bn, much higher than the $11.01 Bn in net inflows reported for the year to September 2020. Fixed income ETFs/ETPs listed in Asia Pacific (ex-Japan) gained net inflows of $3.63 Bn during September, bringing YTD net inflows for 2021 to $6.42 Bn, higher than the $6.01 Bn in net inflows fixed income products had attracted for the corresponding period through September 2020. Commodities ETFs/ETPs listed in Asia Pacific (ex-Japan) reported net inflows of $110 Mn during September 2021, bringing net outflows for the year to $415 Mn, lower than the $5.89 Bn in net inflows reported for the year to September 2020. Active ETFs/ETPs listed in Asia Pacific (ex-Japan) reported net outflows of $495 Mn during September, taking net inflows for the year to $13.93 Bn, much higher than the $4.26 Bn in net inflows active products had attracted for the year to September 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $9.40 Bn during September. E Fund CSI Overseas China Internet 50 ETF Index Fund (513050 CH) gathered $1.20 Bn the largest individual net inflow.

Top 20 ETFs by net new assets in September 2021: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

E Fund CSI Overseas China Internet 50 ETF Index Fund |

513050 CH |

4,135.19 |

4,329.81 |

1,201.76 |

|

China CSI 500 ETF - Acc |

510500 CH |

7,370.98 |

621.62 |

919.65 |

|

China AMC China 50 ETF |

510050 CH |

8,203.76 |

210.41 |

874.78 |

|

Tracker Fund of Hong Kong (TraHK) |

2800 HK |

12,662.04 |

81.22 |

663.61 |

|

ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

3,461.21 |

1,469.24 |

654.26 |

|

GF CSI Construction and Engineering ETF |

516970 CH |

887.87 |

888.14 |

598.09 |

|

Huatai-Pinebridge CSI 300 ETF |

510300 CH |

6,038.14 |

(827.89) |

514.99 |

|

iShares USD Asia High Yield Bond Index ETF |

AHYG SP |

866.89 |

751.03 |

508.32 |

|

Huatai-PineBridge CSI Photovoltaic Industry ETF |

515790 CH |

1,936.16 |

(23.05) |

403.12 |

|

Capital ICE BofA Merrill Lynch 15+ Year US Banking Index ETF |

00724B TT |

2,383.52 |

51.83 |

341.83 |

|

CTBC Bloomberg Banking Senior 10+ Year Bond ETF |

00773B TT |

1,835.17 |

383.21 |

330.41 |

|

E Fund CSI STAR and CHINEXT 50 ETF |

159781 CH |

1,302.88 |

1,380.22 |

323.01 |

|

Guotai CSI Coal and Consumable Fuels ETF |

515220 CH |

560.29 |

392.66 |

293.35 |

|

ChinaAMC Hengsheng Internet Science and Technology Industry ETF QDII |

513330 CH |

1,807.82 |

2,368.59 |

283.24 |

|

Capital ICE BofA Merrill Lynch 15+ Year US Tech & Electr Index ETF |

00723B TT |

1,554.05 |

280.11 |

262.77 |

|

BetaShares Australian High Interest Cash ETF |

AAA AU |

1,811.48 |

217.62 |

261.52 |

|

ChinaAMC CNI Semi-conductor Chip ETF |

159995 CH |

2,536.85 |

(1,932.86) |

260.17 |

|

Mirae Asset TIGER China Electric Vehicle Solactive ETF |

371460 KS |

1,759.86 |

1,528.03 |

245.84 |

|

SBI Sensex ETF - Acc |

SBISENX IN |

8,073.06 |

1,493.79 |

235.29 |

|

KGI 15+ Years AAA-A US Corporate Bond ETF |

00777B TT |

1,255.39 |

435.74 |

225.87 |

The top 10 ETPs by net new assets collectively gathered $177.58 Mn during September. ETFS Physical Gold (AUS) - Acc - Acc (GOLD AU) gathered $24.29 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in September 2021: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ETFS Physical Gold (AUS) - Acc - Acc |

GOLD AU |

1574.88 |

137.25 |

24.29 |

|

Samsung Securities Samsung Inverse 2X WTI Crude Oil Futures ETN 36 - Acc |

530036 KS |

36.51 |

30.95 |

18.26 |

|

MiraeAsset Securities MiraeAsset Inverse 2X Silver Futures ETN 49 |

520034 KS |

22.63 |

16.88 |

16.88 |

|

MiraeAsset Securities MiraeAsset Leverage Silver Futures ETN 48 |

520033 KS |

12.88 |

16.88 |

16.88 |

|

Korea Investment & Securities TRUE Inverse 2X Silver Futures ETN 62 |

570062 KS |

22.63 |

16.88 |

16.88 |

|

Korea Investment & Securities TRUE Leverage Silver futures ETN 61 |

570061 KS |

12.88 |

16.88 |

16.88 |

|

Shinhan Investment Shinhan FnGuide Metaverse ETN 59 |

500059 KS |

16.36 |

16.88 |

16.88 |

|

NH QV Inverse 2X Silver Futures ETN H 65 |

550065 KS |

22.10 |

16.88 |

16.88 |

|

NH QV Leverage Silver Futures ETN H 64 |

550064 KS |

12.58 |

16.88 |

16.88 |

|

MiraeAsset Securities Miraeasset KRX Gold Auto-KO-C P200 2210 ETN 50 |

520035 KS |

16.67 |

16.88 |

16.88 |

Investors have tended to invest in Equity ETFs/ETPs during September.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register now for the 2nd annual ETFGI Global ETFs Insights Summit – Asia Pacific, a virtual event on November 2 & 3!

The event is designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, active and trading developments impacting investors.

Speakers will include key regulators, leading ETF issuers, stock exchanges, law firms and others involved in the ETF ecosystem.

Free registration and educational credits are available for qualified institutional investor and financial advisors. Standard registration is available for everyone else. Register here

Featured Sessions:

Other sessions include:

- ETF Trading - Creating Better Trading Systems and Trading Tools

- Regulatory Issues Impacting Market Structure and ETF Trading

- Regulatory Update on Topics Impacting ETFs in Asia

- Trends in Thematic Indices and ETFs

- Trends in Crypto - Digital Indices and Products

- How Investors are Using and Selecting ETFs

- Trends in ESG Indices and ETFs

Click here to see the full list of speakers, agenda and register

The ETFGI Global ETFs Insights Summits are a series of events organised by ETFGI. In 2021 we have held 4 events with 2 more scheduled.

Upcoming 2021 events are:

- 2nd Annual Asia Pacific, November 2 & 3 Register Here

- 3rd Annual Canada, December 1 & 2 Register Here

Past 2021 events include:

- ESG and Active ETFs Trends, March 24th & 25th Session Recordings

- 2nd Annual Latin America, April 14th & 15th Session Recordings

- 2nd Annual USA, May 19th & 20th Session Recordings

- 2nd Annual Europe & MEA, September 14, 15th & 16th Session Recordings

If you are interested in sponsoring, supporting or speaking at our upcoming events in 2021 or 2022 or have any questions, please contact Margareta Hricova at margareta.hricova@etfgi.com and Deborah Fuhr at deborah.fuhr@etfgi.com.

Follow us on Linkedin and Twitter for updates about the event.

ETF TV news #94 Paul Kim, CEO & Cofounder, Simplify, Victoria Wolodzko, Senior Vice President, Mission at Susan G. Komen the new actively managed Simplify Health Care ETF ticker PINK which will donate the profits - to the Susan G. Komen® organization with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/2XpTBWz

ETF TV news #94 Paul Kim, CEO & Cofounder, Simplify, Victoria Wolodzko, Senior Vice President, Mission at Susan G. Komen the new actively managed Simplify Health Care ETF ticker PINK which will donate the profits - to the Susan G. Komen® organization with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/2XpTBWz

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()