ETFGI reports ETFs and ETPs listed globally have gathered over 1 trillion US dollars in net inflows in the first 10 months of 2021

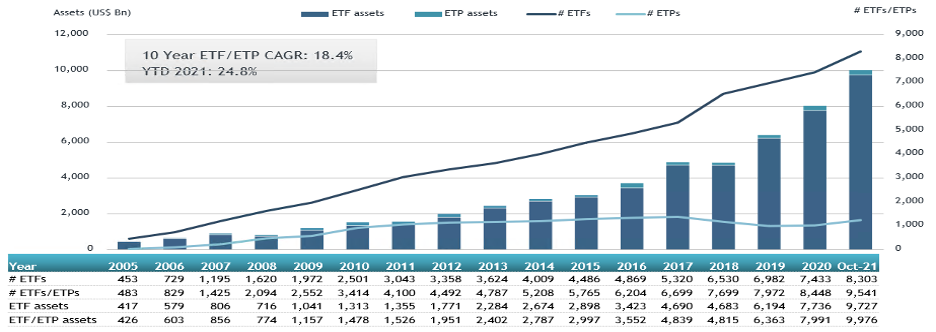

LONDON —November 10, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed globally gathered net inflows of US$116.21 billion during October, bringing year-to-date net inflows to US$1.04 trillion which is higher than the US$538.26 billion gathered at this point last year and significantly higher then the record US$762.77 billion gathered in all of 2020. Assets invested in the global ETFs/ETPs industry have increased by 5% from US$9.50 trillion at the end of September 2021, to US$9.98 trillion at the end of October, according preliminary data collected by ETFGI's October 2021 Global ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets of $9.98 trillion invested in ETFs and ETPs listed globally at the end of October 2021 are the highest on record.

- Strong net inflows of $116.21 Bn gathered in October.

- Record YTD 2021 net inflows of $1.04 Tn beating the prior record of $538.26 Bn gathered in YTD 2020.

- $1.04 Tn YTD net inflows are $277.4 Bn higher than the full year 2020 record net inflows $762.77 Bn.

- $1.26 trillion in net inflows gathered in the past 12 months.

- Assets increased 24.8% YTD in 2021, going from US$7.99 trillion at end of 2020, to US$9.98 trillion.

- 29th month of consecutive net inflows.

- Equity ETFs and ETPs listed globally gathered a record $716.48 Bn in YTD net inflows 2021.

“Due to strong corporate earnings the S&P 500 gained 7.01% in October and is up 24.04% year to date. Developed markets ex-U.S. experienced gains of 2.50% in October. Canada 7.46% and Sweden 7.21% were the leaders of the month while Japan suffer the biggest loss of 3.43%. Emerging markets were up by 1.00% during October. Peru (up 14.45%) and Egypt (up 10.76%) were the leaders, whilst Brazil (down 10.72%) and Chile (down 5.66%) were down the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of October 2021

The Global ETF/ETP industry had 9,541 products, with 19,201 listings, assets of $9.976 trillion, from 583 providers listed on 79 exchanges in 62 countries at the end of October 2021.

During October 2021, ETFs/ETPs gathered net inflows of $ 116.21 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $83.67 Bn during October, bringing net inflows for 2021 to $716.48 Bn, much greater than the $193.79 Bn in net inflows equity products had attracted YTD in 2020. Fixed Income ETFs/ETPs listed globally gathered net inflows of $20.61 Bn during October, bringing net inflows for 2021 to $195.07 Bn, higher than the $194.01 Bn in net inflows YTD in 2020. Commodity ETFs/ETPs listed globally suffered net outflows of $1.31 Bn, bringing net outflows for 2021 to $10.86 Bn, significantly lower than the $71.48 Bn in net inflows commodity products had attracted YTD in 2020. Active ETFs/ETPs reported $10.36 Bn in net inflows, bringing net inflows for 2021 to $120.28 Bn, significantly higher than the $58.56 Bn in net inflows active products had attracted YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $49.41 Bn during October. iShares Core S&P 500 ETF (IVV US) gathered $9.54 Bn the largest individual net inflow.

Top 20 ETFs by net new inflows October 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

iShares Core S&P 500 ETF |

|

IVV US |

312,583.00 |

22,204.80 |

9,543.06 |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

419,268.22 |

13,620.14 |

7,571.24 |

|

Invesco QQQ Trust |

|

QQQ US |

201,391.06 |

14,217.17 |

4,318.71 |

|

Vanguard S&P 500 ETF |

|

VOO US |

268,036.25 |

44,401.38 |

4,048.79 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

280,823.58 |

33,155.79 |

2,462.96 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

103,071.01 |

10,500.94 |

2,134.73 |

|

iShares TIPS Bond ETF |

|

TIP US |

35,868.02 |

9,215.53 |

1,937.24 |

|

Financial Select Sector SPDR Fund |

|

XLF US |

45,310.67 |

9,460.28 |

1,897.13 |

|

iShares Core S&P 500 UCITS ETF - Acc |

|

CSSPX SW |

55,513.00 |

3,281.73 |

1,778.09 |

|

Nuveen Growth Opportunities ETF |

|

NUGO US |

1,687.38 |

1,650.03 |

1,645.20 |

|

Schwab US TIPS ETF |

|

SCHP US |

21,405.50 |

7,024.35 |

1,405.86 |

|

KraneShares CSI China Internet ETF |

|

KWEB US |

8,329.95 |

7,161.97 |

1,307.17 |

|

ProShares Bitcoin Strategy ETF |

|

BITO US |

1,200.91 |

1,242.98 |

1,242.98 |

|

iShares Fallen Angels USD Bond ETF |

|

FALN US |

4,675.98 |

4,192.75 |

1,237.29 |

|

Vanguard Total Bond Market ETF |

|

BND US |

83,020.71 |

17,026.60 |

1,236.83 |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

|

1570 JP |

3,470.58 |

(1,563.91) |

1,214.24 |

|

Vanguard Information Technology ETF |

|

VGT US |

53,449.59 |

2,316.70 |

1,190.89 |

|

Vanguard Short-Term Inflation-Protected Securities Index Fund |

|

VTIP US |

18,021.55 |

7,945.80 |

1,118.14 |

|

iShares Edge MSCI USA Quality Factor UCITS ETF |

|

IUQD LN |

1,316.96 |

1,063.67 |

1,070.59 |

|

Vanguard Value ETF |

|

VTV US |

88,287.83 |

13,590.85 |

1,048.95 |

The top 10 ETPs by net new assets collectively gathered $1.99 Bn over October. BTCetc - Bitcoin ETP - Acc (BTCE GY) gathered $396 Mn the largest individual net inflow.

Top 10 ETPs by net new inflows October 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

BTCetc - Bitcoin ETP - Acc |

|

BTCE GY |

1,555.83 |

728.25 |

395.51 |

|

ProShares Ultra VIX Short-Term Futures |

|

UVXY US |

1,057.23 |

1,829.20 |

375.83 |

|

Invesco DB Commodity Index Tracking Fund |

|

DBC US |

2,934.20 |

831.20 |

312.94 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

|

VXX US |

1,089.86 |

1,339.71 |

308.43 |

|

Xtrackers IE Physical Gold ETC Securities - EUR Hdg Acc |

|

XGDE GY |

933.22 |

852.46 |

115.08 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

|

XGDU LN |

2,163.90 |

1,925.46 |

115.02 |

|

United States Natural Gas Fund LP |

|

UNG US |

478.11 |

(132.13) |

112.81 |

|

21Shares Bitcoin ETP - Acc |

|

ABTC SW |

521.28 |

205.32 |

98.25 |

|

ProShares Ultra DJ-UBS Natural Gas |

|

BOIL US |

172.94 |

(85.09) |

79.10 |

|

WisdomTree Industrial Metals - Acc |

|

AIGI LN |

674.05 |

399.99 |

78.88 |

Investors have tended to invest in Equity ETFs/ETPs during October.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register now to join us at our 3rd annual ETFGI Global ETFs Insights Summit – Canada, a virtual event on December 1st & 2nd.

The event is designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, active and trading developments impacting investors.

Speakers will include key regulators, leading ETF issuers, stock exchanges, law firms and others involved in the ETF ecosystem.

Free registration and educational credits are available for qualified institutional investors and financial advisors. Standard registration is available for everyone else. Register here

Speakers include:

- Darim Abdullah, Vice President, ETF Strategist, Invesco

- Raymond Chan, Director, Investment Funds and Structured Products, Ontario Securities Commission

- Tracy Chenier, Managing Director, Product Development & Management, CIBC Asset Management

- Michael Cooke, Senior Vice President, Head of Exchange Traded Funds, Mackenzie Investments

- Michael Craig, Managing Director Head of Asset Allocation & Derivatives, TD Asset Management

- Carol E. Derk, Partner, Borden Ladner Gervais

- Pat Dunwoody, Executive Director, Canadian ETF Association

- Deborah Fuhr, Managing Partner, Founder, ETFGI

- Margaret Gunawan, Managing Director, Head of Canada Legal & Compliance, BlackRock

- John Jacobs, Executive Director, Center for Financial Markets and Policy, McDonough School of Business, Georgetown University

- Ronald C. Landry, Head of Product and Canadian ETF Services, CIBC Mellon

- Lisa Langley, CEO and Founder, Emerge Canada Inc.

- Steven Leong, Director, Head of Canada iShares Product, BlackRock

- Rob Marrocco, Senior Director, Listings, CBOE

- Jason McIntyre, Vice President, Wealth, TD Asset Management

- Fred Pye, Chairman & CEO, 3iQ Corp.

- Rick Redding, CEO, Index Industry Association

- Peter Shea, Partner, K&L Gates LLP

Click here to see the full list of speakers, agenda, and register

The ETFGI Global ETFs Insights Summits are a series of events organised by ETFGI. In 2021 we have held 5 events with 1 more scheduled.

Upcoming 2021 event:

- 3rd Annual Canada, December 1 & 2 Register Here

Past 2021 events include:

- ESG and Active ETFs Trends, March 24th & 25th Session Recordings

- 2nd Annual Latin America, April 14th & 15th Session Recordings

- 2nd Annual USA, May 19th & 20th Session Recordings

- 2nd Annual Europe & MEA, September 14, 15th & 16th Session Recordings

- 2nd Annual Asia Pacific, November 2nd & 3rd Session Recordings

If you are interested in sponsoring, supporting or speaking at our upcoming events in 2021 or 2022 or have any questions, please contact Margareta Hricova at margareta.hricova@etfgi.com and Deborah Fuhr at deborah.fuhr@etfgi.com.

Follow us on Linkedin and Twitter for updates about the event.

As HANetf ETFs offering continues to expand, we catch up with Hector McNeil, Co-CEO & Founder of HANetf to understand how assets under management have grown from $1.1bn to $3bn in 2021 #PressPlay https://bit.ly/3wrkHJV

As HANetf ETFs offering continues to expand, we catch up with Hector McNeil, Co-CEO & Founder of HANetf to understand how assets under management have grown from $1.1bn to $3bn in 2021 #PressPlay https://bit.ly/3wrkHJV

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()