ETFGI reports a record US$543 billion invested in ETFs and ETPs listed in Asia Pacific (ex-Japan) at the end of November 2021

LONDON —December 17, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today reports a record US$543 billion invested in ETFs and ETPs listed in Asia Pacific (ex-Japan) at the end of November. ETFs and ETPs listed in Asia Pacific (ex-Japan) saw net inflows of US$9.77 billion during November, bringing year-to-date net inflows to US$86.99 billion. Assets invested in the Asia Pacific (ex-Japan) ETFs/ETPs industry have increased by 0.4%, from US$541.09 billion at the end of October, to US$543.08 billion, according to ETFGI's November 2021 Asia Pacific (ex-Japan) ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $543.08 billion invested in ETFs and ETPs listed in Asia Pacific (ex-Japan) at the end of November 2021

- Record YTD 2021 net inflows of $86.99 Bn beating the prior record of $53.86 Bn gathered in YTD 2020.

- $86.99 Bn YTD net inflows are $32.69 Bn over full year 2020 record net inflows $54.30 Bn.

- $87.43 billion in net inflows gathered in the past 12 months.

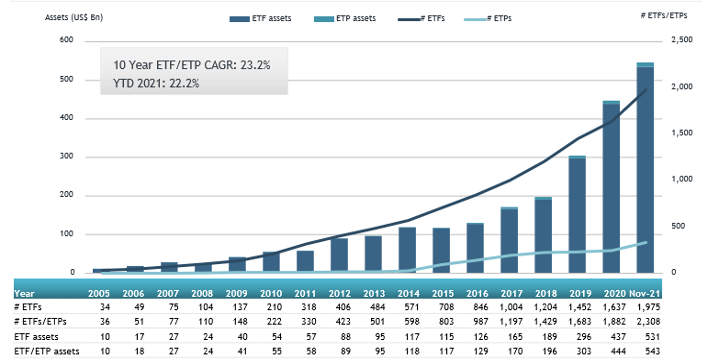

- Assets increased 22.2% YTD in 2021, going from US$444.46 billion at end of 2020, to US$543.08 billion.

- 5th month of consecutive net inflows

- Equity ETFs and ETPs listed in the Asia Pacific (ex-Japan) gathered a record of $63.21 Bn in YTD net inflows.

“Due to the growing threat of a new COVID variant Omicron, the S&P 500 declined 0.69% in November, however, the index is up 23.18% year to date. Developed markets, excluding the US, experienced a fall of 4.94% in November. Israel (down 1.03%) and the US (down 1.47%) experienced the smallest losses among the developed markets in November, while Luxembourg suffered the biggest loss of 16.90%. Emerging markets declined 3.53% during November. United Arab Emirates (up 8.15%) and Chile (up 5.51%) gained the most, whilst Turkey (down 13.72%) and Poland (down 11.95%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Asia Pacific (ex-Japan) ETF and ETP asset growth as at the end of November 2021

At the end of November 2021, the Asia Pacific (ex-Japan) ETFs and ETPs industry had 2,308 products, with 2,467 listings, from 218 providers on 20 exchanges in 15 countries.

Equity ETFs/ETPs listed in Asia Pacific (ex-Japan) gained net inflows of $12.71 Bn during November 2021, bringing net inflows for the year to $63.21 Bn, much higher than the $18.16 Bn in net inflows reported for the year to November 2020. Fixed income ETFs/ETPs listed in Asia Pacific (ex-Japan) suffered net outflows of $304 Mn during November, bringing YTD net inflows for 2021 to $10.45 Bn, higher than the $7.90 Bn in net inflows fixed income products had attracted for the corresponding period through November 2020. Commodities ETFs/ETPs listed in Asia Pacific (ex-Japan) reported net outflows of $295 Mn during November 2021, bringing net outflows for the year to $940 Mn, lower than the $5.87 Bn in net inflows reported for the year to November 2020. Active ETFs/ETPs listed in Asia Pacific (ex-Japan) reported net outflows of $2.79 Bn during November, taking net inflows for the year to $12.03 Bn, lower than the $18.07 Bn in net inflows active products had attracted for the year to November 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $11.09 Bn during November. ChinaAMC MSCI China A 50 Connect ETF (159601 CH) gathered $1.59 Bn the largest individual net inflow.

Top 20 ETFs by net new assets in November 2021: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ChinaAMC MSCI China A 50 Connect ETF |

159601 CH |

1,585.99 |

1,591.50 |

1,591.50 |

|

E Fund MSCI China A 50 Connect ETF |

563000 CH |

1,553.93 |

1,560.95 |

1,560.95 |

|

China Universal MSCI China A 50 Connect ETF |

560050 CH |

1,324.91 |

1,330.69 |

1,330.69 |

|

Tianhong CSI Food and Beverage ETF |

159736 CH |

692.49 |

691.65 |

676.36 |

|

Mirae Asset TIGER China Electric Vehicle Solactive ETF |

371460 KS |

2,565.36 |

1,925.49 |

635.58 |

|

China Southern MSCI China A 50 Connect ETF |

159602 CH |

596.26 |

599.08 |

599.08 |

|

CSOP Bloomberg ChinaTreasury + Policy Bank Bond Index ETF |

83199 HK |

793.69 |

755.39 |

501.16 |

|

CSOP Bloomberg ChinaTreasury + Policy Bank Bond Index ETF |

3199 HK |

792.39 |

755.19 |

501.02 |

|

E Fund CSI Overseas China Internet 50 ETF Index Fund |

513050 CH |

4,731.79 |

5,232.39 |

469.03 |

|

ChinaAMC Hengsheng Internet Science and Technology Industry ETF QDII |

513330 CH |

2,383.11 |

2,975.65 |

384.67 |

|

Samsung KODEX MSCI Korea Total Return ETF - Acc |

278540 KS |

1,368.21 |

(65.98) |

375.82 |

|

SBI-ETF Nifty 50 - Acc |

SBINIFT IN |

15,431.44 |

1,511.67 |

329.99 |

|

iShares USD Asia High Yield Bond Index ETF |

AHYG SP |

1,845.24 |

1,815.07 |

298.21 |

|

ICBC Credit Suisse CSI300 ETF - Acc |

510350 CH |

772.89 |

266.86 |

287.84 |

|

Guotai CSI All Share Securities Companies ETF - Acc |

512880 CH |

5,829.65 |

139.92 |

276.14 |

|

Tracker Fund of Hong Kong (TraHK) |

2800 HK |

11,985.47 |

232.82 |

270.96 |

|

Samsung KODEX K-Metaverse Active ETF |

401470 KS |

357.82 |

354.43 |

266.47 |

|

Huatai-PineBridge Dividend ETF |

510880 CH |

2,723.07 |

1,184.40 |

260.41 |

|

Mirae Asset TIGER S&P500 ETF |

360750 KS |

869.16 |

698.97 |

237.72 |

|

Yuanta Taiwan High Dividend LowVolatility ETF |

00713 TT |

342.25 |

226.72 |

237.57 |

The top 10 ETPs by net new assets collectively gathered $225.47 Mn during November. ETFS Physical Gold (AUS) - Acc - Acc (GOLD AU) gathered $41.67 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in November 2021: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ETFS Physical Gold (AUS) - Acc - Acc |

GOLD AU |

1,708.66 |

208.92 |

41.67 |

|

Korea Investment & Securities TRUE KOSPI 200 ETN 67 |

570067 KS |

40.14 |

42.13 |

33.60 |

|

KB Securities KB Leveraged S&P 500 Futures ETN H |

580016 KS |

42.66 |

32.05 |

32.05 |

|

Shinhan Investment Shinhan S&P500 VIX S/T Futures ETN C 58 |

500058 KS |

37.24 |

17.60 |

17.60 |

|

MiraeAsset Securities MiraeAsset K200 Auto-KO-C 2212-01 ETN 59 |

520044 KS |

14.54 |

16.76 |

16.76 |

|

MiraeAsset Securities MiraeAsset K200 Auto-KO-P 2212-01 ETN 60 |

520045 KS |

18.65 |

16.76 |

16.76 |

|

Korea Investment & Securities TRUE Inverse 2X Copper Futures ETN 73 |

570073 KS |

17.08 |

16.76 |

16.76 |

|

Korea Investment & Securities TRUE Leverage Copper Futures ETN 72 |

570072 KS |

16.55 |

16.76 |

16.76 |

|

Hana Financial Investment Hana Inverse 2X Copper Futures ETN H 10 |

700010 KS |

16.88 |

16.76 |

16.76 |

|

Hana Financial Investment Hana Leverage Copper Futures ETN H 9 |

700009 KS |

16.35 |

16.76 |

16.76 |

Investors have tended to invest in Equity ETFs/ETPs during November.

###

Announcing the dates for the 2022 ETFGI Global ETFs Insights Summits!

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem is excited to announce the dates have been set and registrations are open for our 2022 ETFGI Global ETFs Insights Summits!

Over the past 10 years ETFGI has hosted a number of webinars and events. Our summits have evolved and expanded to provide in-depth discussion on the trends Investment Management and ETFs industry. The 6 annual events cover the global ETF landscape in terms of geography, asset classes, the types of ETFs, the growing categories of investors and the regulatory initiatives that are driving product development and product use and selection.

The events are designed as educational events for financial advisors and traders, portfolio managers, CIOs at buyside institutional investor to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, active, product and trading developments impacting investors.

Exciting line up of speakers in fireside chats and panel discussions on timely and relevant topics with sponsor booths and virtual networking!

![]() Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors. The sessions are recorded so sessions can be watched later or watched again at your convenience.

Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors. The sessions are recorded so sessions can be watched later or watched again at your convenience.

2022 Virtual Events Schedule:

- 2nd ESG & Active ETFs Trends, March 23 – 24 Register Here

- 3rd Annual Latin America, April 27 - 28 Register Here

- 3rd Annual USA, May 17 - 18 Register Here

- 3rd Annual Europe & MEA, September 20 - 22 Register Here

- 3rd Annual Asia Pacific, October 12 - 13 Register Here

- 4th Annual Canada, November 30 - December 1 Register Here

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you interested in speaking, sponsoring or have any questions about any of our upcoming events.

Click below to see the 2021 Event Agendas and Session Recordings:

- ESG and Active ETFs Trends, March 24th & 25th Session Recordings

- 2nd Annual Latin America, April 14th & 15th Session Recordings

- 2nd Annual USA, May 19th & 20th Session Recordings

- 2nd Annual Europe & MEA, September 14, 15th & 16th Session Recordings

- 2nd Annual Asia Pacific, November 2nd & 3rd Session Recordings

- 3rd Annual Canada, December 1st & 2nd Session Recordings

We look forward to seeing you at our events!

Debbie and Margareta

Follow us on Linkedin and Twitter for updates about the event.

ETF TV News #99 Roy Leckie, Director at Walter Scott discusses the new Actively managed BNY Mellon Concentrated International ETF (BKCI) that was listed on the NYSE last week with Margareta Hricova and Deborah Fuhr and why now is a good time to invest internationally outside the US on ETF TV. #PressPlay to watch the interview https://bit.ly/3m7DsOW

ETF TV News #99 Roy Leckie, Director at Walter Scott discusses the new Actively managed BNY Mellon Concentrated International ETF (BKCI) that was listed on the NYSE last week with Margareta Hricova and Deborah Fuhr and why now is a good time to invest internationally outside the US on ETF TV. #PressPlay to watch the interview https://bit.ly/3m7DsOW

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()