ETFGI reports a record US$803 billion of net inflows into ETFs and ETPs listed in US at end of November 2021

LONDON — December 14, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reports a record US$803 billion of net inflows into ETFs and ETPs listed in US at end of November 2021. ETFs and ETPs listed in US gained net inflows of US$70.68 billion during November, bringing year-to-date net inflows to US$803.40 billion. Assets invested in the US ETFs and ETPs industry have decreased by 0.2%, from US$6.98 trillion at the end of October, to US$6.96 trillion, according to ETFGI's November 2021 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $6.96 Tn invested in ETFs and ETPs listed in US at the end of November 2021 are the 2nd highest on record.

- Record YTD 2021 net inflows of $803.40 Bn beating the prior record of $426.70 Bn gathered in YTD 2020.

- $803.40 Bn YTD net inflows are $313.21 Bn over full year 2020 record net inflows $490.19 Bn.

- $867 Bn in net inflows gathered in the past 12 months.

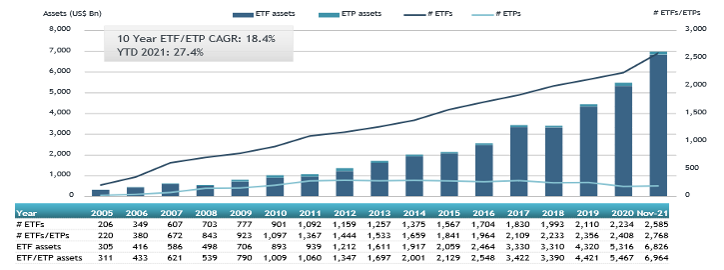

- Assets increased 27.4% YTD in 2021, going from US$5.47 Tn at end of 2020, to US$6.96 Tn.

- 27th month of consecutive net inflows

- Equity ETFs and ETPs listed in the US gathered a record $551.20 Bn in YTD net inflows 2021.

“Due to the growing threat of a new COVID variant Omicron, the S&P 500 declined 0.69% in November, however, the index is up 23.18% year to date. Developed markets, excluding the US, experienced a fall of 4.94% in November. Israel (down 1.03%) and the US (down 1.47%) experienced the smallest losses among the developed markets in November, while Luxembourg suffered the biggest loss of 16.90%. Emerging markets declined 3.53% during November. United Arab Emirates (up 8.15%) and Chile (up 5.51%) gained the most, whilst Turkey (down 13.72%) and Poland (down 11.95%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in US ETF and ETP assets as of the end of November 2021

The US ETF/ETP industry had 2,768 ETFs/ETPs, assets of US$6,964 Bn, from 221 providers listed on 3 exchanges at the end of November 2021.

During November 2021, ETFs/ETPs gathered net inflows of $70.68 Bn. Equity ETFs/ETPs listed in US gained net inflows of $51.19 Bn during November, bringing YTD net inflows for 2021 to $551.19 Bn, much higher than the

$168.79 Bn in net inflows equity products had attracted for the corresponding period through November 2020. Fixed income ETFs/ETPs listed in US reported net inflows of $10.76 Bn during November, bringing YTD net inflows for 2021 to $154.10 Bn, lower than the $161.60 Bn in net inflows fixed income products had attracted YTD in 2020. Commodities ETFs/ETPs reported net inflows of $1.35 Bn over November, bringing year to date net outflows for 2021 to $9.17 Bn, less than net inflows of $39.93 Bn commodities products had attracted over the same period last year. Active ETFs/ETPs saw net inflows of $6.78 Bn during November, bringing year to date net inflows for 2021 to $96.23 Bn, significantly more than the $46.61 Bn in net inflows active products had reported YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $40.33 Bn during November. Vanguard Total Stock Market ETF (VTI US) gathered $5.74 Bn the largest individual net inflow.

Top 20 ETFs by net new assets November 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Total Stock Market ETF |

VTI US |

287,384.43 |

38,895.37 |

5,739.58 |

|

iShares Core S&P 500 ETF |

IVV US |

314,607.33 |

26,545.18 |

4,340.38 |

|

Vanguard S&P 500 ETF |

VOO US |

274,833.46 |

48,422.27 |

4,020.88 |

|

Invesco QQQ Trust |

QQQ US |

210,092.41 |

17,803.32 |

3,586.15 |

|

Vanguard FTSE Developed Markets ETF |

VEA US |

104,387.11 |

12,566.93 |

2,378.88 |

|

iShares 7-10 Year Treasury Bond ETF |

IEF US |

16,781.50 |

2,458.75 |

2,224.59 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

100,920.99 |

12,152.42 |

1,651.48 |

|

Nuveen Growth Opportunities ETF |

NUGO US |

3,279.59 |

3,282.06 |

1,632.03 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

VCIT US |

46,955.57 |

6,347.66 |

1,589.74 |

|

iShares TIPS Bond ETF |

TIP US |

37,722.39 |

10,784.50 |

1,568.96 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

90,929.59 |

8,097.93 |

1,442.76 |

|

iShares Russell 2000 ETF |

IWM US |

68,827.89 |

4,071.50 |

1,375.72 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

17,160.69 |

(1,101.28) |

1,308.81 |

|

SPDR S&P 500 ETF Trust |

SPY US |

417,698.54 |

14,895.39 |

1,275.25 |

|

Vanguard Value ETF |

VTV US |

88,927.85 |

14,860.99 |

1,270.14 |

|

iShares 0-5 Year TIPS Bond ETF |

STIP US |

8,621.87 |

5,635.56 |

1,124.63 |

|

iShares Core S&P Small-Cap ETF |

IJR US |

70,542.47 |

3,497.26 |

1,048.91 |

|

Vanguard Mid-Cap ETF |

VO US |

56,290.00 |

5,306.71 |

1,036.46 |

|

Invesco Nasdaq 100 ETF |

QQQM US |

3,473.49 |

2,816.76 |

864.89 |

|

Vanguard Small-Cap ETF |

VB US |

49,216.20 |

5,950.66 |

853.66 |

The top 10 ETPs by net new assets collectively gathered $1.34 Bn during November. The SPDR Gold Shares (GLD US) gathered $663 Mn the largest individual net inflow.

Top 10 ETPs by net new assets November 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

56,592.95 |

(9,771.73) |

663.25 |

|

iShares Gold Trust |

IAU US |

28,824.50 |

(1,457.50) |

117.17 |

|

Invesco DB Agriculture Fund |

DBA US |

1,055.37 |

245.12 |

96.99 |

|

United States Natural Gas Fund LP |

UNG US |

510.27 |

(38.05) |

94.08 |

|

ProShares Ultra DJ-UBS Natural Gas |

BOIL US |

182.70 |

0.82 |

85.91 |

|

iShares S&P GSCI Commodity-Indexed Trust |

GSG US |

1,348.08 |

255.10 |

85.45 |

|

iShares Silver Trust |

SLV US |

12,541.55 |

(16.61) |

58.92 |

|

ProShares Ultra DJ-UBS Crude Oil |

UCO US |

882.82 |

(753.39) |

52.40 |

|

United States Oil Fund LP |

USO US |

2,336.66 |

(2,584.44) |

45.69 |

|

X-Links Crude Oil Shares Covered Call ETN |

USOI US |

165.63 |

123.98 |

37.73 |

Investors have tended to invest in Equity ETFs/ETPs during November.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Watch the fireside chats and panel recordings from our six ETFGI Global ETFs Insight Summits Events in 2021:

- ESG and Active ETFs Trends, March 24th & 25th Session Recordings

- 2nd Annual Latin America, April 14th & 15th Session Recordings

- 2nd Annual USA, May 19th & 20th Session Recordings

- 2nd Annual Europe & MEA, September 14, 15th & 16th Session Recordings

- 2nd Annual Asia Pacific, November 2nd & 3rd Session Recordings

- 3rd Annual Canada, December 1st & 2nd Session Recordings

If you are interested in sponsoring, supporting or speaking at our upcoming events in 2022 or have any questions, please contact Margareta Hricova at margareta.hricova@etfgi.com and Deborah Fuhr at deborah.fuhr@etfgi.com.

Follow us on Linkedin and Twitter for updates about the event.

ETF TV News #98 David Stephenson, Director, ETF Strategy at CIBC Asset discusses low vol dividend and clean energy ETFs with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/31GV24D

ETF TV News #98 David Stephenson, Director, ETF Strategy at CIBC Asset discusses low vol dividend and clean energy ETFs with Margareta Hricova and Deborah Fuhr on ETF TV #PressPlay https://bit.ly/31GV24D

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()