ETFG ETFGI reports ETFs industry in Europe gathered US$11.85 billion of net inflows in February 2022

LONDON —March 18, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that the ETFs industry in Europe gathered US$11.85 billion in net inflows in February 2022, bringing year to date net inflows to US$40.91 billion. At the end of the month, assets invested in the European ETFs industry decreased by 1.2%, from US$1.57 trillion at the end of January, to US$1.55 trillion, according to ETFGI's February 2022 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs industry in Europe gathered $11.85 billion of net inflows in February 2022.

- YTD net inflows of $40.91 Bn are the second highest on record, after YTD net inflows in 2021 of $41.91 Bn.

- $192.63 Bn net inflows gathered in the past 12 months.

- 23rd month of consecutive net inflows.

- Assets of $1.55 Tn invested in ETFs and ETPs listed in Europe at the end of February.

- Assets decreased 3.1% YTD in 2022, going from a record $1.60 Tn at the end of 2021, to $1.55 Tn.

- Equity ETFs and ETPs listed in Europe gathered $32.08 Bn in YTD net inflows 2022 are the highest on record.

“The S&P 500 decreased by 2.99% in February as the world watches the situation in the Ukraine unfold. Developed markets excluding the US, experienced a loss of 1.34% in February. Japan (down 0.59%) and Portugal (down 0.62%) experienced the smallest losses amongst the developed markets in February, while Austria suffered the largest loss of 10.92%. Emerging markets decreased by 3.43% during February. Peru (up 7.07%) and UAE (up 6.02%) gained the most while Russia (down 50.32 %) and Hungary (down 24.63 %) witnessed the largest declines. S&P Dow Jones announced the removal of all stocks domiciled and listed in Russia due to the country’s invasion of Ukraine.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

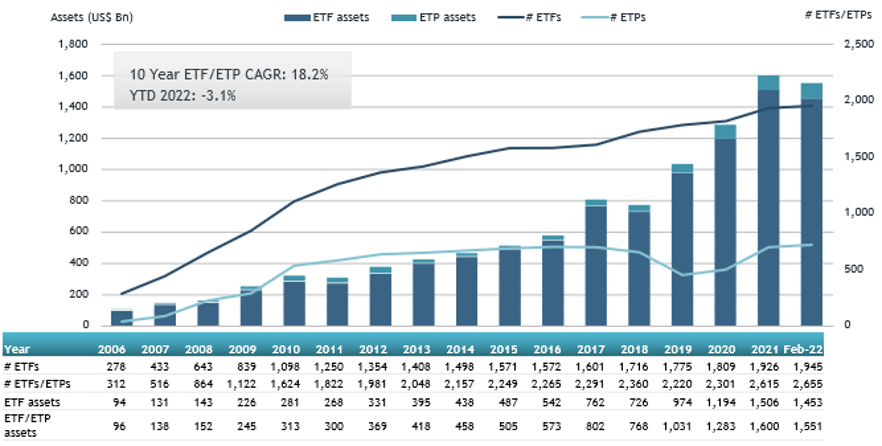

Europe ETFs and ETPs asset growth as at the end of February 2022

The ETFs industry in Europe had 2,655 products, with 10,497 listings, assets of $1.55 Tn, from 90 providers listed on 29 exchanges in 24 countries at the end of February.

During February 2022, ETFs/ETPs gathered net inflows of $11.85 Bn. Equity ETFs/ETPs gathered net inflows of $7.14 Bn over February, bringing year to date net inflows to $32.08 Bn, higher than the $29.68 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs/ETPs had net inflows of $860 Mn during February, bringing net inflows for the year through February 2022 to $3.65 Bn, much lower than the $8.53 Bn in net inflows fixed income products had attracted by the end of February 2021. Commodities ETFs/ETPs reported net inflows of $2.35 Bn during February, bringing net inflows for the year through February 2022 to $3.89 Bn, higher than the $2.85 Bn in net inflows commodities products had reported year to date in 2021. Active ETFs/ETPs attracted net inflows of $744 Mn over the month, gathering net inflows year to date of $874 Mn, higher than the $21 Mn in net outflows active products had reported in the first two months of 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $13.59 Bn during February. Invesco S&P 500 ETF - Acc (SPXS LN) gathered $1.48 Bn, the largest individual net inflow.

Top 20 ETFs by net inflows in February 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPXS LN |

13,760.73 |

1,177.08 |

1,483.97 |

|

|

iShares Core S&P 500 UCITS ETF - Acc |

CSSPX SW |

55,366.94 |

1,862.55 |

1,387.50 |

|

SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc |

SPPU GY |

6,750.77 |

1,374.70 |

1,372.93 |

|

iShares S&P 500 Swap UCITS ETF - Acc |

I500 NA |

2,365.13 |

827.13 |

825.46 |

|

iShares Edge MSCI USA Value Factor UCITS ETF - Acc |

IUVL LN |

4,142.89 |

1,393.13 |

811.18 |

|

AMUNDI S&P 500 UCITS ETF - USD (C) - Acc |

500USD SW |

4,086.65 |

662.59 |

802.06 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

5,044.80 |

776.23 |

674.17 |

|

LYXOR UCITS ETF MSCI WORLD - MONTHLY HEDGED D-EUR - Acc |

WLDHC FP |

694.63 |

702.90 |

648.20 |

|

iShares Edge MSCI Europe Value Factor UCITS ETF |

IEFV LN |

3,963.85 |

1,046.89 |

579.83 |

|

iShares Edge MSCI World Value Factor UCITS ETF - Acc |

IWVL LN |

5,393.27 |

1,058.74 |

567.33 |

|

iShares $ Treasury Bond 3-7yr UCITS ETF - USD D - Acc |

CSBGU7 SW |

2,852.30 |

368.33 |

563.09 |

|

Lyxor S&P 500 UCITS ETF - D-USD |

LSPU LN |

3,099.99 |

458.57 |

521.64 |

|

HSBC MSCI China UCITS ETF |

HMCH LN |

1,070.77 |

550.66 |

466.75 |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

43,955.64 |

1,494.28 |

464.44 |

|

iShares MSCI Europe UCITS ETF EUR (Dist) |

IMEU LN |

7,387.73 |

488.95 |

464.02 |

|

Vanguard S&P 500 UCITS ETF |

VUSA LN |

32,089.76 |

1,023.51 |

440.34 |

|

Invesco US Treasury 7-10 Year UCITS ETF |

TREX LN |

718.39 |

488.52 |

390.85 |

|

Lyxor UCITS ETF STOXX EUROPE 600 BANKS - Acc |

BNK FP |

1,808.31 |

611.53 |

383.81 |

|

Vanguard FTSE All-World UCITS ETF - Acc |

VWRA LN |

4,710.28 |

666.81 |

376.59 |

|

iShares MSCI ACWI UCITS ETF - Acc |

ISAC LN |

4,841.11 |

685.75 |

367.79 |

The top 10 ETPs by net new assets collectively gathered $1.96 Bn during February. iShares Physical Gold ETC - Acc (SGLN LN) gathered $514 Mn, the largest individual net inflow.

Top 10 ETPs by net inflows in February 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

14,104.53 |

598.28 |

513.74 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

XGDU LN |

2,856.71 |

514.23 |

391.00 |

|

Xtrackers Physical Gold ETC (EUR) - Acc |

XAD5 GY |

3,184.08 |

486.85 |

201.02 |

|

Invesco Physical Gold ETC - EUR Hdg Acc |

SGLE IM |

297.41 |

198.35 |

189.88 |

|

Royal Mint Physical Gold ETC Securities - Acc |

RMAU LN |

449.26 |

156.84 |

153.84 |

|

Xtrackers IE Physical Gold ETC Securities - GBP Hdg Acc |

XGDG LN |

358.54 |

150.51 |

150.51 |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

14,795.47 |

(116.42) |

149.55 |

|

WisdomTree Carbon - Acc |

CARB LN |

303.14 |

83.94 |

80.77 |

|

Xetra Gold EUR - Acc |

4GLD GY |

14,589.74 |

90.56 |

68.92 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

4,294.80 |

103.75 |

60.35 |

Investors have tended to invest in Equity ETFs and ETPs during February.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

ETFG ETFGI reports ETFs industry in Europe gathered US$11.85 billion of net inflows in February 2022

Interested in learning more about the latest trends? Register now to join us at our 2nd annual ETFGI Global ETFs Insights Summit - ESG & Active ETFs Trends, a virtual event on March 23 & 24. Exhibit Hall and Networking starts at 8:00 am EDT/12:00 pm GMT, Welcoming Remarks 8:30am EDT/12:30 pm GMT.

The event is designed as educational events for financial advisors and traders, portfolio managers, CIOs at buyside institutional investor to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, active, product and trading developments impacting investors.

Exciting line up of speakers in fireside chats and panel discussions on timely and relevant topics with sponsor booths and virtual networking! Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors. If you cannot attend on the day, register and you will receive the links to the session recordings.

![]()

Confirmed Speakers:

The event will cover:

- Overview of ESG ETF Landscape – ETFGI Research

- ESG Regulatory Issues Impacting Investors in Asia Pacific

- ESG Regulatory Issues Impacting Investors in the United Kingdom

- ESG Regulatory Issues Impacting Investors in Europe

- Overview of The ESG Benchmark Regulatory Landscape

- ESG Reporting and Disclosure

- How to Incorporate ESG Data Into Investment Decisions

- ESG Integration for Fixed Income Portfolios

- How Investors are Implementing ESG in Their Portfolios

- ESG and Crypto Investing

- ESG & Active ETFs Regulatory Issues Impacting Investors in the United States

- Overview of Active ETF Landscape – ETFGI Research

- How are Active ETFs Evolving

- How Investors are Using AI and Direct Indexing

- Active and ESG ETF Trends in the ETF Industry

- Women in ETFs Session: The Pathway to Inclusive Investments

To view the agendas, speakers, sponsors and hear recordings from our prior events in 2021, 2020 and 2019, please visit the ETFGI website.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you interested in speaking, sponsoring or have any questions about any of our upcoming events.

We look forward to seeing you at our events!

Debbie and Margareta

Follow us on Linkedin and Twitter for updates about the event.