ETFGI reports ETFs focused on ESG strategies listed globally gathered net inflows of US$7.55 billion during February 2022

LONDON —March 17, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$7.55 billion during February, bringing year to date net inflows to US$17.35 Bn which is much lower than the US$40.51 Bn gathered at this point last year. Total assets invested in ESG ETFs and ETPs decreased by 0.05% from US$379.3 billion at the end of January 2022 to US$379.1 billion, according to ETFGI’s February 2022 ETF and ETP ESG industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs focused on ESG strategies listed globally gathered net inflows of $7.55 billion during February

- YTD net inflows of $17.35 Bn are the second highest on record, after YTD net inflows in 2021 of $40.51 Bn.

- $138 Bn in net inflows gathered in the past 12 months.

- 38th month of consecutive net inflows.

- Assets of $379 Bn invested in ESG ETFs and ETPs industry at the end of February 2022.

- ESG Equity ETFs and ETPs gathered $5.12 Bn in net inflows in February.

“The S&P 500 decreased by 2.99% in February as the world watches the situation in the Ukraine unfold. Developed markets excluding the US, experienced a loss of 1.34% in February. Japan (down 0.59%) and Portugal (down 0.62%) experienced the smallest losses amongst the developed markets in February, while Austria suffered the largest loss of 10.92%. Emerging markets decreased by 3.43% during February. Peru (up 7.07%) and UAE (up 6.02%) gained the most while Russia (down 50.32 %) and Hungary (down 24.63 %) witnessed the largest declines. S&P Dow Jones announced the removal of all stocks domiciled and listed in Russia due to the country’s invasion of Ukraine.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

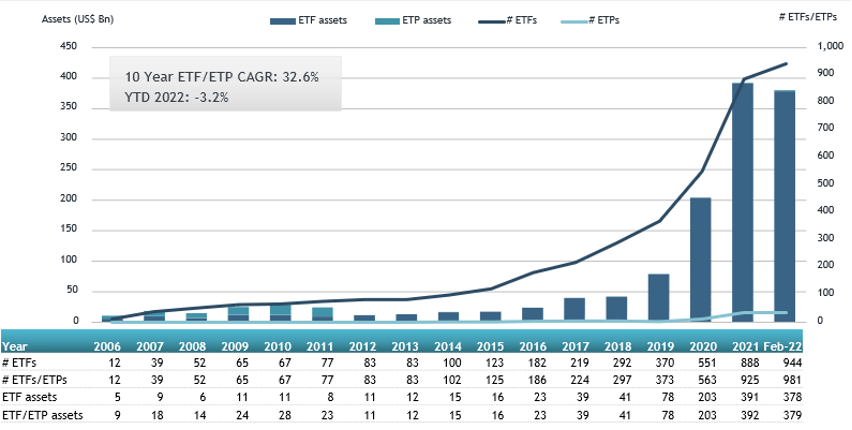

Global ESG ETF and ETP asset growth as at end of February 2022

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily, with 981 ESG products and 2,814 listings from 193 providers on 41 exchanges in 32 countries at the end of February 2022. During February, 25 new ESG ETFs/ETPs were launched.

The Global ESG ETF/ETP had 981 ETFs/ETPs, with 2,814 listings, assets of $379 Bn, from 193 providers on 41 exchanges in 32 countries. Following net inflows of $7.55 Bn and market moves during the month, assets invested in ESG ETFs/ETPs listed globally decreased by 0.05% from $379.3 Bn at the end of January 2022 to $379.1 Bn at the end of February 2022.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $7.06 Bn in February. SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc (SPPU GY) gathered $1.37 Bn, the largest individual net inflow.

Top 20 ESG ETFs/ETPs by net new assets February 2022

|

Name |

Ticker |

Assets ($ Mn) Feb-22 |

NNA ($ Mn) YTD-22 |

NNA ($ Mn) Feb-22 |

|

SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc |

SPPU GY |

6,750.77 |

1,374.70 |

1,372.93 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

5,044.80 |

776.23 |

674.17 |

|

iShares ESG MSCI EM ETF |

ESGE US |

6,513.07 |

678.81 |

643.90 |

|

iShares Paris-Aligned Climate MSCI USA ETF |

PABU US |

615.34 |

624.07 |

624.07 |

|

BMO MSCI USA ESG Leaders Index ETF |

ESGY CN |

1,223.46 |

592.56 |

584.45 |

|

Cathay Taiwan Select ESG Sustainability High Yield ETF |

00878 TT |

1,819.04 |

590.05 |

513.47 |

|

UBS Lux Fund Solutions - MSCI USA Socially Responsible UCITS ETF (USD) A-dis |

UIMP GY |

2,451.41 |

307.55 |

284.68 |

|

iShares MSCI EM SRI UCITS ETF - Acc |

SUES LN |

3,795.53 |

483.23 |

267.43 |

|

Cathay Global Autonomous and Electric Vehicles ETF |

00893 TT |

957.74 |

377.39 |

251.22 |

|

iShares MSCI EM IMI ESG Screened UCITS ETF - Acc - Acc |

SAEM LN |

1,998.25 |

218.96 |

221.25 |

|

iShares ESG US Aggregate Bond ETF |

EAGG US |

1,985.87 |

277.88 |

202.46 |

|

UBS (Irl) ETF plc – MSCI United Kingdom IMI Socially Responsible UCITS ETF (GBP) A-dis |

UKSR LN |

1,135.03 |

214.75 |

200.70 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

4,970.81 |

272.71 |

197.96 |

|

iShares JP Morgan ESG USD EM Bond UCITS ETF - Acc - Acc |

EMSA LN |

1,044.74 |

(61.44) |

170.20 |

|

Amundi Floating Rate Euro Corporate ESG UCITS ETF DR - Acc |

AFRN FP |

1,316.33 |

169.32 |

152.08 |

|

UBS Lux Fund Solutions - J.P. Morgan USD EM IG ESG Diversified Bond UCITS ETF (USD) Acc |

EMIG GY |

329.04 |

165.20 |

151.74 |

|

iShares ESG Advanced MSCI USA ETF |

USXF US |

683.25 |

167.70 |

148.85 |

|

BNP Paribas Easy MSCI Europe SRI S-Series PAB 5% Capped |

SRIE FP |

1,404.49 |

401.79 |

148.11 |

|

Mirae Asset TIGER China Electric Vehicle Solactive ETF |

371460 KS |

2,848.20 |

433.23 |

124.63 |

|

Vanguard ESG US Stock ETF |

ESGV US |

6,115.37 |

300.57 |

124.18 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity. Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

ESG ETFs and ETPs listed globally gathered net inflows of US$7.55 billion during February, making it the 38th month of consecutive net inflows.

Interested in learning more about the latest trends? Register now to join us at our 2nd annual ETFGI Global ETFs Insights Summit - ESG & Active ETFs Trends, a virtual event on March 23 & 24. Exhibit Hall and Networking starts at 8:00 am EDT/12:00 pm GMT, Welcoming Remarks 8:30am EDT/12:30 pm GMT.

The event is designed as educational events for financial advisors and traders, portfolio managers, CIOs at buyside institutional investor to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, active, product and trading developments impacting investors.

Exciting line up of speakers in fireside chats and panel discussions on timely and relevant topics with sponsor booths and virtual networking! Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors. If you cannot attend on the day, register and you will receive the links to the session recordings.

![]()

Day 2 Speakers:

The event will cover:

- Overview of ESG ETF Landscape – ETFGI Research

- ESG Regulatory Issues Impacting Investors in Asia Pacific

- ESG Regulatory Issues Impacting Investors in the United Kingdom

- ESG Regulatory Issues Impacting Investors in Europe

- Overview of The ESG Benchmark Regulatory Landscape

- ESG Reporting and Disclosure

- How to Incorporate ESG Data Into Investment Decisions

- ESG Integration for Fixed Income Portfolios

- How Investors are Implementing ESG in Their Portfolios

- ESG and Crypto Investing

- ESG Regulatory Issues Impacting Investors in the United States

- Active ETFs Regulatory Issues Impacting Investors in the United States

- Overview of Active ETF Landscape – ETFGI Research

- How are Active ETFs Evolving

- How Investors are Using AI and Direct Indexing

- Active and ESG ETF Trends in the ETF Industry

- Women in ETFs Session: The Pathway to Inclusive Investments

To view the agendas, speakers, sponsors and hear recordings from our prior events in 2021, 2020 and 2019, please visit the ETFGI website.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you interested in speaking, sponsoring or have any questions about any of our upcoming events.

We look forward to seeing you at our events!

Debbie and Margareta

Follow us on Linkedin and Twitter for updates about the event.