ETFGI reports the ETFs industry in Canada gathered US$3.36 billion US dollars in February 2022

LONDON — March 9, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs listed in Canada gathered net inflows of US$3.36 billion during February, bringing year-to-date net inflows to US$7.77 billion. At the end of the month, Canadian ETF assets increased by 0.4%, from US$269 billion at the end of January to US$270 billion but are below the record high of US$273 billion set at the end of 2021, according to ETFGI's February 2022 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $270 Bn invested in ETFs listed in Canada at end of February are the 2nd highest on record.

- Assets increased by 0.4%, from $269 billion at the end of January to $270 billion at end of February

- Net inflows of $3.36 Bn gathered in February 2022.

- $46.51 Bn in net inflows gathered in the past 12 months.

- 32nd month of consecutive net inflows.

- Majority of net inflows have gone into Equity exposure in February and year to date.

“The S&P 500 decreased by 2.99% in February as the world watches the situation in the Ukraine unfold. Developed markets excluding the US, experienced a loss of 1.34% in February. Japan (down 0.59%) and Portugal (down 0.62%) experienced the smallest losses amongst the developed markets in February, while Austria suffered the largest loss of 10.92%. Emerging markets decreased by 3.43% during February. Peru (up 7.07%) and UAE (up 6.02%) gained the most while Russia (down 50.32 %) and Hungary (down 24.63 %) witnessed the largest declines. S&P Dow Jones announced the removal of all stocks domiciled and listed in Russia due to the country’s invasion of Ukraine.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

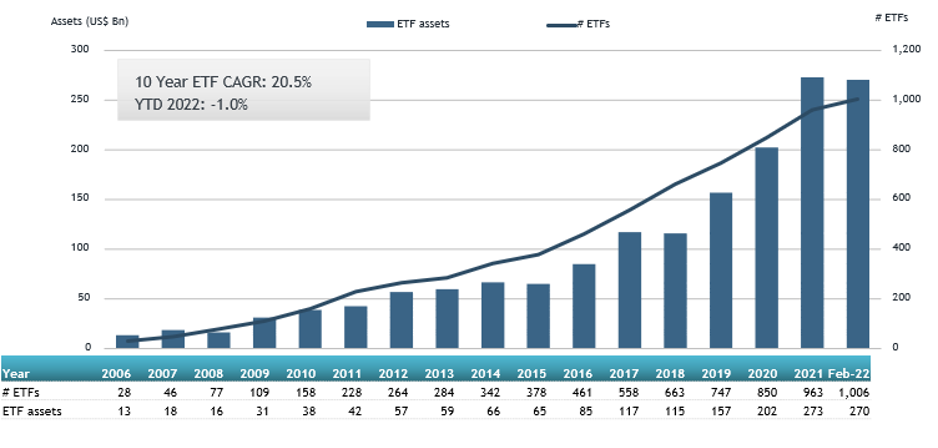

Growth in Canadian ETF assets as of the end of February 2022

The Canadian ETF industry had 1,006 ETFs, with 1,274 listings, assets of $270 Bn, from 42 providers listed on 2 exchanges at the end of February.

During February 2022, ETFs gathered net inflows of $3.36 Bn. Equity ETFs gathered net inflows of $2.19 Bn over February, bringing year to date net inflows to $5.68 Bn, higher than the $4.35 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs had net outflows of $531 Mn during February, bringing net outflows for the year through February 2022 to $464 Mn, lower than the $960 Mn in net inflows fixed income products had attracted by the end of February 2021. Commodities ETFs reported net outflows of $43 Mn during February, bringing net outflows for the year to February 2022 to $194 Mn, lower than the $10 Mn in net outflows commodities products had reported year to date in 2021. Active ETFs attracted net inflows of $1.42 Bn over the month, gathering net inflows year to date of $2.31 Bn, higher than the $1.77 Bn in net inflows active products had reported in the first two months of 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $3.62 Bn during February. iShares S&P/TSX 60 Index Fund (XIU CN) gathered $980 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets February 2022: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

XIU CN |

9,983.43 |

1,365.63 |

979.85 |

|

|

BMO MSCI USA ESG Leaders Index ETF |

ESGY CN |

1,223.46 |

592.56 |

584.45 |

|

TD Canadian Long Term Federal Bond ETF |

TCLB CN |

601.42 |

382.91 |

352.07 |

|

iShares Core S&P/TSX Capped Composite Index ETF |

XIC CN |

8,242.80 |

138.13 |

338.48 |

|

Horizons Cash Maximizer ETF - Acc |

HSAV CN |

1,636.95 |

435.33 |

232.66 |

|

Horizon S&P/TSX 60 Index ETF - Acc |

HXT CN |

2,596.23 |

334.52 |

155.76 |

|

BMO Aggregate Bond Index ETF |

ZAG CN |

4,826.75 |

3.28 |

105.47 |

|

Vanguard S&P 500 Index ETF |

VFV CN |

5,092.12 |

372.54 |

101.66 |

|

Vanguard U.S. Total Market Index ETF |

VUN CN |

4,070.48 |

237.21 |

72.47 |

|

BMO Covered Call Canadian Banks ETF |

ZWB CN |

2,197.90 |

120.32 |

69.10 |

|

Vanguard Growth ETF Portfolio |

VGRO CN |

2,656.13 |

172.84 |

66.82 |

|

Vanguard All-Equity ETF Portfolio |

VEQT CN |

1,485.75 |

210.52 |

65.71 |

|

BMO S&P 500 Index ETF |

ZSP CN |

8,425.56 |

475.29 |

65.54 |

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

4,414.59 |

(62.96) |

63.82 |

|

Vanguard FTSE Developed All Cap EX North America Index ETF |

VIU CN |

2,267.15 |

145.90 |

63.80 |

|

Mackenzie US Large Cap Equity Index ETF |

QUU CN |

1,713.75 |

102.42 |

63.55 |

|

Vanguard FTSE Canada All Cap Index ETF |

VCN CN |

3,845.57 |

133.17 |

63.20 |

|

iShares Floating Rate Index ETF |

XFR CN |

310.22 |

91.82 |

59.98 |

|

AGFiQ US Market Neutral Anti-Beta CAD-Hedged ETF |

QBTL CN |

318.81 |

56.33 |

56.33 |

|

CI First Asset Morningstar Canada Momentum Index ETF |

WXM CN |

735.91 |

81.78 |

55.86 |

Investors have tended to invest in Equity ETFs during February.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

###

Additional Speakers have been added for the 2nd annual ETFGI Global ETFs Insights Summit - ESG & Active ETFs Trends

Register now to join us at our 2nd annual ETFGI Global ETFs Insights Summit - ESG & Active ETFs Trends, a virtual event on March 23 & 24.

The event is designed as educational events for financial advisors and traders, portfolio managers, CIOs at buyside institutional investor to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, active, product and trading developments impacting investors.

Exciting line up of speakers in fireside chats and panel discussions on timely and relevant topics with sponsor booths and virtual networking!

Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors. All sessions will be recorded and will be made available to all registrants after the event.

![]()

Speakers include:

- Georgia Bullitt, Partner, Willkie Farr & Gallagher LLP

- Hernando Cortina, Head of Index Strategy, ISS ESG

- Boris Couteaux, VP, Business and Product Development, Impak Finance

- Henrietta De Salis, Partner, Willkie Farr & Gallagher LLP

- Deborah Fuhr, Founder, Managing Partner, ETFGI

- Justin Lowry, CIO, Global Beta Advisors

- Christian Kronseder, CEO, Allindex

- Jon Maier, CIO, Global X

- Aude Martin, Senior ETF Investment Specialist LGIM, Legal & General Investment Management

- Tobin McComas, Vice President, Development & Member Services, Chamber of Digital Commerce

- Anthony Miller, Economic Affairs Officer, UNCTAD

- Stephanie Pierce, CEO of ETFs, BNY Mellon

- Rick Redding, CEO, Index Industry Association

- Keri Riemer, Of Counsel, K&L Gates LLP

- Diana van Maasdijk, Co-Founder & Executive Director, Equileap

- Ken Zockoll, CEO, Spatial Risk Systems

The event will cover:

- Overview of the ESG benchmark regulatory landscape

- Key issues for ESG in Europe

- Key issues for ESG in Asia Pacific

- Key issues for ESG in the United States

- ESG reporting and disclosure

- How to incorporate ESG data into investment decisions

- ESG integration for fixed income portfolios

- ESG and Crypto investing

- How investors are implementing ESG in their portfolios

- How investors are using AI and direct indexing

- The Pathway to inclusive investments

- Overview of Active ETF Landscape – ETFGI Research

- How have Active ETFs performed over the past 2 years

Additional speakers will be added. To view the agendas, speakers, sponsors and hear recordings from our prior events in 2021, 2020 and 2019, please visit the ETFGI website.

2022 Virtual Events Schedule:

- 2nd ESG & Active ETFs Trends, March 23 – 24 Register Here

- 3rd Annual Latin America, April 27 - 28 Register Here

- 3rd Annual USA, May 17 - 18 Register Here

- 3rd Annual Europe & MEA, September 20 - 22 Register Here

- 3rd Annual Asia Pacific, October 12 - 13 Register Here

- 4th Annual Canada, November 30 - December 1 Register Here

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you interested in speaking, sponsoring or have any questions about any of our upcoming events.

We look forward to seeing you at our events!

Debbie and Margareta

Follow us on Linkedin and Twitter for updates about the event.

ETF TV News #107 Kevin Kelly, CEO of Kelly ETFs discusses creating disruptive indices and ETFs with Margareta Hricova and Deborah Fuhr on ETF TV. #PressPlay https://bit.ly/3h7cML5

ETF TV News #107 Kevin Kelly, CEO of Kelly ETFs discusses creating disruptive indices and ETFs with Margareta Hricova and Deborah Fuhr on ETF TV. #PressPlay https://bit.ly/3h7cML5

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.