ETFGI reports Global ETFs industry gathered US$123.35 billion in net inflows in March 2022

LONDON —April 14, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today Global ETFs industry gathered US$123.35 billion in net inflows in March bringing Q1 2022 net inflows to US$305.63 billion. At the end of the month, assets invested globally in the ETFs industry increased by 2.7%, from US$9.82 trillion at the end of February to US$10.08 trillion, according to ETFGI's March 2022 global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Global ETFs industry gathered US$123.35 billion in net inflows in March.

- $305.63 Bn in net inflows in Q1 which are the 2nd highest, after the Q1 2021 record of $361.14 Bn.

- Assets of $10.08 Tn invested in Global ETFs industry at end of Q1 are the 2nd highest on record.

- Assets decreased 1.8% in Q1 2022, going from $10.27 Tn at end of 2021 to $10.08 Tn.

- $1.24 Tn in net inflows gathered in the past 12 months.

- 34th month of consecutive net inflows.

- Equity ETFs and ETPs listed globally gathered $76.24 Bn net inflows in March 2022.

“The S&P 500 increased by 3.71% in March but is down 4.60% YTD. Developed markets excluding the US, increased 1.10% in March but are down 5.57% YTD 2022. Australia (up 10.46%) and Portugal (up 6.50%) experienced the largest increases amongst the developed markets in March. Emerging markets decreased by 2.27% during March and are down 6.52% YTD in 2022. Egypt (down 14.31%) and China (down 8.34%) witnessed the largest declines among emerging markets in March, whilst Brazil (up 14.51%) and Colombia (up 11.98%) gained the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

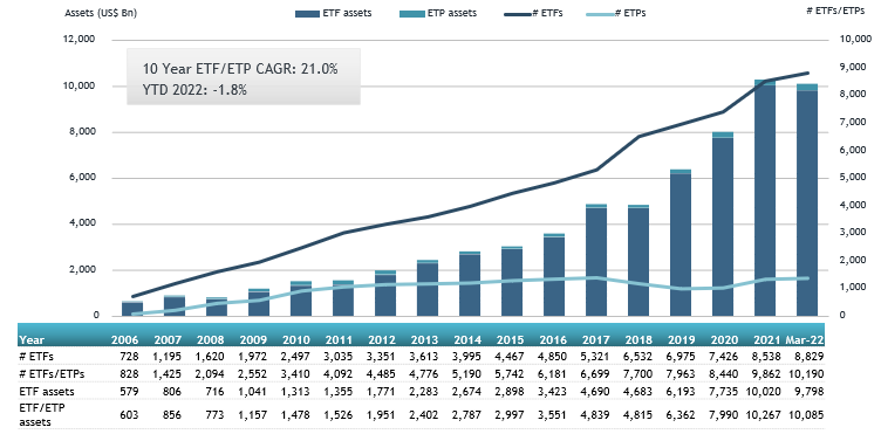

Global ETF and ETP assets as of the end of March 2022

The Global ETFs industry had 10,190 products, with 20,707 listings, assets of $10.08 Tn, from 628 providers listed on 79 exchanges in 62 countries at the end of Q1 2022.

During March, ETFs/ETPs gathered net inflows of $123.35 Bn. Equity ETFs/ETPs gathered net inflows of $76.24 Bn during March, bringing Q1 net inflows to $210.75 Bn, lower than the $267.52 Bn in net inflows equity products had attracted during Q1 2021. Fixed income ETFs/ETPs had net inflows of $23.96 Bn during March, bringing Q1 net inflows to $29.79 Bn, lower than the $40.66 Bn in net inflows fixed income products had attracted at the end of Q1 2021. Commodities ETFs/ETPs reported net inflows of $11.08 Bn during March, bringing Q1 net inflows to $19.59 Bn, higher than the 6.49 Bn in net outflows commodities products had reported in Q1 2021. Active ETFs/ETPs attracted net inflows of $10.12 Bn during the month, gathering net inflows of $32.97 Bn in Q1 2022, lower than the $48.16 Bn in net inflows active products had reported in Q1 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $58.78 Bn during March. SPDR S&P 500 ETF Trust (SPY US) gathered $9.50 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows March 2022: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

420,400.11 |

(17,561.17) |

9,501.60 |

|

Invesco QQQ Trust |

|

QQQ US |

198,841.01 |

2,046.89 |

9,059.33 |

|

iShares 20+ Year Treasury Bond ETF |

|

TLT US |

19,987.56 |

2,266.34 |

4,811.83 |

|

iShares Core S&P 500 ETF |

|

IVV US |

329,154.36 |

11,913.89 |

4,574.89 |

|

Vanguard S&P 500 ETF |

|

VOO US |

291,337.61 |

24,906.41 |

4,436.29 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

289,262.49 |

8,816.75 |

3,433.48 |

|

Vanguard Total Bond Market ETF |

|

BND US |

83,288.92 |

4,428.98 |

3,113.54 |

|

iShares Core MSCI Emerging Markets ETF |

|

IEMG US |

73,555.07 |

2,473.52 |

2,290.11 |

|

JPMorgan BetaBuilders Europe ETF |

|

BBEU US |

11,189.25 |

2,267.59 |

1,822.34 |

|

iShares MSCI Emerging Markets ETF |

|

EEM US |

27,770.41 |

1,742.18 |

1,742.18 |

|

Health Care Select Sector SPDR Fund |

|

XLV US |

37,031.96 |

2,426.64 |

1,551.41 |

|

iShares Short Treasury Bond ETF |

|

SHV US |

17,277.52 |

4,133.17 |

1,507.95 |

|

iShares 0-5 Year TIPS Bond ETF |

|

STIP US |

11,112.79 |

2,193.44 |

1,494.43 |

|

Tracker Fund of Hong Kong (TraHK) |

|

2800 HK |

14,307.72 |

2,166.93 |

1,463.00 |

|

Kamnd |

|

KMND1 |

4,758.49 |

1,427.69 |

1,427.69 |

|

Vanguard Growth ETF |

|

VUG US |

83,392.04 |

2,247.15 |

1,381.38 |

|

iShares Core S&P 500 UCITS ETF - Acc |

|

CSSPX SW |

60,548.35 |

3,208.86 |

1,348.65 |

|

iShares S&P 500 Growth ETF |

|

IVW US |

36,758.38 |

(275.39) |

1,318.67 |

|

Vanguard Short-Term Inflation-Protected Securities Index Fund |

|

VTIP US |

20,249.84 |

468.11 |

1,299.55 |

|

Vanguard Value ETF |

|

VTV US |

102,602.18 |

9,501.20 |

1,197.00 |

The top 10 ETPs by net new assets collectively gathered $13.55 Bn over March. SPDR Gold Shares (GLD US) gathered $3.92 Bn, the largest individual net inflow.

Top 10 ETPs by net new inflows March 2022: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

|

GLD US |

67,127.77 |

7,129.89 |

3,917.33 |

|

iShares Physical Gold ETC - Acc |

|

SGLN LN |

17,362.49 |

3,467.73 |

2,869.46 |

|

Invesco Physical Gold ETC - Acc |

|

SGLD LN |

17,252.88 |

2,102.37 |

2,218.79 |

|

iShares Gold Trust |

|

IAU US |

32,249.03 |

1,601.59 |

1,153.18 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

|

XGDU LN |

3,973.09 |

1,551.91 |

1,037.67 |

|

SPDR Gold MiniShares Trust |

|

GLDM US |

5,222.56 |

578.10 |

578.82 |

|

Invesco DB Agriculture Fund |

|

DBA US |

1,877.90 |

741.00 |

508.94 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

|

GOLD FP |

4,850.53 |

591.32 |

487.57 |

|

ProShares Ultra VIX Short-Term Futures |

|

UVXY US |

1,112.75 |

88.15 |

392.67 |

|

Teucrium Wheat Fund |

|

WEAT US |

492.64 |

423.36 |

383.77 |

Investors have tended to invest in Equity ETFs/ETPs during March.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

###

Register to join us at the 3rd annual ETFGI Global ETFs Insights Summit - Latin America, a virtual event on April 27 & 28 and receive a free copy of the ETFGI directory of all products listed in Latin America*!

The summit is designed to facilitate a substantive and in-depth discussion on the market structure, regulatory, trading, and technological developments impacting the use of and opportunity for local, US domiciled and UCITS ETFs by various types of investors in Latin America.

The event is aimed at ETF issuers, brokerage firms and others in the ETF ecosystem globally that are interested in understanding how to tap into the growing interest in ETFs in Latin America.

Exciting line up of speakers in fireside chats and panel discussions on timely and relevant topics with sponsor booths and virtual networking!

? Free registration for buy side institutional investors and financial advisors

? CPD educational credits

? All sessions are recorded and you will also receive access to last year's session recordings

*(qualified investors only)

![]()

Speakers include:

- Soledad Almarza, Managing Director, LarrainVial

- Ignacio Arrospide, CIO, Creuza Advisors

- Alexei Bonamin, Head of the Capital Markets Group, TozziniFreire Advogados

- Felipe Cousino, Partner, Alessandri

- Matias Cremaschi, Co-Head Investments, Delta Asset Management

- Deborah Fuhr, Founder, Managing Director, ETFGI

- Manuel Felipe García, VP, Wealth Management division, Skandia Colombia

- Rodolfo Garcia, Director of Institutional Relationships Latam, Global X ETFs

- Nicolas Gomez, Managing Director, Head of Latin America ETF and Index Investments and Product Development, BlackRock

- Eduardo Flores Herrera, Partner, Creel

- Joshua Kaplan, CFA, Global Head of Research, MV Index Solutions

- Jamie Lazaro, CEO, BBVA Asset Management Mexico

- Martin Leinweber, CFA, Digital Asset Product Strategist, MV Index Solutions

- Julio Pueyrredon, Partner, Negri & Pueyrredon Abogados

- Adriana Rangel, Head of Institutional Sales, Vanguard LATAM

- Rick Redding, CEO, Index Industry Association

- April Reppy Suydam, Head of Latin America Sales & Distribution, First Trust

- Jamie Saborio, Head of ETF & Indexing Sales, Mexico, HSBC Asset Management

- Zeb Saeed, Passive Products Specialist, DWS

- Ximena Sánchez Kehr, SIC Manager, Bolsa Mexicana de Valores

- Gabriela Santos, Global Market Strategist, J.P. Morgan Asset Management

- Allan Stewart, ETF Sales and Relationship Manager - Investment Fund Services, Clearstream

- Joswilb Vega Ugarte, CIO, AFP Profuturo

- Miguel A. Zapatero, Chief Executive Officer, Lima Stock Exchange

The event will cover:

- Trends in the Use of ETFs in LATAM

- How Investors are Using ETFs in Argentina

- How Investors are Using ETFs in Brazil

- How Investors are Using ETFs in Chile

- How Investors are Using ETFs in Colombia

- How Investors are Using ETFs in Mexico

- How Investors are Using ETFs in Peru

- Overview of the offshore ETF Landscape

- Overview of Trends in the ETF industry - ETFGI Research

- Global Macro Outlook

- Sustainable Finance and ESG regulations impacting investors

- How are Investors using equity and fixed income ESG ETFs

- How are Investors are using Crypto and Digital Assets ETFs

- Designing Thematic ETFs and Rethinking Country ETFs

- Best Practices when Trading ETFs

- Women in ETFs: The Case for Diversity

To view the agendas, speakers, sponsors and hear recordings from our prior events, please visit the ETFGI website.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you interested in speaking, sponsoring or have any questions about any of our upcoming events.

We look forward to seeing you at our events!

Debbie and Margareta

Follow us on Linkedin and Twitter for updates about the event.

2022 ETFGI Global ETFs Insights Summits:

- 3rd Annual Latin America (Virtual), April 27 - 28 Register Here

- 3rd Annual USA (Hybrid), May 17 - 18 Register Here

- 3rd Annual Europe & MEA (Hybrid), September 20 - 22 Register Here

- 3rd Annual Asia Pacific (Virtual), October 12 - 13 Register Here

- 4th Annual Canada (Hybrid), November 30 - December 1 Register Here

ETF TV News #110 Tim Maloney, CFA, Co-Founder and Chief Investment Officer, Roundhill Investments discusses the Metaverse and listing their first ETF in Europe with Deborah Fuhr and Margareta Hricova on ETF TV #PressPlay https://bit.ly/3JmimVO

ETF TV News #110 Tim Maloney, CFA, Co-Founder and Chief Investment Officer, Roundhill Investments discusses the Metaverse and listing their first ETF in Europe with Deborah Fuhr and Margareta Hricova on ETF TV #PressPlay https://bit.ly/3JmimVO

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.