ETFGI reports assets invested in Active ETFs listed globally reached a record US$474 billion at the end of July 2022

LONDON — August 24, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that assets invested in Active ETFs listed globally reach record US$474 billion at the end of July. Active ETFs listed globally gathered US$8.22 billion US dollars of net inflows during July 2022, bringing year-to-date net inflows to US$71.41 billion. Assets invested in actively managed ETFs increased by 5.3%, going from US$450 billion at the end of June 2022 to US$474 billion, according to ETFGI's July 2022 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in actively managed ETFs listed globally reached a record $474 Bn at end of July 2022

- Assets have increased 7.1% year-to-date in 2022, going from $442 Bn at the end of 2021 to $474 Bn.

- Net inflows of $8.22 Bn during July.

- YTD net inflows of $71.41 Bn are the 2nd highest on record, after the YTD net inflows in 2021 of $88.97 Bn.

- 28th month of consecutive net inflows.

- Actively managed Equity ETFs and ETPs gathered $5.71 Bn in net inflows in July.

“The S&P 500 increased by 9.22% in July but is down 12.58% YTD 2022. Developed markets excluding the US increased by 5.32% in July but are down 15.84% YTD 2022. Sweden (up 12.13%) and Netherlands (up 9.64%) saw the largest increases amongst the developed markets in July. Emerging markets decreased by 0.40% during July and are down 16.46% YTD in 2022. Pakistan (down 16.59%) and China (down 8.77%) saw the largest decreases amongst emerging markets in July, while Chile (up 12.24%) and India (up 9.14%) saw the largest increases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

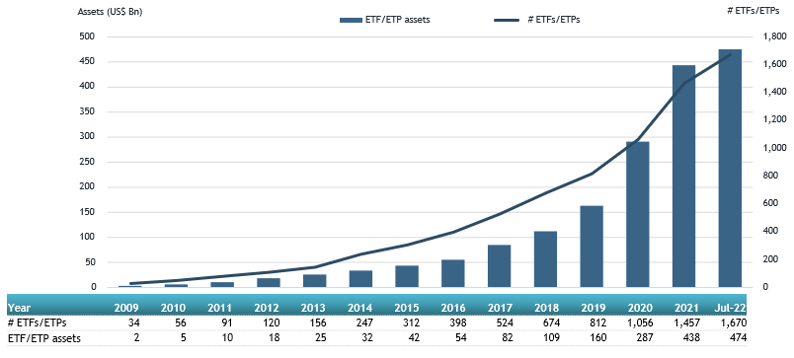

Growth in actively managed ETF and ETP assets as of the end of July 2022

At the end of July there were 1,670 Active ETFs listed globally, with 2,137 listings, assets of $474 Bn, from 319 providers listed on 30 exchanges in 23 countries.

Active ETFs providing equity exposure listed globally gathered net inflows of $5.71 Bn during July, bringing year to date net inflows to $47.52 Bn, higher than the $40.84 Bn in net inflows active equity products had attracted at this point in 2021. Fixed Income focused active ETFs listed globally attracted net inflows of $2.27 Bn during July, bringing net inflows for the year through July 2022 to $13.06 Bn, lower than the $37.62 Bn in net inflows fixed income products had reported in the seven months of 2021.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered

$7.13 Bn during July. Hwabao WP Cash Tianyi Listed Money Market Fund (511990 CH) gathered $1.75 Bn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets July 2022

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

22,566.65 |

933.96 |

1,751.58 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

11,690.54 |

6,510.80 |

1,127.84 |

|

First Trust Enhanced Short Maturity Fund |

FTSM US |

5,639.47 |

1,416.91 |

451.41 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

20,373.97 |

2,051.52 |

447.98 |

|

ARK Innovation ETF |

ARKK US |

9,334.31 |

1,912.52 |

443.12 |

|

TD Canadian Long Term Federal Bond ETF |

TCLB CN |

1,052.21 |

875.41 |

313.28 |

|

JPMorgan US Research Enhanced Index Equity ESG UCITS ETF - Acc |

JREU LN |

1,471.46 |

603.73 |

300.46 |

|

Innovator U.S. Equity Power Buffer ETF - July |

PJUL US |

449.08 |

236.44 |

261.02 |

|

CI High Interest Savings ETF |

CSAV CN |

2,268.87 |

637.56 |

236.91 |

|

Dimensional US Core Equity 2 ETF |

DFAC US |

15,120.42 |

1,821.99 |

232.31 |

|

Samsung KODEX KOFR Active ETF (Synth) |

423160 KS |

1,133.01 |

1,153.12 |

192.75 |

|

Dimensional International Core Equity Market ETF |

DFAI US |

1,822.02 |

969.53 |

177.72 |

|

Dimensional International Core Equity 2 ETF |

DFIC US |

737.96 |

745.49 |

162.12 |

|

Andishe Varzan ETF - Acc |

AVSF1 |

837.63 |

170.31 |

154.26 |

|

High Interest Savings Account Fund |

HISA CN |

349.43 |

142.84 |

151.44 |

|

PIMCO Euro Short Maturity Source UCITS ETF - Acc |

PJSR GY |

1,409.74 |

173.74 |

150.41 |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

2,748.32 |

(1,576.97) |

150.09 |

|

Purpose High Interest Savings ETF |

PSA CN |

1,721.67 |

299.30 |

147.36 |

|

Dimensional Emerging Markets Core Equity 2 ETF |

DFEM US |

499.03 |

514.36 |

140.42 |

|

Pingan-Uob Traded Money Market Fund - Acc |

511700 CH |

231.13 |

201.03 |

135.34 |

Investors have tended to invest in Equity actively managed ETFs/ETPs during July.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register now for the 3rd annual ETFGI Global ETFs Insight Summit Europe & MEA Sept 14 - 16

Register to join the discussions at our 3rd annual ETFGI Global ETFs Insights Summit – EMEA September 14 – 16th. The summit is designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, product trends: active, bitcoin, crypto, ESG, Thematic and trading developments that are impacting investors.

This event will bring together leaders from across the ETF industry, including ETF sponsors, exchanges, broker-dealers, institutional investors, regulators, and other market participants. DAY 1 - In person on September 14th in London at the London Stock Exchange from 12:30pm – 5:00pm BST followed by drinks reception from 5pm – 6:30pm BST (attendees will receive access to virtual event content). Limited spaces for buyside institutional investors and IFAs. All sessions will be recorded.

DAY 2 & 3 - Virtual on September 15th & 16th - panel discussions on our virtual event platform.

SESSIONS INCLUDE:

- Macro Investment Outlook

- Trends in the ETF industry in Europe and MEA

- The Future of Equity ETFs: “Scalable, Sustainable – Super Cheap?”

- Discussion with Catharine Dwyer, Senior Policy Advisor, Central Bank of Ireland

- Trends in ESG Investing

- How are Investors Using Thematic ETFs

- Trends in Crypto – Digital Indices and Products

- How Institutions and Financial Advisors are Selecting and Using ETFs

- Industry Leaders Outlook

- Fireside Chat with Martin Moloney, Secretary General, IOSCO

- Regulatory Issues Impacting ETF Trading and Market Structure

- Fireside Chat: How a Consolidated Tape Could Contribute to the Development of ETFs in the EU

- Hot Regulatory Topics Impacting ETFs in the US and Europe

- Hot Topics Impacting Index Providers

- Regulatory Trends Impacting ESG, Active ETFs and Crypto in US and Europe

- Overview of the ETF Landscape in the United Arab Emirates

- Overview of the ETF Landscape in Qatar

- Overview of the ETF Landscape in Saudi Arabia

- Overview of the ETF Landscape in South Africa

- Overview of the ETF Landscape in Africa

- Overview of the ETF Landscape in Israel

- Women in ETFs – Managing Career Transitions

- Trends in Fixed Income Indices and ETFs

![]()

![]()

? All sessions are recorded and you will also receive access to last year's session recording

? CPD educational credits

? Free registration for buy side institutional investors and financial advisors

If you can't attend on the day, register anyway and you'll receive recordings of all the sessions.

Upcoming 2022 ETFGI Global ETFs Insights Summits:

- 3rd Annual Europe & MEA (Hybrid), Sept 14 in person at the London Stock Exchange and Sept 15 & 16 virtual Register Here

- 3rd Annual Asia Pacific (Virtual), October 12 - 13 Register Here

- 3rd Annual USA (Hybrid), November 15 in person at the Manhattan Manor, New York and November 16 virtual Register Here

- 4th Annual Canada (Hybrid), November 30 in person in BLG’s Toronto office & December 1 virtual Register Here

If you interested in speaking, sponsoring or have any questions please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com.

Prior 2022 ETFGI Global ETFs Insights Summits Recordings:

- 3rd Annual LATAM, April 27 - 28 Watch Here

- 2nd Annual ESG & Active, March 23 - 24 Watch Here

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you interested in speaking, sponsoring or have any questions about any of our upcoming events.

ETF TV #121 Alexander Morris, President, and Chief Investment Officer at F/m Investments discusses the world’s first single-bond US Treasury ETFs with Margareta Hricova and Deborah Fuhr on ETF TV. PressPlay bit.ly/3zZR5pn

ETF TV #121 Alexander Morris, President, and Chief Investment Officer at F/m Investments discusses the world’s first single-bond US Treasury ETFs with Margareta Hricova and Deborah Fuhr on ETF TV. PressPlay bit.ly/3zZR5pn

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.