ETFGI reports the Bank of Japan reported owning 64 percent of the assets in the ETFs industry in Japan at the end of August 2022

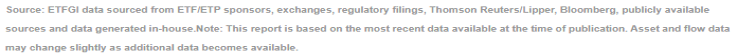

LONDON — September 30, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today the ETFs industry in Japan suffered net outflows of US$2.00 billion U in August, bringing year-to-date net inflows to US$1.38 billion. Assets invested in the Japanese ETFs/ETPs industry have decreased by 3.6%, from US$459 billion at the end of July to US$443 billion during August, according to ETFGI's August 2022 Japanese ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $443 Bn invested in ETFs and ETPs listed in Japan at the end of August 2022.

- Assets decreased 18.1% YTD in 2022, going from $541 Bn at end of 2021 to $443 Bn.

- ETFs industry in Japan suffered net outflows of $2.00 Bn in August 2022.

- YTD net inflows of $1.38 Bn gathered in 2022.

- $3.77 Bn in net inflows gathered in the past 12 months.

- Equity ETFs and ETPs listed in Japan saw $2.43 Bn in net outflows in August 2022.

“The S&P 500 decreased by 4.08% in August and was down by 16.14% in 2022. Developed markets excluding the US decreased by 4.39% in August and were down 19.53% in 2022. Sweden (down 10.80%) and Netherlands (down 9.52%) saw the largest decreases amongst the developed markets in August. Emerging markets increased by 1.46% during August but were down 15.23% in 2022. Turkey (up 19.47%) and Pakistan (up 15.39%) saw the largest increases amongst emerging markets in August, while Poland (down 10.78%) and Czech Republic (down 8.75%) saw the largest decreases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

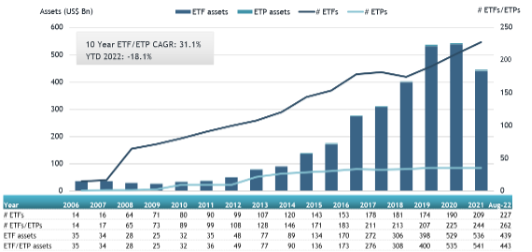

Japanese ETF and ETP asset growth as at the end of August 2022

At the end of August 2022, the ETFs industry in Japan had 262 products, with 295 listings, assets of $443 Bn, from 18 providers listed on 3 exchanges.

Equity ETFs saw net outflows of $2.43 Bn duirng August, bringing net inflows for the year through August 2022 to

$2.20 Bn, much lower than the $20.22 Bn in net inflows equity products had attracted YTD in 2021. Fixed income ETFs reported net inflows of $378 Mn during August, bringing YTD net inflows to $649 Mn, lower than the $757 Mn in net inflows fixed income products had attracted by the end of August 2021. Commodities ETFs reported net outflows of $8 Mn during August, bringing YTD net outflows to $540 Mn, less than the $780 Mn in net outflows commodities products had reported YTD in 2021.

At the end of August 2022, the Bank of Japan reported holding ETFs worth $284 Bn or 64% of the assets invested in the ETF industry in Japan. During August 2022, the Bank of Japan did not purchase any ETFs assets.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $1.71 Bn during August. One ETF TOPIX - Acc (1473 JP) gathered $444 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets August 2022: Japan

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

One ETF TOPIX - Acc |

1473 JP |

3,165.15 |

236.03 |

443.89 |

|

NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund - Acc |

1357 JP |

1,740.77 |

580.31 |

360.20 |

|

iShares Germany Government Bond JPY Hedged ETF - JPY Hdg |

2857 JP |

179.87 |

193.02 |

192.14 |

|

MAXIS NIKKEI225 ETF |

1346 JP |

12,808.70 |

(696.89) |

110.56 |

|

MAXIS TOPIX ETF |

1348 JP |

17,974.77 |

771.40 |

108.61 |

|

Simplex - Nikkei Average Bear Double Exchange Trade Fund - Acc |

1360 JP |

408.96 |

134.26 |

58.54 |

|

NEXT FUNDS Bloomberg US Treasury Bond (7-10 year) Index (Yen-Hedged) Exchange Traded Fund |

2648 JP |

87.77 |

86.38 |

55.63 |

|

Kokusai S&P500 VIX Short-Term Futures Index ETF - Acc |

1552 JP |

285.22 |

76.37 |

55.39 |

|

NEXT FUNDS International Bond FTSE WGBI ex Japan Yen-Hedged Exchange Traded Fund |

2512 JP |

720.88 |

354.64 |

53.74 |

|

Listed Index Fund US Bond (No Currency Hedge) - Acc |

1486 JP |

167.93 |

0.35 |

46.09 |

|

NEXT FUNDS Nikkei 225 Inverse Index ETF |

1571 JP |

351.55 |

171.95 |

44.31 |

|

Rakuten ETF-Nikkei 225 Double Inverse Index - Acc |

1459 JP |

329.23 |

158.34 |

31.52 |

|

Listed Index Fund US Bond (Currency Hedge) - JPY Hdg - Acc |

1487 JP |

336.51 |

48.34 |

27.70 |

|

NEXT FUNDS Japan Bond NOMURA-BPI Exchange Traded Fund |

2510 JP |

425.38 |

115.87 |

25.80 |

|

iFreeETF NASDAQ100 Inverse |

2842 JP |

93.72 |

98.18 |

25.66 |

|

iShares Core 7-10 Year US Treasury Bond ETF - Acc |

1656 JP |

223.71 |

81.70 |

21.11 |

|

iShares USD Investment Grade Corporate Bond JPY Hedged ETF - Acc |

1496 JP |

195.69 |

34.68 |

15.16 |

|

NEXT FUNDS International Bond FTSE WGBI ex Japan Unhedged Exchange Traded Fund |

2511 JP |

214.41 |

65.48 |

12.50 |

|

iShares USD High Yield Corporate Bond JPY Hedged ETF - Acc |

1497 JP |

90.48 |

22.08 |

10.28 |

|

Daiwa ETF Tokyo Stock Exchange REIT Index - Acc |

1488 JP |

1,396.29 |

65.94 |

7.76 |

Investors have tended to invest in Equity ETFs/ETPs during August.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research

###

|

|