ETFGI reports ETFs industry in Asia Pacific (ex-Japan) has gathered record year-to-date net inflows of US$83.05 billion at the end of August 2022

LONDON —September 30, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that the ETFs industry in Asia Pacific (ex-Japan) gathered net inflows of US$9.53 billion US dollars during August, bringing year-to-date net inflows to US$83.05 billion. During the month, assets invested in the ETFs industry in Asia Pacific (ex-Japan) decreased by 0.2%, from US$552 billion at the end of July to US$550 billion, according to ETFGI's August 2022 Asia Pacific (ex-Japan) ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in Asia Pacific (ex-Japan) gathered net inflows of $9.53 Bn during August.

- YTD net inflows of $83.05 Bn are the highest on record, beating YTD net inflows of $47.94 Bn in 2021.

- 14th month of consecutive net inflows.

- Assets of $550 Bn invested in ETFs/ETPS listed in the Asia Pacific (ex-Japan) region at the end of August 2022.

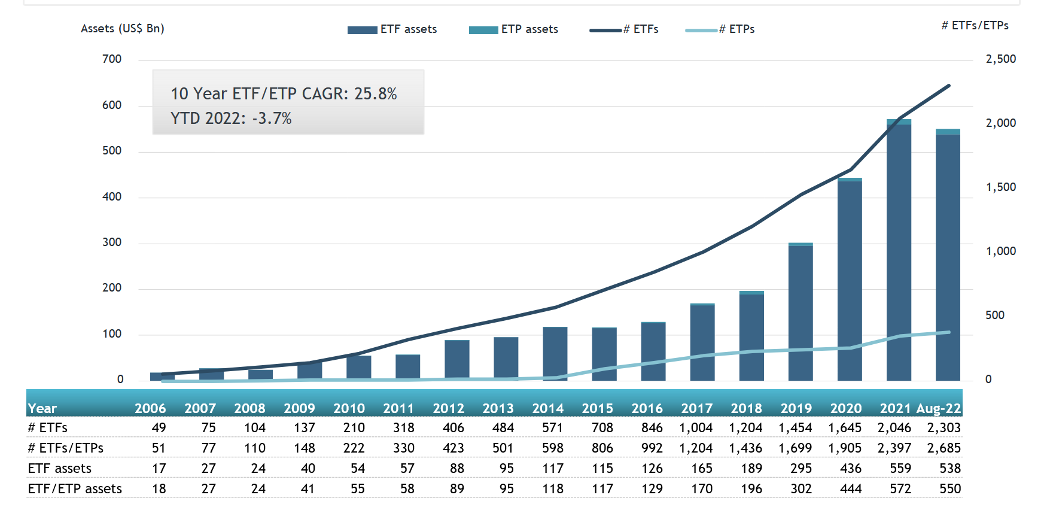

- Assets decreased by 3.7% YTD in 2022, going from $572 Bn at end of 2021 to $550 Bn.

“The S&P 500 increased by 9.22% in July but is down 12.58% YTD 2022. Developed markets excluding the US increased by 5.32% in July but are down 15.84% YTD 2022. Sweden (up 12.13%) and Netherlands (up 9.64%) saw the largest increases amongst the developed markets in July. Emerging markets decreased by 0.40% during July and are down 16.46% YTD in 2022. Pakistan (down 16.59%) and China (down 8.77%) saw the largest decreases amongst emerging markets in July, while Chile (up 12.24%) and India (up 9.14%) saw the largest increases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Asia Pacific (ex-Japan) ETF and ETP asset growth as at the end of August 2022

At the end of August 2022, the ETFs industry in Asia Pacific (ex-Japan) had 2,685 products with 2,844 listings, from 233 providers listed on 20 exchanges in 15 countries.

During August, ETFs/ETPs gathered net inflows of $9.53 Bn. Equity ETFs/ETPs gathered net inflows of $7.26 Bn during August, bringing YTD net inflows to $70.09 Bn, much higher than the $29.27 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs/ETPs reported net inflows of $1.02 Bn during August, bringing YTD net inflows to $7.53 Bn, higher than the $2.79 Bn in net inflows fixed income products had attracted by the end of August 2021. Commodities ETFs/ETPs reported net outflows of $468 Mn during August, bringing YTD net outflows to $1.50 Bn, more than the $525 Mn in net outflows commodities products had reported year to date in 2021. Active ETFs/ETPs attracted net inflows of $1.99 Bn during the month, gathering YTD net inflows of $5.31 Bn, lower than the $14.43 Bn in net inflows active products had reported YTD in 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $10.25 Bn during August. Hwabao WP Cash Tianyi Listed Money Market Fund (511990 CH) gathered $1.16 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets in August 2022: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

23,220.74 |

2,097.91 |

1,163.95 |

|

E Fund CSI 1000 ETF |

159633 CH |

1,106.45 |

1,157.86 |

1,157.86 |

|

GF CSI 1000 ETF |

560010 CH |

1,079.57 |

1,127.12 |

1,127.12 |

|

Fullgoal CSI 1000 ETF |

159629 CH |

797.16 |

832.19 |

832.19 |

|

Tracker Fund of Hong Kong (TraHK) |

2800 HK |

14,898.36 |

3,837.39 |

691.40 |

|

ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

4,299.63 |

2,387.31 |

604.13 |

|

Cathay Taiwan Select ESG Sustainability High Yield ETF |

00878 TT |

3,394.65 |

2,593.27 |

493.76 |

|

China AMC China 50 ETF |

510050 CH |

7,353.81 |

(1,480.20) |

462.08 |

|

Samsung KODEX 200 ETF |

069500 KS |

4,254.35 |

524.96 |

428.41 |

|

Huatai-Pinebridge CSI 300 ETF |

510300 CH |

6,529.76 |

(426.31) |

423.96 |

|

Harvest CSI High-End Equipment Sub-industry 50 ETF |

159638 CH |

339.11 |

380.85 |

380.85 |

|

China Merchants Caifubao Traded Money Market Fund - Acc |

511850 CH |

1,740.83 |

831.82 |

374.25 |

|

Yuanta US Treasury 20+ Year Bond ETF |

00679B TT |

1,130.53 |

784.23 |

324.73 |

|

China Universal CSI 1000 ETF |

560110 CH |

265.39 |

276.77 |

276.77 |

|

GTJA Allianz CSI All-share Semi-conductor Product and Equipment ETF - Acc |

512480 CH |

1,937.38 |

1,035.43 |

275.59 |

|

iShares Hang Seng TECH ETF |

3067 HK |

3,072.96 |

1,234.68 |

265.77 |

|

Yuanta/P-shares Taiwan Dividend Plus ETF |

0056 TT |

4,778.67 |

1,699.29 |

257.83 |

|

GTJA Allianz CSI 300 ETF |

515660 CH |

321.90 |

258.07 |

244.17 |

|

Hwabao CSI Medical ETF |

512170 CH |

2,293.44 |

837.01 |

235.32 |

|

Samsung KODEX KOFR Active ETF (Synth) |

423160 KS |

1,327.34 |

1,378.16 |

225.04 |

The top ETPs by net new assets collectively gathered $185 Mn during August. Samsung Securities Samsung Inverse 2X Natural Gas Futures ETN C 102 (530102 KS) gathered $60 Mn, the largest individual net inflow.

Top ETPs by net inflows in August 2022: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Samsung Securities Samsung Inverse 2X Natural Gas Futures ETN C 102 |

530102 KS |

87.44 |

110.94 |

60.31 |

|

Kiwoom Securities Kiwoom KOSPI200 ETN 2 |

760002 KS |

36.96 |

37.28 |

37.28 |

|

ETFS Physical Gold (AUS) - Acc - Acc |

GOLD AU |

1,756.18 |

134.63 |

29.71 |

|

Kiwoom Securities Kiwoom KOSDAQ 150 ETN 3 |

760003 KS |

14.97 |

15.07 |

15.07 |

|

Shinhan Investment Shinhan Inverse 2X Natural Gas Futures ETN 54 |

500054 KS |

35.95 |

95.26 |

10.28 |

|

NH QV iSelect-WG GreenEnergy ESG ETN 73 |

550073 KS |

8.27 |

8.26 |

8.26 |

|

KB Securities KB Inverse 2X NASDAQ100 ETN |

580014 KS |

13.14 |

6.67 |

6.67 |

|

Shinhan Investment Shinhan Inverse 2X Natural Gas Futures ETN H 32 - KRW Hdg - Acc |

500032 KS |

19.00 |

49.71 |

6.13 |

|

KB Securities KB Inverse Natural Gas Futures ETN 21 |

580021 KS |

13.56 |

9.83 |

5.96 |

|

Daishin Securities Daishin Inverse Natural Gas Futures ETN H 19 |

510019 KS |

14.31 |

16.83 |

5.35 |

Investors have tended to invest in Equity ETFs/ETPs during August.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

|

|