ETFGI reports actively managed ETFs listed globally gathered US$8.80 billion in net inflows in September 2022

LONDON — October 25, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that actively managed ETFs listed globally gathered net inflows of

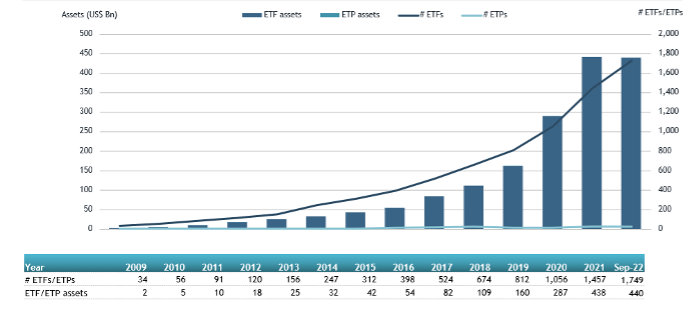

US$8.80 billion during September, bringing year-to-date net inflows to US$88.82 billion. Assets invested in actively managed ETFs decreased by 5.5%, from US$465 billion at the end of August 2022 to US$440 billion, according to ETFGI's September 2022 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Net inflows of $8.80 Bn during September 2022.

- Year-to-date net inflows of $88.82 Bn in 2022 are the second highest on record, after year-to-date net inflows in 2021 of $110.65 Bn.

- 30th month of consecutive net inflows.

- Assets of $440 Bn invested in actively managed ETFs and ETPs industry at the end of September 2022.

- Assets decreased 0.5% year-to-date in 2022, going from $442 Bn at the end of 2021 to $440 Bn.

“The S&P 500 decreased by 9.21% in September and is down by 23.87% YTD 2022. Developed markets excluding the US decreased by 10.07% in September and are down 27.63% YTD in 2022. Norway (down 18.96%) and Korea (down 18.78 %) saw the largest decreases amongst the developed markets in September. Emerging markets decreased by 10.23 % during September and were down 23.91% in 2022. Philippines (down 16.31%) and Hungary (down 16.07%) saw the largest decreases amongst emerging markets in September.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

There were 1,749 actively managed ETFs listed globally with 2,231 listings, assets of US$440 Bn, from 328 providers listed on 30 exchanges in 23 countries at the end of September.

Equity focused actively managed ETFs/ETPs listed globally gathered net inflows of $6.40 Bn during September, bringing year to date net inflows to $58.70 Bn, higher than the $53.27 Bn in net inflows equity products had attracted at this point in 2021. Fixed Income focused actively managed ETFs/ETPs listed globally attracted net inflows of $2.84 Bn during September, bringing net inflows for the year through September 2022 to $18.61 Bn, lower than the $45.79 Bn in net inflows fixed income products had reported in Year-to-date 2021.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered

$7.65 Bn during September. JPMorgan Equity Premium Income ETF (JEPI US) gathered $1.06 Bn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets September 2022

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

12,592.89 |

8,851.76 |

1,058.42 |

|

Samsung KODEX KOFR Active ETF (Synth) |

423160 KS |

2,237.42 |

2,216.50 |

838.34 |

|

First Trust Enhanced Short Maturity Fund |

FTSM US |

6,337.71 |

2,123.80 |

600.03 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

22,137.76 |

3,811.75 |

561.36 |

|

ARK Innovation ETF |

ARKK US |

7,610.68 |

1,561.78 |

452.39 |

|

PGIM Ultra Short Bond ETF |

PULS US |

2,784.84 |

821.04 |

376.54 |

|

CI High Interest Savings ETF |

CSAV CN |

2,624.36 |

1,187.33 |

344.59 |

|

High Interest Savings Account Fund |

HISA CN |

652.64 |

488.08 |

342.24 |

|

iMGP DBi Managed Futures Strategy ETF |

DBMF US |

920.35 |

800.00 |

326.56 |

|

Innovator U.S. Equity Power Buffer ETF - September |

PSEP US |

503.20 |

268.05 |

291.75 |

|

Purpose High Interest Savings ETF |

PSA CN |

1,977.45 |

702.03 |

280.35 |

|

Dimensional US Core Equity 2 ETF |

DFAC US |

13,740.07 |

2,390.31 |

277.49 |

|

Lyxor Smart Overnight Return - UCITS ETF - C-EUR - Acc |

CSH2 FP |

1,649.28 |

336.86 |

276.00 |

|

Dimensional International Core Equity 2 ETF |

DFIC US |

1,027.79 |

1,179.04 |

262.93 |

|

JPMorgan Nasdaq Equity Premium Income ETF |

JEPQ US |

539.45 |

595.49 |

247.02 |

|

BlackRock Ultra Short-Term Bond ETF |

ICSH US |

7,021.07 |

982.62 |

242.46 |

|

Samsung KODEX Active Korea FRN Bank 1Y AAA ETF |

273140 KS |

326.85 |

231.08 |

231.32 |

|

JPMorgan EUR Ultra-Short Income UCITS ETF |

JSET LN |

1,335.47 |

251.37 |

214.63 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

947.59 |

201.72 |

211.78 |

|

AXA IM ACT Biodiversity Equity UCITS ETF - Acc |

ABIT GY |

201.42 |

209.23 |

209.23 |

Investors have tended to invest in Equity actively managed ETFs/ETPs during September.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

|

|

|

|

|