ETFGI reports the ETFs industry in Canada gathered US$1.56 billion in net inflows in September 2022

LONDON — October 27, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs industry in Canada gathered net inflows of US$1.56 billion during September, bringing year-to-date net inflows to US$19.64 billion. During the month, Canadian ETF assets decreased by 8.5%, from US$247 billion at the end of August to US$226 billion, according to ETFGI's September 2022 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in Canada gathered $1.56 Bn in net inflows in September.

- Net inflows of $19.64 Bn YTD in 2022 are 3rd on record, after YTD net inflows of $34.74 Bn in 2021 and YTD net inflows of $24.64 Bn in 2020.

- 3rd month of net inflows.

- Assets of $226 Bn invested in ETFs listed in Canada at the end of September 2022.

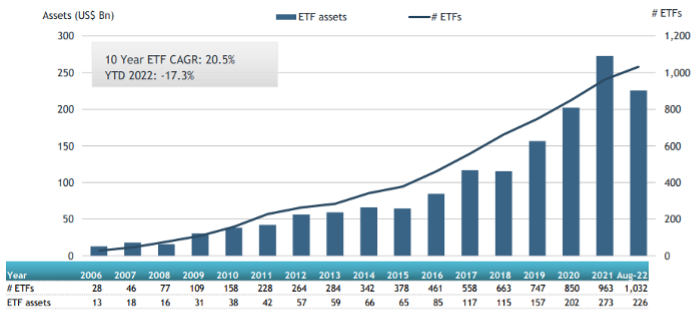

- Assets have decreased 17.3 % YTD in 2022, going from $273 Bn at the end of 2021, to $226 Bn.

“The S&P 500 decreased by 9.21% in September and was down by 23.87% YTD 2022. Developed markets excluding the US decreased by 10.07% in September and are down 27.63% YTD in 2022. Norway (down 18.96%) and Korea (down 18.78 %) saw the largest decreases amongst the developed markets in September. Emerging markets decreased by 10.23 % during September and were down 23.91% in 2022. Philippines (down 16.31%) and Hungary (down 16.07%) saw the largest decreases amongst emerging markets in September.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in Canadian ETF assets as of the end of September 2022

The ETFs industry in Canada had 1,032 products, with 1,307 listings, assets of $226 Bn, from 42 providers listed on 2 exchanges at the end of September.

During September, ETFs industry gathered net inflows of $1.56 Bn. Equity ETFs reported net outflows of $316 Mn during September, bringing YTD net inflows to $6.48 Bn, lower than the $14.93 Bn in net inflows equity products had attracted YTD in 2021. Fixed income ETFs suffered net outflows of $37 Mn during September, bringing YTD net inflows to $2.39 Bn, lower than the $4.87 Bn in net inflows fixed income products had attracted YTD in 2021. Active ETFs attracted net inflows of $1.97 Mn during the month, gathering YTD net inflows of $10.32 Bn, slightly lower than the $10.47 Bn in net inflows active products reported YTD in 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $2.87 Bn during September. CI High Interest Savings ETF (CSAV CN) gathered $345 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets September 2022: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

CSAV CN |

2,624.36 |

1,187.33 |

344.59 |

|

|

High Interest Savings Account Fund |

HISA CN |

652.64 |

488.08 |

342.24 |

|

Purpose High Interest Savings ETF |

PSA CN |

1,977.45 |

702.03 |

280.35 |

|

BMO Long Federal Bond Index ETF |

ZFL CN |

1,417.18 |

6.59 |

263.70 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

947.59 |

201.72 |

211.78 |

|

Horizons High Interest Savings ETF |

CASH CN |

430.98 |

445.41 |

192.44 |

|

iShares Core S&P 500 Index ETF (CAD-Hedged) |

XSP CN |

4,989.98 |

488.85 |

154.82 |

|

BMO Ultra Short-Term US Bond ETF |

ZUS/U CN |

342.64 |

211.08 |

129.80 |

|

Horizons USD Cash Maximizer ETF - Acc |

HSUV/U CN |

666.01 |

410.61 |

121.16 |

|

iShares Core Canadian Short Term Bond Index ETF |

XSB CN |

2,310.73 |

(119.51) |

114.82 |

|

BMO S&P 500 Index ETF |

ZSP CN |

8,242.84 |

20.92 |

105.78 |

|

iShares Core S&P US Total Market Index ETF |

XUU CN |

1,525.87 |

172.28 |

77.65 |

|

iShares S&P/TSX Capped Energy Index ETF |

XEG CN |

1,397.11 |

220.32 |

76.77 |

|

Vanguard S&P 500 Index ETF |

VFV CN |

4,692.19 |

981.04 |

75.19 |

|

BMO Aggregate Bond Index ETF |

ZAG CN |

4,301.18 |

380.69 |

69.18 |

|

Invesco 1-3 Year Laddered Floating Rate Note Index ETF |

PFL CN |

133.62 |

112.61 |

67.13 |

|

iShares Premium Money Market Fund |

CMR CN |

225.99 |

98.19 |

65.09 |

|

Vanguard Canadian Aggregate Bond Index ETF |

VAB CN |

2,405.48 |

170.53 |

62.34 |

|

Vanguard S&P 500 Index ETF (CAD-hedged) |

VSP CN |

1,373.11 |

289.87 |

61.44 |

|

BMO S&P 500 Hedged To CAD Index ETF |

ZUE CN |

1,013.96 |

73.97 |

55.58 |

Investors have tended to invest in Active ETFs during September.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

###

Additional Speakers announced for the 4th Annual ETFGI Global ETFs Insights Summit, Canada, in person in Toronto on Nov 30th & Dec 1st virtual. Register Now

Nov 30th - day 1 - In person at Borden Ladner Gervais LLPs Toronto office Bay Adelaide Centre, East Tower, 22 Adelaide St W Suite 3400, Toronto, ON M5H 4E3 from 9:30am – 6:30pm ET including a drinks reception from 5pm – 6:30pm. Educational credits and free for IFAs and institutional investors – spaces are allocated on a first come basis as spaces are limited. All sessions will be recorded. Attendees will receive access to virtual event content on day 2.

Dec 1st - day 2 - virtual panel discussions on our virtual event platform.

If you can't attend on the day, register anyway and you'll receive recordings of all the sessions.

This event will bring together leaders from across the ETF industry, including ETF sponsors, exchanges, broker-dealers, institutional investors, regulators, and other market participants.

The summit is designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, product trends: active, bitcoin, crypto, ESG, Thematic and trading developments that are impacting investors.

? Free registration for buy side institutional investors and financial advisors

? CPD educational credits

? Session recordings - If you cannot attend on the day, register anyway and you will receive the links to the session recordings. You will also receive access to last year's session recordings.

![]()

![]()

2022 ETFGI GLOBAL ETFs INSIGHTS SUMMITS:

- 3rd Annual USA, November 15 in person at the Manhattan Manor, New York and November 16 virtual Register Here

- 4th Annual Canada, November 30 in person in BLG’s Toronto office & December 1 virtual Register Here

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you interested in speaking, sponsoring or have any questions about any of our upcoming events.

ETF TV episode #125 David Botset, Head of Equity Product Management and Innovation at Schwab Asset Management discusses highlights from their new report “ETFs and Beyond” with Margareta Hricova and Deborah Fuhr on ETF TV. #Press Play https://bit.ly/3rzXWSF

ETF TV episode #125 David Botset, Head of Equity Product Management and Innovation at Schwab Asset Management discusses highlights from their new report “ETFs and Beyond” with Margareta Hricova and Deborah Fuhr on ETF TV. #Press Play https://bit.ly/3rzXWSF

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()