ETFGI reports the ETFs industry in Europe suffered net outflows of US$5.06 billion in September 2022

LONDON —October 31, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that reports the ETFs industry in Europe suffered net outflows of US$5.06 billion in September, bringing year-to-date net inflows to US$61.52 billion. During the month, assets invested in the ETFs industry in Europe decreased by 8.4%, from US$1.37 trillion at the end of August to US$1.26 trillion, according to ETFGI's September 2022 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs industry in Europe suffered net outflows of $5.06 Bn in September 2022.

- YTD net inflows of $61.52.

- 1st month of net outflows.

- Assets of $1.26 Tn invested in ETFs and ETPs listed in Europe at the end of September 2022.

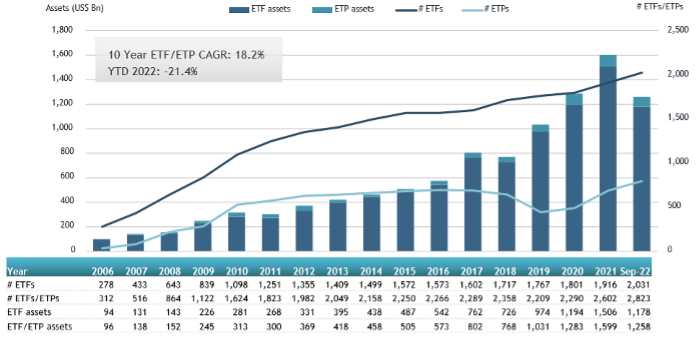

- Assets decreased 21.4% YTD in 2022, going from $1.60 Tn at end of 2021 to $1.26 Tn.

“The S&P 500 decreased by 9.21% in September and was down by 23.87% YTD 2022. Developed markets excluding the US decreased by 10.07% in September and are down 27.63% YTD in 2022. Norway (down 18.96%) and Korea (down 18.78 %) saw the largest decreases amongst the developed markets in September. Emerging markets decreased by 10.23 % during September and were down 23.91% in 2022. Philippines (down 16.31%) and Hungary (down 16.07%) saw the largest decreases amongst emerging markets in September.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Europe ETFs and ETPs asset growth as at the end of September 2022

ETFs industry in Europe had 2,823 products, with 11,562 listings, assets of $1.26 Tn, from 94 providers listed on 28 exchanges in 24 countries at the end of Spetember.

During September, ETFs/ETPs gathered net outflows to US$5.06 billion. Equity ETFs/ETPs gathered net outflows of $1.25 Bn during September, bringing YTD net inflows to $43.09 Bn, lower than the $110.03 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs/ETPs suffered net outflows of $2.72 Bn during September, bringing net inflows for the year through September 2022 to $18.17 Bn, lower than the $33.44 Bn in net inflows fixed income products had attracted by the end of September 2021. Commodities ETFs/ETPs reported net outflows of $2.00 Bn during September, bringing YTD net outflows to $2.52 Bn, lower than the $2.32 Bn in net inflows commodities products had reported year to date in 2021. Active ETFs/ETPs attracted net inflows of $806 Mn over the month, gathering net inflows for the year in Europe of $1.68 Bn, lower than the $5.08 Bn in net inflows active products had reported YTD in 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $10.92 Bn during September. iShares MSCI USA ESG Enhanced UCITS ETF (EEDS LN) gathered $4.71 Bn, the largest individual net inflow.

Top 20 ETFs by net inflows in September 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

EEDS LN |

9,780.95 |

6,503.63 |

4,711.66 |

|

|

Vanguard FTSE All-World UCITS ETF |

VWRD LN |

12,600.75 |

2,885.52 |

515.35 |

|

HSBC MSCI Emerging Markets UCITS ETF |

HMEM LN |

1,418.31 |

548.80 |

511.28 |

|

Xtrackers II iBoxx Eurozone Government Bond Yield Plus 1-3 UCITS ETF - 1C - Acc |

XYP1 GY |

860.38 |

347.82 |

509.73 |

|

HSBC FTSE EPRA/NAREIT Developed UCITS ETF |

HPRO LN |

602.35 |

495.60 |

494.66 |

|

L&G Multi-Strategy Enhanced Commodities UCITS ETF - Acc |

ENCO LN |

1,305.96 |

592.09 |

485.56 |

|

Deka MSCI Europe Climate Change ESG UCITS ETF |

D6RR GY |

566.57 |

496.78 |

367.80 |

|

iShares $ Treasury Bond 7-10yr UCITS ETF USD (Acc) - Acc |

CSBGU0 SW |

1,942.51 |

1284.42 |

316.24 |

|

iShares Core EURO STOXX 50 UCITS ETF (DE) |

SX5EEX GY |

4,266.67 |

(303.56) |

298.56 |

|

Lyxor Smart Overnight Return - UCITS ETF - C-EUR - Acc |

CSH2 FP |

1,649.28 |

336.86 |

276.00 |

|

iShares $ TIPS 0-5 UCITS ETF |

TP05 LN |

1,470.17 |

560.40 |

260.07 |

|

BNP Paribas Easy MSCI USA SRI S-Series PAB 5% Capped - Acc |

EKLD FP |

1,542.66 |

879.83 |

259.00 |

|

Lyxor UCITS ETF EURO STOXX 50 - D-EUR |

MSE FP |

2,390.38 |

-641.97 |

257.88 |

|

BNP Paribas Easy JPM ESG EMU Government Bond IG 3-5Y UCITS ETF - Acc |

ASRE GY |

925.71 |

950.78 |

255.29 |

|

iShares MSCI Europe ESG Screened UCITS ETF - Acc - Acc |

SAEU LN |

1,706.49 |

454.87 |

246.65 |

|

iShares S&P 500 Equal Weight UCITS ETF - Acc |

EWSP LN |

378.25 |

412.05 |

243.61 |

|

iShares $ Treasury Bond 7-10yr UCITS ETF |

IBTM LN |

5,877.85 |

2,428.34 |

235.76 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

5,506.35 |

807.39 |

230.80 |

|

Xtrackers MSCI USA Swap UCITS ETF - Acc |

XMUS GY |

3,675.37 |

(85.16) |

228.14 |

|

JPMorgan EUR Ultra-Short Income UCITS ETF |

JSET LN |

1,335.47 |

251.37 |

214.63 |

The top 10 ETPs by net new assets collectively gathered $495 Mn during September. WisdomTree Physical Gold - EUR Daily Hedged – Acc (GBSE GY) gathered $308.26 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in September 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

WisdomTree Physical Gold - EUR Daily Hedged - Acc |

GBSE GY |

295.87 |

308.26 |

308.26 |

|

WisdomTree Brent Crude Oil - Acc |

BRNT LN |

206.66 |

(121.99) |

46.48 |

|

WisdomTree NASDAQ 100 3x Daily Leveraged - Acc |

QQQ3 LN |

103.20 |

107.97 |

22.26 |

|

WisdomTree Agriculture - Acc |

AIGA LN |

336.17 |

112.78 |

21.44 |

|

WisdomTree WTI Crude Oil 3x Daily Leveraged - Acc |

3OIL LN |

27.28 |

8.58 |

20.59 |

|

Royal Mint Responsibly Source Physical Gold ETC - Acc |

RMAU LN |

605.69 |

393.64 |

19.88 |

|

WisdomTree WTI Crude Oil 2x Daily Leveraged - Acc |

LOIL LN |

102.87 |

(192.33) |

19.81 |

|

WisdomTree WTI Crude Oil - Acc |

CRUD LN |

653.01 |

(1,404.88) |

15.96 |

|

WisdomTree Carbon - Acc |

CARB LN |

247.20 |

138.83 |

11.11 |

|

WisdomTree Natural Gas 3x Daily Leveraged - Acc |

3NGL LN |

19.29 |

(49.58) |

9.38 |

Investors have tended to invest in Active ETFs and ETPs during September.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

|

|

|

|

|