ETFGI reports ETFs industry in the United States gathered US$25.85 billion in net inflows in September 2022

LONDON — October 25, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs industry in the United States gathered US$25.85 billion in net inflows during September, bringing year-to-date net inflows to US$412.06 billion. During the month, assets invested in ETFs industry in the US decreased by 8.1%, from US$6.43 trillion at the end of July to US$5.91 trillion in September 2022, according to ETFGI's September 2022 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in the United States gathered $25.85 Bn in net inflows in September.

- YTD net inflows of $412.06 Bn in 2022 are 2nd highest on record, after YTD net inflows of

$650.03 Bn in 2021.

- 5th month of consecutive net inflows.

- Equity ETFs and ETPs listed in the US gathered YTD net inflows of $201.42 Bn, the third highest on record, after YTD net inflows of $439.91 Bn in 2021 and YTD net inflows of $223.13 Bn in 2017.

“The S&P 500 decreased by 9.21% in September and was down by 23.87% YTD 2022. Developed markets excluding the US decreased by 10.07% in September and are down 27.63% YTD in 2022. Norway (down 18.96%) and Korea (down 18.78 %) saw the largest decreases amongst the developed markets in September. Emerging markets decreased by 10.23 % during September and were down 23.91% in 2022. Philippines (down 16.31%) and Hungary (down 16.07%) saw the largest decreases amongst emerging markets in September.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

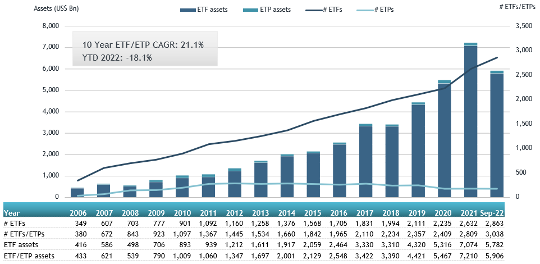

Growth in US ETF and ETP assets as of the end of September 2022

The ETFs industry in the United States had 3,038 products, assets of US$5.906 Tn, from 259 providers listed on 3 exchanges at the end of September.

During September, ETFs/ETPs gathered net inflows of $25.85 Bn. Equity ETFs/ETPs gathered net inflows of $11.44 Bn during September, bringing YTD net inflows to $201.42 Bn, lower than the $439.91 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs/ETPs had net inflows of $11.85 Bn during September, bringing net inflows YTD to $119.16 Bn, lower than the $128.41 Bn in net inflows fixed income products had attracted YTD in 2021. Commodities ETFs/ETPs reported net outflows of $3.57 Bn during September, bringing YTD net outflows to $2.28 Bn, less than the $10.37 Bn in net outflows commodities products had reported year to date in 2021. Active ETFs/ETPs attracted net inflows of $5.69 Bn during the month, gathering YTD net inflows of $69.20 Bn, lower than the $81.32 Bn in net inflows active products had reported by the end of September 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $42.58 Bn during September. SPDR S&P 500 ETF Trust (SPY US) gathered $6.33 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets September 2022: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

SPY US |

330,238.74 |

(23,235.08) |

6,327.99 |

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF |

BIL US |

24,599.98 |

10,987.18 |

5,886.80 |

|

Vanguard S&P 500 ETF |

VOO US |

241,660.23 |

36,508.88 |

3,435.58 |

|

iShares 1-3 Year Treasury Bond ETF |

SHY US |

28,483.31 |

9,095.61 |

3,429.44 |

|

iShares Short Treasury Bond ETF |

SHV US |

23,369.18 |

10,268.83 |

2,614.19 |

|

Vanguard Total Stock Market ETF |

VTI US |

236,563.99 |

19,216.96 |

2,521.83 |

|

ProShares UltraPro QQQ |

TQQQ US |

10,284.10 |

10,186.08 |

2,226.25 |

|

iShares MSCI USA Min Vol Factor ETF |

USMV US |

27,287.23 |

2,558.73 |

1,694.31 |

|

WisdomTree Floating Rate Treasury Fund |

USFR US |

9,736.25 |

7,899.22 |

1,684.47 |

|

iShares MSCI EAFE Min Vol Factor ETF |

EFAV US |

6,635.96 |

503.79 |

1,616.13 |

|

iShares 0-3 Month Treasury Bond ETF |

SGOV US |

4,792.91 |

4,048.11 |

1,532.14 |

|

Schwab US Dividend Equity ETF |

SCHD US |

35,210.17 |

10,967.28 |

1,271.10 |

|

iShares Treasury Floating Rate Bond ETF |

TFLO US |

3,420.84 |

3,072.57 |

1,194.40 |

|

Vanguard Russell 1000 Growth |

VONG US |

7,672.21 |

2,154.01 |

1,124.81 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

12,592.89 |

8,851.76 |

1,058.42 |

|

iShares Core S&P 500 ETF |

IVV US |

265,168.83 |

16,763.97 |

1,056.78 |

|

iShares Expanded Tech-Software Sector ETF |

IGV US |

4,616.83 |

840.37 |

1,015.92 |

|

Direxion Daily Semiconductors Bull 3x Shares |

SOXL US |

3,213.84 |

6,212.55 |

973.50 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

24,188.69 |

12,135.73 |

963.41 |

|

Invesco QQQ Trust |

QQQ US |

147,755.03 |

2,358.01 |

955.38 |

The top 10 ETPs by net assets collectively gathered $946.75 Mn during September. iShares Silver Trust (SLV US) gathered $294.12 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets September2022: US

|

Name |

Ticker |

Assets |

NNA |

NNA Sep-22 |

|

iShares Silver Trust |

SLV US |

9140.94 |

(746.54) |

294.12 |

|

ProShares Ultra DJ-UBS Natural Gas |

BOIL US |

294.41 |

(19.92) |

174.32 |

|

ProShares Ultra DJ-UBS Crude Oil |

UCO US |

724.72 |

(856.47) |

77.65 |

|

Invesco CurrencyShares Euro Currency Trust |

FXE US |

388.68 |

215.08 |

72.85 |

|

Invesco CurrencyShares British Pound Sterling Trust |

FXB US |

160.91 |

70.61 |

71.27 |

|

MicroSectors FANG Innovation 3X Leveraged ETN |

BULZ US |

207.74 |

504.03 |

69.71 |

|

MicroSectors FANG+ Index 3X Leveraged ETNs due January 8, 2038 |

FNGU US |

530.42 |

313.64 |

63.19 |

|

United States Oil Fund LP |

USO US |

1948.93 |

(1,054.54) |

57.22 |

|

United States Natural Gas Fund LP |

UNG US |

469.46 |

(163.78) |

41.48 |

|

MicroSectors Gold Miners 3X Leveraged ETN - Acc |

GDXU US |

73.58 |

80.91 |

24.94 |

Investors have tended to invest in Equity ETFs/ETPs during September.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Additional Speakers announced for the 3rd Annual ETFGI Global ETFs Insights Summit, United States, Taking Place on November 15th in New York City & Nov 16th. Register Now

Nov 15th - day 1 - In person in New York City at Manhattan Manor, 201 West 52nd Street, New York, NY 10019 from 12:30pm – 6:00pm ET including a networking drinks reception. Educational credits and free for IFAs and institutional investors – spaces are allocated on a first come basis as spaces are limited. All sessions will be recorded. Attendees will receive access to virtual event content on day 2.

Nov 16th - day 2 - virtual panel discussions on our virtual event platform.

If you can't attend on the day, register anyway and you'll receive recordings of all the sessions.

This event will bring together leaders from across the ETF industry, including ETF sponsors, exchanges, broker-dealers, institutional investors, regulators, and other market participants.

The summit is designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, product trends: active, bitcoin, crypto, ESG, Thematic and trading developments that are impacting investors.

2022 TOPICS WILL INCLUDE:

- Trends Impacting Investors and ETFs – ETFGI Research

- Macro Outlook

- How Regulations are Impacting Market Structure and ETF Trading

- Alternative Income Ideas in a Rising Rates Environment

- Impact of Regulations on Investor Choice

- Product and Investor Trends in the United States and Europe

- Crypto: Product and User Trends

- Investor Trends

- Trading Trends and Trading Tools

- Trends in Active ETF Products + Users

- Direct Indexing – What is the Future

- Index Development Trends

- Fireside Chat: Outlook for the ETF industry

- Fireside Chat: Outlook for the ETF industry in the United States on the 30th anniversary

- Women in ETFs – Managing Career Transitions

? Free registration for buy side institutional investors and financial advisors

? CPD educational credits

? Session recordings - If you cannot attend on the day, register anyway and you will receive the links to the session recordings. You will also receive access to last year's session recordings.

![]()

![]()

2022 ETFGI GLOBAL ETFs INSIGHTS SUMMITS:

- 3rd Annual USA, November 15 in person at the Manhattan Manor, New York and November 16 virtual Register Here

- 4th Annual Canada, November 30 in person in BLG’s Toronto office & December 1 virtual Register Here

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you interested in speaking, sponsoring or have any questions about any of our upcoming events.

ETF TV episode #125 David Botset, Head of Equity Product Management and Innovation at Schwab Asset Management discusses highlights from their new report “ETFs and Beyond” with Margareta Hricova and Deborah Fuhr on ETF TV. #Press Play https://bit.ly/3rzXWSF

ETF TV episode #125 David Botset, Head of Equity Product Management and Innovation at Schwab Asset Management discusses highlights from their new report “ETFs and Beyond” with Margareta Hricova and Deborah Fuhr on ETF TV. #Press Play https://bit.ly/3rzXWSF

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()