ETFGI reports the ETFs industry in Europe gathered US$13.85 billion in net inflows in November 2022

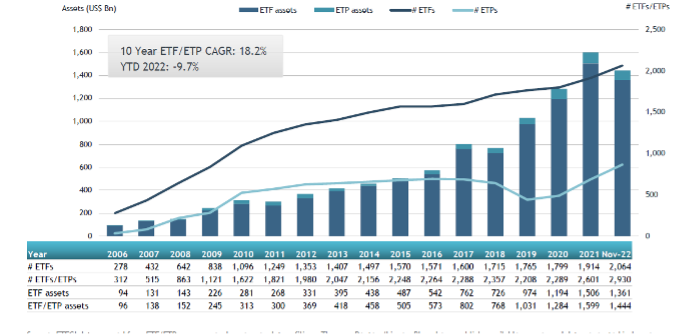

LONDON —December 20, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that the ETFs industry in Europe gathered US$13.85 billion in net inflows during November, bringing year-to-date net inflows to US$82.65 billion. During the month, assets invested in the European ETF/ETP industry increased by 9.3%, from US$1.32 trillion at the end of October to US$1.44 trillion, according to ETFGI's November 2022 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs industry in Europe gathered net inflows of $13.85 Bn in November.

- YTD net inflows of $82.65 are the fifth highest on record.

- 2nd consecutive month of net inflows.

- Assets of $1.44 Tn invested in ETFs industry in Europe at the end of November

- Assets decreased 9.7% YTD in 2022, going from $1.60 Tn at end of 2021 to $1.44 Tn.

“The S&P 500 increased by 5.59 % in November but is down 13.10% YTD in 2022. Developed markets excluding the US increased by 10.63% in November but are down 15.67% YTD in 2022. Hong Kong (up 24.17%) and Netherlands (up 17.45%) saw the largest increases amongst the developed markets in November. Emerging markets increased by 13.26% during November but are down 16.86% YTD in 2022. China (up 27.38%) and Turkey (up 24.58%) saw the largest increases amongst emerging markets in November.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Europe ETFs and ETPs asset growth as at the end of November 2022

The European ETFs industry had 2,930 products, with 11,950 listings, assets of $1.44 Tn, from 97 providers listed on 29 exchanges in 24 countries at the end of November.

During November, ETFs/ETPs gathered net inflows to US$13.85 billion. Equity ETFs/ETPs gathered net inflows of

$5.72 Bn during November, bringing YTD net inflows to $51.84 Bn, lower than the $130.56 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs/ETPs had net inflows of $8.21 Bn during November, bringing net inflows for the year through November 2022 to $31.18 Bn, lower than the $39.83 Bn in net inflows fixed income products had attracted by the end of November 2021. Commodities ETFs/ETPs reported net outflows of $360 Mn during November, bringing YTD net outflows to $4.01 Bn, lower than the $1.65 Bn in net inflows commodities products had reported year to date in 2021. Active ETFs/ETPs attracted net inflows of $118 Mn during the month, gathering net inflows for the year in Europe of $2.51 Bn, lower than the $5.47 Bn in net inflows active products had reported YTD in 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $10.46 Bn during November. UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to USD) A-acc (ACWIU SW) gathered $2.52 Bn, the largest individual net inflow.

Top 20 ETFs by net inflows in November 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ACWIU SW |

5,583.75 |

3,600.29 |

2,515.87 |

|

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

11,814.32 |

1,761.65 |

1,197.72 |

|

iShares € Corp Bond ESG UCITS ETF |

SUOE LN |

3,817.00 |

1,343.75 |

580.89 |

|

iShares $ Corp Bond UCITS ETF |

LQDE LN |

7,178.11 |

2,732.68 |

503.29 |

|

iShares S&P 500 Energy Sector UCITS ETF - Acc |

IESU LN |

2,001.31 |

791.09 |

485.12 |

|

Xtrackers II Eurozone Government Bond UCITS ETF DR - Acc |

XGLE GY |

2,403.54 |

332.20 |

441.12 |

|

iShares USD Corp Bond ESG UCITS ETF - Acc |

SUOA NA |

1,750.61 |

931.90 |

437.40 |

|

iShares MSCI USA Swap UCITS ETF - Acc |

MUSD NA |

422.39 |

425.39 |

422.36 |

|

Xtrackers II Eurozone Government Bond 7-10 UCITS ETF - Acc |

X710 GY |

635.53 |

293.12 |

416.55 |

|

iShares J.P. Morgan $ EM Bond UCITS ETF |

SEMB LN |

7,764.47 |

334.07 |

409.81 |

|

iShares Global Aggregate Bond ESG UCITS ETF |

AGGE NA |

1,299.10 |

708.60 |

369.69 |

|

iShares S&P 500 Health Care Sector UCITS ETF - Acc |

IHCU LN |

3,115.56 |

767.30 |

327.94 |

|

Invesco S&P 500 ESG UCITS ETF - Acc |

SPXE LN |

2,498.65 |

955.76 |

324.83 |

|

iShares S&P 500 Utilities Sector UCITS ETF - Acc |

IUSU LN |

494.14 |

355.17 |

303.85 |

|

iShares JP Morgan ESG USD EM Bond UCITS ETF - Acc - Acc |

EMSA LN |

2,223.91 |

799.86 |

298.50 |

|

iShares S&P 500 UCITS ETF |

IUSA LN |

12,978.13 |

(25.94) |

298.22 |

|

iShares $ Short Duration Corp Bond UCITS ETF |

SDIG LN |

6,244.08 |

272.23 |

289.14 |

|

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) - 1C - Acc |

XDEW GY |

3,533.92 |

(707.94) |

281.63 |

|

Amundi MSCI USA ESG Leaders Extra UCITS ETF - Acc |

MWOK GY |

289.34 |

277.65 |

277.65 |

|

AMUNDI INDEX EURO AGG CORPORATE SRI - UCITS ETF DR (C) - Acc |

ECRP FP |

2,000.62 |

523.39 |

276.78 |

The top 10 ETPs by net new assets collectively gathered $453 Mn during November. WisdomTree Aluminium - Acc (ALUM LN) gathered $93.65 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in November 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

WisdomTree Aluminium - Acc |

ALUM LN |

146.81 |

106.40 |

93.65 |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

14,103.35 |

2,005.53 |

68.68 |

|

WisdomTree Copper - Acc |

COPA LN |

437.62 |

12.90 |

46.48 |

|

Royal Mint Responsibly Source Physical Gold ETC - Acc |

RMAU LN |

739.39 |

494.10 |

44.88 |

|

WisdomTree Physical Silver - Acc |

PHAG LN |

1,302.58 |

(691.03) |

42.70 |

|

SG ETC WTI Oil Daily Euro Hedged Collateralized - Acc |

OILH IM |

64.60 |

(9.35) |

40.57 |

|

WisdomTree S&P 500 3x Daily Short - Acc |

3USS LN |

76.51 |

33.37 |

37.74 |

|

WisdomTree WTI Crude Oil 2x Daily Leveraged - Acc |

LOIL LN |

127.63 |

177.97 |

30.20 |

|

WisdomTree Natural Gas 3x Daily Short - Acc |

3NGS LN |

40.26 |

97.15 |

26.44 |

|

Leverage Shares 3x Tesla ETP - Acc |

TSL3 LN |

68.01 |

172.47 |

21.26 |

Investors have tended to invest in Fixed Income ETFs and ETPs during November.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

? Session recordings - Register to watch the session recordings from our 2022 events.

2022 ETFGI Global ETFs Insights Summits:

2nd ESG & Active ETFs Trends, March 23th & 24th Watch the session recordings

3rd Annual Latin America, April 27th & 28th Watch the session recordings

3rd Annual Europe & MEA, September 14-16 Watch the session recordings

3rd Annual Asia Pacific, October 12 - 13 Watch the session recordings

3rd Annual USA, November 15 - 16 Watch the session recordings

4th Annual Canada, November 30 - December 1 Watch the session recordings

2023 ETFGI Global ETFs Insights Summits:

4th Annual Latin America, Register your interest here

4th Annual Europe & MEA, Register your interest here

4th Annual Asia Pacific, Register your interest here

4th Annual USA, Register your interest here

5th Annual Canada, Register your interest here

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you interested in speaking, sponsoring or have any questions about any of our upcoming events.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.