ETFGI reports actively managed ETFs listed globally gathered net inflows of US13.40 billion during December 2022

LONDON — January 20, 2023 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that actively managed ETFs listed globally gathered net inflows of

US$13.40 billion during December, bringing year-to-date net inflows to US$122.64 billion. Assets invested in actively managed ETFs decreased by 0.5%, from US$490 billion at the end of November 2022 to US$488 billion, according to ETFGI's December 2022 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Actively managed ETFs listed globally gathered $13.40 Bn in net inflows during December.

- Net inflows of $122.64 Bn in 2022 are the 2nd highest, after $131.08 Bn in net inflows in 2021.

- 33rd month of consecutive net inflows.

- Assets of $488 Bn invested in actively managed ETFs at the end of December 2022.

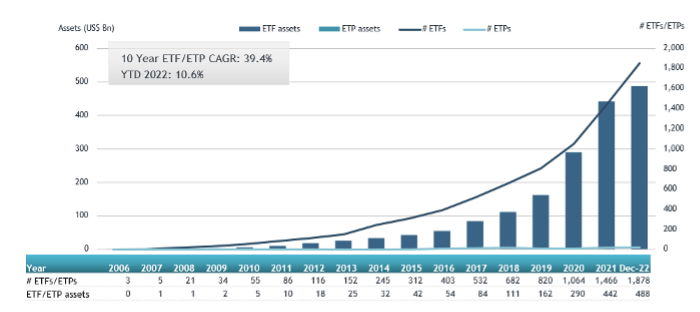

- Assets increased 10.6% year-to-date in 2022, going from $441 Bn at the end of 2021 to $488 Bn.

“The S&P 500 was down 5.76 % in December and was down 18.11% for 2022. Developed markets excluding the US were down 0.46% in December and were down 16.06% in 2022. Israel (down 6.05%) and US (down 17.45%) saw the largest decreases amongst the developed markets in December. Emerging markets decreased by 1.07% during December and were down 17.75% in 2022. Qatar (down 10.21%) and Peru (down 7%) saw the largest increases amongst emerging markets in December.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in actively managed ETF and ETP assets as of the end of December 2022

There were the 1,878 actively managed ETFs listed globally, with 2,369 listings, assets of $488 Bn, from 353 providers listed on 32 exchanges in 24 countries at the end of December.

Equity focused actively managed ETFs/ETPs listed globally gathered net inflows of $9.04 Bn during December, bringing year to date net inflows to $86.33 Bn, higher than the $68.56 Bn in net inflows equity products had attracted at this point in 2021. Fixed Income focused actively managed ETFs/ETPs listed globally attracted net inflows of $4.64 Bn during December, bringing net inflows for the year through December 2022 to $24.75 Bn, lower than the $46.48 Bn in net inflows fixed income products had reported in Year-to-date 2021.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered

$10.98 Bn during December. JPMorgan Ultra-Short Income ETF (JPST US) gathered $1.57 Bn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets December 2022

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

23,868.55 |

5,554.27 |

1,566.92 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

17,484.99 |

12,924.74 |

1,445.71 |

|

Samsung KODEX Active Korea Total Bond Market AA- ETF |

273130 KS |

1,836.01 |

732.58 |

744.32 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

1,311.14 |

549.01 |

636.22 |

|

First Trust Enhanced Short Maturity Fund |

FTSM US |

7,758.59 |

3,531.46 |

633.06 |

|

Kovitz Core Equity ETF |

EQTY US |

582.79 |

612.21 |

612.21 |

|

PGIM Ultra Short Bond ETF |

PULS US |

3,858.32 |

1,890.75 |

593.79 |

|

CI High Interest Savings ETF |

CSAV CN |

3,910.07 |

2,404.43 |

544.48 |

|

Dimensional US Core Equity 2 ETF |

DFAC US |

16,246.75 |

3,625.39 |

537.91 |

|

CI Enhanced Short Duration Bond Fund - ETF - CAD Hdg |

FSB CN |

673.48 |

379.49 |

456.60 |

|

Samsung KODEX 23-12 Bank Bond AA+ Active ETF |

448320 KS |

648.62 |

635.64 |

436.38 |

|

Innovator U.S. Equity Power Buffer ETF - December |

PDEC US |

612.67 |

412.85 |

415.99 |

|

Horizons High Interest Savings ETF |

CASH CN |

1,140.84 |

1,146.65 |

370.53 |

|

Dimensional US Small Cap Value ETF |

DFSV US |

1,087.77 |

1,071.50 |

337.04 |

|

Vanguard Ultra Short-Term Bond ETF |

VUSB US |

3,248.50 |

1,281.79 |

320.78 |

|

Dimensional International Core Equity 2 ETF |

DFIC US |

2,143.78 |

2,075.93 |

309.60 |

|

Avantis U.S. Small Cap Value ETF |

AVUV US |

4,743.74 |

2,644.60 |

292.63 |

|

Purpose High Interest Savings ETF |

PSA CN |

2,783.15 |

1,471.06 |

244.05 |

|

Amplify CWP Enhanced Dividend Income ETF |

DIVO US |

2,515.52 |

1,623.96 |

243.94 |

|

Dimensional Core Fixed Income ETF |

DFCF US |

2,073.11 |

2,008.06 |

235.62 |

Investors have tended to invest in Equity actively managed ETFs/ETPs during December.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

If you like our research and events, please support us by nominating ETFGI in the Best ETF Research Provider category (No. 21) at the European ETF Awards for Service Providers 2023 here. Nominations close on Friday 27th January 2023.

Register now to attend the Women in ETFs Breakfast on Feb 6th, 7:00-8:30am in the Eden Roc Ballroom II, Nobu Hotel Miami Beach. All members - women and men are invited to attend. Not a member? Complete the application here.

Members of Women in ETFs receive a discount on the registration cost to attend the Exchange: An ETF Experience event in Miami Feb 5-8th. You do not need to be registered to attend the Exchange ETF event to attend our breakfast.

AGENDA

7:00 AM REGISTRATION, NETWORKING & CONTINENTAL BREAKFAST

7:30 AM WELCOME

Jennica Ross

Co-President, Women in ETFs - United States

Head of US ETF Sales & Portfolio Trading

Susquehanna International Group, LLP (SIG)

MOMENT OF SILENCE FOR KATHLEEN MORIARTY, WE BOARD MEMBER

7:35 AM SERVICE AWARD

7:40 AM CEO FIRESIDE CHAT

Outlook for the Asset Management & ETF Industry including tips on managing careers and diversity

SPEAKERS:

Natalie Wolfsen

Chief Executive Officer

AssetMark

Yie-Hsin Hung

President & Chief Executive Officer

State Street Global Advisors

Moderated by:

Deborah Fuhr

Board Member & Co-President, Women in ETFs - EMEA Founder, Managing Partner ETFGI

8:25 AM CLOSING REMARKS

Jennica Ross

Co-President, Women in ETFs - United States

Head of US ETF Sales & Portfolio Trading

Susquehanna International Group, LLP (SIG)

Register your interest in attending our upcoming 2023 ETFGI Global ETFs Insights Summits:

4th Annual Latin America, Register your interest here

4th Annual Europe & MEA, Register your interest here

4th Annual Asia Pacific, Register your interest here

4th Annual USA, Register your interest here

5th Annual Canada, Register your interest here

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you are interested in speaking, sponsoring or have any questions about any of our upcoming events.

? Session recordings - Register to watch the session recordings from our 2022 events.

2022 ETFGI Global ETFs Insights Summits:

2nd ESG & Active ETFs Trends, March 23th & 24th Watch the session recordings

3rd Annual Latin America, April 27th & 28th Watch the session recordings

3rd Annual Europe & MEA, September 14-16 Watch the session recordings

3rd Annual Asia Pacific, October 12 - 13 Watch the session recordings

3rd Annual USA, November 15 - 16 Watch the session recordings

4th Annual Canada, November 30 - December 1 Watch the session recordings

ETF TV episode #127 Patricia Lizarraga, Managing Partner, Hypatia Capital Group, discusses the case for investing women-led companies in the US with Margareta Hricova and Deborah Fuhr on ETF TV. #Press Play https://bit.ly/3Xko3e6

ETF TV episode #127 Patricia Lizarraga, Managing Partner, Hypatia Capital Group, discusses the case for investing women-led companies in the US with Margareta Hricova and Deborah Fuhr on ETF TV. #Press Play https://bit.ly/3Xko3e6

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.