ETFGI reports the ETFs industry in Asia Pacific ex Japan gathered US$559 million in net inflows during February 2023

LONDON —March 28, 2023 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that ETFs industry in Asia Pacific ex Japan gathered net inflows of US$559 million during February, bringing year-to-date net inflows to US$1.99 billion. During the month, assets invested in the Asia Pacific ex-Japan ETFs industry increased by 6.1%, from US$555 billion at the end of January to US$588 billion, according to ETFGI's February 2023 Asia Pacific (ex-Japan) ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in Asia Pacific ex Japan gathered $559 million in net inflows during February

- YTD net inflows of $1.99 Bn are the eighth highest on record, while the highest recorded YTD net inflows are $31.38 Bn for 2022 followed by YTD net inflows of $12.34 Bn in 2021.

- 20th month of consecutive net inflows.

- Assets of $588 Bn invested in ETFs industry in Asia Pacific ex Japan at end of February.

“The S&P 500 decreased by 2.44 % in February but is up by 3.69% YTD in 2023. Developed markets excluding the US decreased by 2.59% in February but are up 5.47% YTD in 2023. Israel (down 6.97%) and Hong Kong (down 6.94%) saw the largest decreases amongst the developed markets in February. Emerging markets decreased by 5.57% during February but are up 0.72% YTD in 2023. Colombia (down 11.62%) and Thailand (down 9.38%) saw the largest decreases amongst emerging markets in February.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

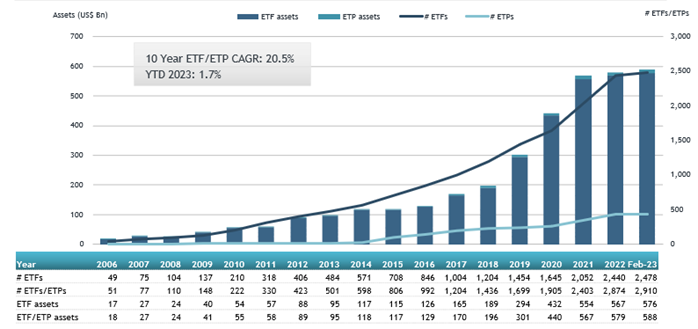

Asia Pacific (ex-Japan) ETF and ETP asset growth as at the end of February 2023

ETFs industry in Asia Pacific ex Japan had 2,910 products, with 3,075 listings, assets of $588 Bn, from 236 providers listed on 20 exchanges in 15 countries at the end of February.

During February, ETFs gathered net inflows of $559 Mn. Equity ETFs suffered net outflows of $4.50 Bn over February, bringing YTD net outflows to $2.66 Bn, much lower than the $26.35 Bn in net inflows YTD in 2022. Fixed income ETFs reported net inflows of $3.10 Mn during February, bringing YTD net inflows to $2.94 Bn, lower than the $3.87 Bn in net inflows YTD in 2022. Commodities ETFs/ETPs reported net inflows of $99 Mn during February, bringing YTD net outflows to $137 Mn, less than the $1.05 Bn in net outflows YTD in 2022. Active ETFs attracted net inflows of $1.45 Bn over the month, gathering YTD net inflows of $1.89 Bn, slightly higher than the $1.78 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $6.54 Bn during February. Cathay Taiwan Select ESG Sustainability High Yield ETF (00878 TT) gathered $615 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets in February 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Cathay Taiwan Select ESG Sustainability High Yield ETF |

00878 TT |

5,410.19 |

666.05 |

615.33 |

|

Yuanta US Treasury 20+ Year Bond ETF |

00679B TT |

1,918.98 |

489.41 |

490.55 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

17,015.98 |

(909.76) |

489.45 |

|

Tracker Fund of Hong Kong (TraHK) |

2800 HK |

16,066.60 |

(623.11) |

430.60 |

|

ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

8,077.87 |

524.31 |

391.41 |

|

GTJA Allianz CSI All-share Semi-conductor Product and Equipment ETF - Acc |

512480 CH |

2,701.58 |

518.89 |

376.37 |

|

Samsung KODEX 200 ETF |

069500 KS |

4,524.41 |

416.43 |

375.12 |

|

Hang Seng China Enterprises Index ETF |

2828 HK |

3,875.16 |

(642.75) |

368.72 |

|

E Fund ChiNext Price Index ETF |

159915 CH |

3,449.95 |

331.87 |

359.00 |

|

CTBC Bloomberg USD Corporate 10+ Year High Grade Capped Bond ETF - Acc |

00772B TT |

2,570.44 |

461.72 |

320.35 |

|

ChinaAMC CNI Semi-conductor Chip ETF |

159995 CH |

3,560.16 |

600.40 |

288.47 |

|

CSOP Hang Seng TECH Index Daily 2X Leveraged Product |

7226 HK |

718.01 |

82.91 |

269.77 |

|

Yuanta US 20+ Year BBB Corporate Bond ETF - Acc |

00720B TT |

1,625.58 |

574.97 |

262.89 |

|

HuaAn ChiNext 50 ETF Fund |

159949 CH |

1,908.27 |

273.92 |

235.03 |

|

KGI 15+ Years AAA-A US Corporate Bond ETF |

00777B TT |

1,320.12 |

225.91 |

225.91 |

|

KGI 25+ Years US Treasury Bond ETF |

00779B TT |

842.54 |

216.80 |

216.80 |

|

CCB Cash TianYi Traded Money Market Fund - Acc |

511660 CH |

2,771.04 |

204.98 |

214.82 |

|

iShares Core S&P/ASX 200 ETF |

IOZ AU |

2,711.12 |

252.84 |

206.81 |

|

Harvest CSI Vaccine and Biotechnology ETF |

562860 CH |

199.79 |

200.44 |

200.44 |

|

Samsung Kodex KOSDAQ150 Inverse ETF - Acc |

251340 KS |

395.94 |

209.44 |

199.68 |

The top ETPs by net new assets collectively gathered $186.33 Mn during February. Samsung Securities Samsung Leverage Natural Gas Futures ETN B 68 - Acc (530068 KS) gathered $82.18 Mn, the largest individual net inflow.

Top ETPs by net inflows in February 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Samsung Securities Samsung Leverage Natural Gas Futures ETN B 68 - Acc |

530068 KS |

133.55 |

113.36 |

82.18 |

|

Korea Investment & Securities TRUE Inverse 2X KOSDAQ 150 Futures ETN 82 |

570082 KS |

47.03 |

37.63 |

37.63 |

|

KB Securities KB Leveraged NASDAQ 100 ETN |

580015 KS |

21.62 |

14.41 |

14.41 |

|

KB Securities KB Bloomberg Leverage Natural Gas Futures ETN H 45 |

580045 KS |

17.96 |

13.47 |

13.47 |

|

KB Securities KB Natural Gas Futures ETN H 20 |

580020 KS |

20.08 |

13.39 |

13.39 |

|

Shinhan Securities Shinhan Bloomberg 2X Natural Gas Futures ETN H 73 |

500073 KS |

17.97 |

13.87 |

8.98 |

|

Korea Investment & Securities TRUE Inverse 2X EURO STOXX 50 ETN H 27 - Acc |

570027 KS |

9.62 |

4.81 |

4.81 |

|

Global X Physical Gold |

GOLD AU |

1,720.96 |

(12.41) |

4.55 |

|

Hana Securities Hana Bloomberg Leverage Natural Gas Futures ETN H 19 |

700019 KS |

5.40 |

3.60 |

3.60 |

|

Daishin Securities Daishin S&P 2X Natural Gas Futures ETN 28 |

510028 KS |

4.97 |

3.32 |

3.32 |

Investors have tended to invest in Fixed Income ETFs/ETPs during February.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Deborah Fuhr, Managing Partner of ETFGI is attending and speaking at the S&P Dow Jones Indices 15th Annual Japan ETF Conference on Tuesday April 4th & Wed April 5th at the Imperial Hotel Tokyo from 9:30am - 6:30pm. Networking Reception 6:30pm - 7:30pm on day 2.

Her session is at 9:55am on April 4th: What's New and What's Next for the ETF Market Globally. Please let us know if you would like to meet her at the event or on Monday.

Register for free to attend the event at https://bit.ly/3TGyw2O

Register now to attend our upcoming 2023 ETFGI Global ETFs Insights Summits:

4th Annual Latin America, April 19-20 Virtual Register Here

4th Annual Europe & MEA, June 14 In person in London & June 15 Virtual Register Here

4th Annual USA, Sep 20 In person in New York & Sep 21 Virtual Register Here

4th Annual Asia Pacific, October 24-25 Virtual Register Here

5th Annual Canada, Nov 29 In person in Toronto & Nov 30 Virtual Register Here

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you are interested in speaking, sponsoring or have any questions about any of our upcoming events.

? Session recordings - Register to watch the session recordings from our 2022 events.

2022 ETFGI Global ETFs Insights Summits:

2nd ESG & Active ETFs Trends, March 23th & 24th Watch the session recordings

3rd Annual Latin America, April 27th & 28th Watch the session recordings

3rd Annual Europe & MEA, September 14-16 Watch the session recordings

3rd Annual Asia Pacific, October 12 - 13 Watch the session recordings

3rd Annual USA, November 15 - 16 Watch the session recordings

4th Annual Canada, November 30 - December 1 Watch the session recordings

ETF TV episode #129 – A special episode to pay tribute to Kathleen H. Moriarty (aka “spdrwoman”), the lawyer instrumental to developing the SPDR S&P 500 ETF (SPY), who passed away in December. We are sharing with our viewers a video tribute made by Emily Meyer, Co-president of Women in ETFs US.https://bit.ly/3SFu2Jx

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.