ETFGI reports assets invested in the ETFs industry in Asia Pacific (ex-Japan) reached a milestone of US$746.73 billion at the end of November

LONDON — December 20, 2023 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today assets invested in the ETFs industry in Asia Pacific (ex-Japan) reached a milestone of US$746.73 billion at the end of November. The ETFs industry in Asia Pacific (ex-Japan) region gathered net inflows of US$18.12 billion during November, bringing year-to-date net inflows of US$147.78 billion. Assets increased by 29.0% year-to-date in 2023, going from US$578.72 billion at end of 2022 to US$746.73 billion, according to ETFGI's November 2023 Asia Pacific (ex-Japan) ETFs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs industry in Asia Pacific (ex-Japan) reached a milestone of $746.73 Bn at the end of November beating the previous record of $717.28 Bn at the end of August 2023.

- Assets invested in the ETFs industry in Asia Pacific (ex-Japan) have increased by 29.0% YTD in 2023, going from $578.72 Bn at end of 2022 to $746.73 Bn.

- Net inflows of $18.12 Bn during November.

- YTD net inflows of $147.78 Bn are the highest record, the second highest recorded YTD net inflows are of $115.02 Bn in 2022.

- 29th month of consecutive net inflows.

“The S&P 500 index was up 9.13% in November and is up 20.8% YTD in 2023. Developed markets excluding the US index increased by 9.75% in November and is up 11.65% YTD in 2023. Israel (up 19.37%) and Sweden (up 18.02%) saw the largest decreases amongst the developed markets in November. Emerging markets increased by 7.19% during November and were up 6.98% YTD in 2023. Egypt (up 14.64%) and Brazil (up 14.15%) saw the largest increases amongst emerging markets in November.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

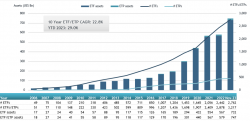

ETFs industry in Asia Pacific (ex-Japan) asset growth as at the end of November

At the end of November 2023, the ETFs industry in Asia Pacific (ex-Japan) had 3,217 prodcuts, with 3,386 listings, assets of $746.73 Bn, from 252 providers listed on 20 exchanges in 15 countries.

During November, ETFs gathered net inflows of $18.12 Bn. Equity ETFs gathered net inflows of $4.94 Bn during November, bringing YTD net inflows to $94.46 Bn, slightly lower than the $95.97 Bn in net inflows YTD in 2022. Fixed income ETFs had net inflows of $2.15 Bn during November, bringing YTD net inflows to $28.02 Bn, higher than the $11.73 Bn in net inflows YTD in 2022. Commodities ETFs/ETPs reported net outflows of $28.77 Mn during November, bringing YTD net inflows to $625.67 Mn, higher than the $1.95 Bn in net outflows YTD in 2022. Active ETFs had net inflows of $10.89 Bn over the month, gathering net inflows YTD of $22.43 Bn, much higher than the $6.07 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $19.37 Bn during November. Dimensional Global Core Equity Trust Managed Fund (DGCE AU) gathered $3.88 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets in November 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Dimensional Global Core Equity Trust Managed Fund |

DGCE AU |

3,879.86 |

3,879.86 |

3,879.86 |

|

Dimensional Australian Core Equity Trust Managed Fund |

DACE AU |

2,995.65 |

2,995.65 |

2,995.65 |

|

MIRAE ASSET TIGER SYNTH-KOFR ACTIVE ETF |

449170 KS |

4,144.62 |

4,106.14 |

2,380.86 |

|

China AMC China 50 ETF |

510050 CH |

9,840.39 |

2,433.88 |

1,550.32 |

|

SAMSUNG KODEX CD Rate Active ETF SYNTH |

459580 KS |

4,420.19 |

4,293.97 |

1,380.62 |

|

CSOP Saudi Arabia ETF |

2830 HK |

1,001.97 |

994.64 |

994.64 |

|

ChinaAMC SSE Science and Technology Innovation Board 100 ETF |

588800 CH |

844.03 |

833.17 |

833.17 |

|

Mirae Asset TIGER CD Rate Investment Synth ETF |

357870 KS |

5,990.40 |

2,869.05 |

668.04 |

|

SAMSUNG KODEX 24-12 Bank Bond AA+ Active ETF |

465680 KS |

1,466.66 |

1,390.09 |

604.64 |

|

Invesco Great Wall CSI Dividend Low Volatility 100 ETF |

515100 CH |

802.67 |

762.81 |

495.86 |

|

Samsung KODEX KOFR Active ETF (Synth) |

423160 KS |

3,760.05 |

1,335.12 |

468.09 |

|

Tracker Fund of Hong Kong (TraHK) |

2800 HK |

15,605.11 |

1,251.50 |

455.43 |

|

Yuanta US Treasury 20+ Year Bond ETF |

00679B TT |

4,084.47 |

2,483.06 |

453.86 |

|

Penghua SSE Science and Technology Innovation Board 100 ETF |

588220 CH |

722.12 |

685.66 |

373.33 |

|

Cathay Taiwan Select ESG Sustainability High Yield ETF |

00878 TT |

7,602.17 |

1,890.10 |

331.44 |

|

GF CSI Hong Kong Brand Name Drug ETF QDII |

513120 CH |

1,038.17 |

1,010.15 |

325.87 |

|

E Fund CSI 300 ETF |

510310 CH |

5,398.24 |

3,437.20 |

321.25 |

|

Bosera SSE Science and Technology Innovation Board 100 ETF |

588030 CH |

793.08 |

432.09 |

317.45 |

|

MIRAE ASSET TIGER 24-12 FINANCIAL ETF |

470260 KS |

287.44 |

287.44 |

287.44 |

|

Yuanta US 20+ Year BBB Corporate Bond ETF - Acc |

00720B TT |

3,495.75 |

2,300.43 |

248.95 |

The top ETPs by net new assets collectively gathered $133.47 Mn during November. MiraeAsset Securities Miraeasset Hongkong H Future ETN H 8 (520067 KS) gathered $36.70 Mn, the largest individual net inflow.

Top ETPs by net inflows in November 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

MiraeAsset Securities Miraeasset Hongkong H Future ETN H 8 |

520067 KS |

36.70 |

36.70 |

36.70 |

|

Meritz Securities Meritz Leverage US Treasury Bond 30Y ETN H 38 |

610038 KS |

42.11 |

37.26 |

21.06 |

|

Samsung Securities Samsung Leverage Nasdaq 100 ETN 115 |

530115 KS |

17.94 |

17.94 |

17.94 |

|

MiraeAsset Securities Miraeasset 2X Inverse Hongkong H Future ETN H 84 |

520069 KS |

16.79 |

16.79 |

16.79 |

|

MiraeAsset Securities Miraeasset 2X Leveraged Hongkong H Future ETN 83 |

520068 KS |

13.69 |

13.69 |

13.69 |

|

Samsung Securities Samsung Inverse 2X Nasdaq 100 ETN 116 |

530116 KS |

11.93 |

11.93 |

11.93 |

|

Daishin Securities Daishin 3X Leverage KTB 30Y ETN 39 |

510039 KS |

7.79 |

7.79 |

7.79 |

|

Daishin Securities Daishin 3X Inverse KTB 30Y ETN 40 |

510040 KS |

7.58 |

7.58 |

7.58 |

Investors have tended to invest in Active ETFs/ETPs during November.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

|

|