ETFGI reports assets invested in actively managed ETFs listed globally reached a new record of US$838.00 billion at the end of March

Press Release

LONDON — April 30, 2024 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reports assets invested in actively managed ETFs listed globally reached a new record of US$838.00 billion at the end of March. Actively managed ETFs reported net inflows of US$25.31 billion during March, bringing year-to-date net inflows to US$71.53 billion, according to ETFGI's March 2024 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in actively managed ETFs listed globally reached a new record of $838.00 Bn at the end of March beating the previous record of $797.63 Bn set at the end of February 2024.

- Assets increased 13.5% year-to-date in 2024, going from $738.21 Bn at the end of 2023 to $838.00 Bn.

- Net inflows of $25.31 Bn during March.

- Year-to-date net inflows of $71.53 Bn are the highest on record, followed by year-to-date net inflows of $46.97 Bn in 2021, and the third highest record was year to date net inflows of $37.00 Bn in 2023.

- 48th month of consecutive net inflows.

“The S&P 500 index increased by 3.22% in March and is up 10.56% YTD in 2024. The developed markets excluding the US index increased by 3.62% in March and is up 5.26% YTD in 2024. Spain (up 10.72%) and Italy (up 6.34%) saw the largest increases amongst the developed markets in March. The Emerging markets index increased by 1.50% during March and was up 2.08% YTD in 2024. Peru (up 10.27%) and Columbia (up 8.19%) saw the largest increases amongst emerging markets in March”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

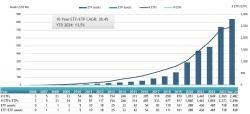

Actively managed ETFs listed globally asset growth as of end March

There were 3,084 actively managed ETFs with assets of $838.00 Bn, from 436 providers listed on 37 exchanges in 29 countries at the end of March.

Equity focused actively managed ETFs listed globally gathered net inflows of $16.83 Bn during March, bringing year to date net inflows to $44.13 Bn, higher than the $27.09 Bn in net inflows YTD in 2023. Fixed Income focused actively managed ETFs listed globally attracted net inflows of $5.97 Bn during March, bringing YTD net inflows to $22.34 Bn, much higher than the $10.07 Bn in net inflows YTD in 2023.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered

$14.07 Bn during March. Blackrock US Equity Factor Rotation ETF (DYNF US) gathered $3.57 Bn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets March 2024

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Blackrock US Equity Factor Rotation ETF |

DYNF US |

7,175.19 |

6,798.25 |

3,574.83 |

|

Eagle Capital Select Equity ETF |

EAGL US |

1,796.98 |

1,788.55 |

1,788.55 |

|

Blackrock Flexible Income ETF |

BINC US |

2,691.91 |

2,194.48 |

1,007.46 |

|

JPMorgan Nasdaq Equity Premium Income ETF |

JEPQ US |

12,017.10 |

2,711.38 |

889.52 |

|

GraniteShares 2x Long NVDA Daily ETF |

NVDL US |

2,052.26 |

1,128.79 |

831.92 |

|

Janus Henderson AAA CLO ETF |

JAAA US |

7,458.62 |

2,066.96 |

671.57 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

33,864.57 |

1,693.17 |

551.97 |

|

Alpha Architect 1-3 Month Box ETF |

BOXX US |

1,963.28 |

1,257.69 |

541.31 |

|

Eaton Vance Floating-Rate ETF |

EVLN US |

565.49 |

564.70 |

511.73 |

|

PGIM Ultra Short Bond ETF |

PULS US |

6,294.78 |

395.49 |

394.13 |

|

Samsung KODEX KOFR Active ETF (Synth) |

423160 KS |

3,987.36 |

570.38 |

386.86 |

|

Eaton Vance Total Return Bond ETF |

EVTR US |

362.86 |

363.37 |

363.37 |

|

Cambria Shareholder Yield ETF |

SYLD US |

1,563.81 |

435.77 |

357.98 |

|

Innovator U.S. Equity Power Buffer ETF - March |

PMAR US |

705.91 |

308.99 |

355.46 |

|

Fidelity Total Bond ETF |

FBND US |

7,929.82 |

1,317.64 |

355.03 |

|

Capital Group Dividend Value ETF |

CGDV US |

7,040.89 |

991.35 |

317.58 |

|

JPMorgan US Research Enhanced Index Equity ESG UCITS ETF - Acc |

JREU LN |

7,047.30 |

1,230.55 |

315.09 |

|

Avantis U.S. Small Cap Value ETF |

AVUV US |

10,874.74 |

1,361.53 |

314.98 |

|

Dimensional US High Profitability ETF |

DUHP US |

5,193.40 |

679.32 |

271.64 |

|

JPMorgan ETFs (Ireland) ICAV - Global Research Enhanced Index Equity (ESG) UCITS ETF |

JREG LN |

5,082.69 |

823.25 |

265.38 |

Investors have tended to invest in Equity actively managed ETFs/ETPs during March.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

ETFGI is a proud partner of Inside ETFs+ 2024, taking place on May 13-16 at The Diplomat Beach Resort in Hollywood, Florida!

Inside ETFs+ is the investment pillar of Wealth Management EGDE. Discover and debate the latest ideas in investment strategies and discuss ETFs and more with hundreds of experts, advisors and issuers.

Join us and save 20% on your registration with code: ETFGI2024EDGE

Advisors attend for free with code: ETFGI2024Adv

Learn more about the event by visiting: https://informaconnect.com/edge/inside-etfs/

|

Contact: |