During the first 4 months of 2024 the global ETFs industry has gathered a record US$467.86 billion in net inflows according to new research by ETFGI

Press Release

LONDON — May 20, 2024 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reports during April the global ETFs industry gathered US$70.35 billion in net inflows, bringing year to date net inflows to a record US$467.86 billion, according to ETFGI's April 2024 global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted)

Highlights

- Global ETFs industry gathered net inflows of $70.35 Bn during April.

- YTD net inflows of $467.86 Bn is the highest on record, while the second highest recorded YTD net inflows was of $464.20 Bn in 2021 and the third highest recorded YTD net inflows of 337.32 Bn in 2022.

- 59th month of consecutive net inflows.

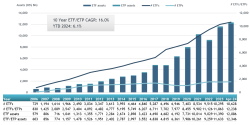

- Assets of $12.35 Tn invested in the global ETFs industry at the end of April 2024

- Assets increased 6.1% YTD in 2024, going from $11.63 Tn at end of 2023 to $12.35 Tn.

“The S&P 500 index decreased by 4.08% in April but is up by 6.04% YTD in 2024. The developed markets excluding the US index decreased by 2.74% in April but is up 2.38% YTD in 2024. Luxembourg (down 9.04%) and Israel (down 6.46%) saw the largest decreases amongst the developed markets in April. The emerging markets index increased by 1.64% during April but is up 3.75% YTD in 2024. Turkey (up 11.24%) and China (up 5.92%) saw the largest increases amongst emerging markets in April”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in assets invested in the Global ETFs industry as of the end of April

At the end of April, the Global ETFs industry had 12,238 products, with 24,518 listings, assets of $12.35 Tn, from 744 providers listed on 80 exchanges in 63 countries.

During April, the industry gathered net inflows of $70.35 Bn. Equity ETFs reported net inflows of $28.93 Bn for the month, bringing YTD net inflows to $264.60 Bn, significantly higher than the $53.66 Bn in net inflows YTD in 2023. Fixed income ETFs gathered net inflows of $16.72 Bn during April, bringing YTD net inflows to $78.57 Bn, lower than the $94.04 Bn in net inflows YTD in 2023. Commodities products reported net outflows of $2.15 Bn during April, bringing YTD net outflows to $8.53 Bn, lower than the $2.62 Bn in net inflows YTD in 2023. Active ETFs attracted net inflows of $25.75 Bn during the month, gathering YTD net inflows of $97.56 Bn, higher than the $44.48 Bn in net inflows YTD in 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $40.12 Bn during April. Vanguard S&P 500 ETF (VOO US) gathered $7.62 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows April 2024: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

|

VOO US |

430,389.98 |

31,872.66 |

7,620.30 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

105,089.45 |

7,882.23 |

3,144.25 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

372,261.35 |

10,663.45 |

2,673.61 |

|

Vanguard Growth ETF |

|

VUG US |

116,175.44 |

5,457.06 |

2,657.29 |

|

NEXT FUNDS Nikkei 225 Exchange Traded Fund |

|

1321 JP |

69,104.22 |

2,763.58 |

2,258.44 |

|

Invesco S&P 500 Equal Weight ETF |

|

RSP US |

54,082.14 |

3,397.86 |

2,189.39 |

|

iShares Core S&P 500 UCITS ETF - Acc |

|

CSSPX SW |

82,493.34 |

6,443.11 |

1,698.29 |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

|

1570 JP |

2,979.41 |

1,034.54 |

1,551.61 |

|

iShares Bitcoin Trust |

|

IBIT US |

16,450.65 |

15,491.29 |

1,520.55 |

|

Vanguard Information Technology ETF |

|

VGT US |

63,781.87 |

3,196.53 |

1,519.67 |

|

Listed Index Fund TOPIX |

|

1308 JP |

71,201.40 |

2,208.95 |

1,496.25 |

|

NEXT FUNDS TOPIX Exchange Traded Fund |

|

1306 JP |

149,788.38 |

1,815.08 |

1,441.07 |

|

SPDR Portfolio S&P 500 ETF |

|

SPLG US |

33,583.79 |

6,298.39 |

1,436.33 |

|

iShares MBS ETF |

|

MBB US |

29,256.88 |

1,938.72 |

1,428.29 |

|

Pacer US Cash Cows 100 ETF |

|

COWZ US |

22,606.26 |

3,296.96 |

1,353.10 |

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF |

|

BIL US |

32,434.80 |

(1,071.68) |

1,280.33 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

112,631.71 |

3,864.29 |

1,278.54 |

|

Direxion Daily Semiconductors Bull 3x Shares |

|

SOXL US |

10,296.06 |

163.30 |

1,257.18 |

|

iShares 0-3 Month Treasury Bond ETF |

|

SGOV US |

20,244.91 |

2,645.63 |

1,179.94 |

|

iShares Russell Mid-Cap ETF |

|

IWR US |

32,804.93 |

1,108.14 |

1,136.32 |

The top 10 ETPs by net new assets collectively gathered $1.72 Bn over April. Hana Securities Hana CD Interest Rate Investment ETN 26 (70026 KS) gathered $326.73 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows April 2024: Global

|

Name |

|

Ticker |

Asset |

NNA |

NNA |

|

|

700026 KS |

544.55 |

549.96 |

326.73 |

|

|

KB Securities KB KIS CD ETN 58 |

|

580058 KS |

363.03 |

366.64 |

217.82 |

|

Japan Physical Gold ETF - Acc |

|

1540 JP |

2,572.47 |

318.74 |

209.70 |

|

SPDR Gold Shares |

|

GLD US |

61,705.25 |

(2,934.46) |

176.77 |

|

WisdomTree Industrial Metals - Acc |

|

AIGI LN |

691.69 |

183.67 |

169.78 |

|

Kiwoom Securities Kiwoom CD Interest Rate Investment ETN 9 |

|

760009 KS |

166.47 |

166.47 |

166.47 |

|

WisdomTree Physical Platinum - Acc |

|

PHPT LN |

526.34 |

159.77 |

143.83 |

|

WisdomTree Energy Enhanced - EUR Hdg Acc |

|

BENE LN |

111.47 |

109.50 |

110.17 |

|

FPA Global Equity ETF |

|

FPAG US |

101.43 |

133.46 |

103.00 |

|

Invesco DB US Dollar Index Bullish Fund |

|

UUP US |

435.87 |

22.38 |

94.42 |

Investors have tended to invest in Equity ETFs during April.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

📢 Register now to join us next week on May 28th at Bolsa Mexicana de Valores in Mexico City from 10:30am - 6:30pm for our 5th Annual ETFGI Global ETFs Insights Summit - Latin America.

The event includes a networking lunch and a networking drinks reception to celebrate diversity initiatives in partnership with CFA Society Mexico, Mujeres en Finanzas Mexico and Women in ETFs, and virtual sessions on May 29th.

Register now to join us!

The event is designed for financial advisors, institutional investors, brokerage firms and people that work in the ETF ecosystem locally and globally.

IN PERSON SPEAKERS WILL INCLUDE:

VIRTUAL SPEAKERS WILL INCLUDE:

For information on speakers and agenda, click here.

📍May 28th - at Bolsa Mexicana de Valores in Mexico City from 10:30am - 6:30pm including a networking lunch and networking drinks reception in partnership with CFA Society Mexico, Mujeres en Finanzas Mexico and Women in ETFs

📍May 29th - Virtual panel discussions

🆓 Free registration for buy side institutional investors and financial advisors Register now

🎧 All sessions are recorded, you will receive links to all sessions after the event

📚 CPD educational credits

![]()

If you can't attend on the day, register anyway and you'll receive recordings of all the sessions.

The Summit is designed to facilitate a substantive and in-depth discussion on the market structure, regulatory, trading, and technological developments impacting the use of and opportunity for local, US domiciled and UCITS ETFs by various types of investors in Latin America. Panels will discuss the current and future use of ETFs by various types of investors and the regulatory requirements for local ETFs, US domiciled and UCITS ETFs to be marketed, sold and bought in Mexico, Brazil, Chile, Colombia, Peru, Uruguay and Argentina.

📢 You can also register to join the discussions and networking at our upcoming events:

- 5th Annual ETFGI Global ETFs Insights Summit - Latin America – May 28th at Bolsa Mexicana de Valores in Mexico City and virtual on May 29th Register

- 5th Annual ETFGI Global ETFs Insights Summit - Asia Pacific – September 11th at Centricity – Concentric in Hong Kong and virtual on September 12th Register

- 5th Annual ETFGI Global ETFs Insights Summit – U.S. – October 29th at The Yale Club in New York City Register

- 6th Annual ETFGI Global ETFs Insights Summit - Canada – November 27th at Borden Ladner Gervais’s office in Toronto Register

ETFGI (www.ETFGI.com) has for over 12 years published monthly subscription research reports covering trends in the global ETFs ecosystem, created factsheets for every ETF listed globally, provided consulting services and educational events.

If you are interested in sponsoring or speaking at any of our upcoming events or have any questions, please contact us deborah.fuhr@etfgi.com and margareta.hricova@etfgi.com.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.