ETFGI Reports Robust Growth in Global ETFs Industry with 35 New Listings last week

Press Release

LONDON, May 13, 2024 – ETFGI, a leading independent research and consultancy firm dedicated to providing insights on the global Exchange Traded Funds (ETFs) ecosystem, has today announced a significant uptick in the ETFs market. Last week alone, the industry saw the introduction of 35 new products and the closure of 6, culminating in a net increase of 29 ETF offerings.

Key Highlights of the Year-to-Date (YTD) Performance:

- The global ETFs industry has welcomed 612 new product listings.

- A total of 182 products have been closed.

- The industry has experienced a net increase of 430 product listings.

- A diverse group of 219 providers have contributed to the new listings across 35 exchanges worldwide.

- There have been 182 closures from 73 providers on 29 exchanges.

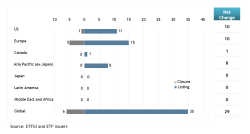

New ETFs listings and ETFs closers during the week of May 6th

A Closer Look at the New Product Structures:

- Of the 612 new products listed YTD:

- 540 are structured as regulated funds, including UCITS and 40 Act.

- 72 have adopted alternative product structures.

- Regional distribution of new listings:

- The United States leads with 207 new listings.

- Asia Pacific (ex-Japan) follows closely with 192.

- Latin America has seen a single new listing.

- The industry has also observed 489 new cross listings on 21 exchanges.

Trends in Product Closures:

- ETFs account for 164 of the 182 closures.

- The US has seen the majority with 83 closures, Europe with 37, and Latin America with one.

Five-Year Comparative Analysis:

- The US and Asia Pacific (ex-Japan) regions have consistently launched over half of the new products each year.

- Latin America remains the region with the least number of new listings.

- The US has recorded the largest increase in new listings, followed by Asia Pacific ex-Japan.

This year’s data reflects a dynamic and expanding ETFs industry, with the US and Asia Pacific regions leading the charge in product innovation and offerings. ETFGI remains committed to monitoring and reporting on these trends, providing valuable insights for investors and industry stakeholders.

|

YTD ETF/ETP launched |

2024 |

2023 |

2022 |

2021 |

2020 |

|

US |

207 |

155 |

175 |

154 |

90 |

|

Europe |

111 |

85 |

187 |

160 |

73 |

|

Canada |

66 |

64 |

63 |

70 |

57 |

|

Asia Pacific (ex-Japan) |

192 |

178 |

186 |

191 |

116 |

|

Japan |

18 |

14 |

15 |

12 |

5 |

|

Latin America |

1 |

4 |

14 |

7 |

1 |

|

Middle East and Africa |

17 |

23 |

12 |

25 |

12 |

|

Total |

612 |

523 |

652 |

619 |

354 |

Source: ETFGI and ETF issuers

For more information, please contact: deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

|

|