ETFGI reports that the global ETFs industry has shattered previous records with a record 1,063 new products listed in the first 7 months of the year

Press Release

ETFGI reports that the global ETFs industry has shattered previous records with a record 1,063 new products listed in the first 7 months of the year

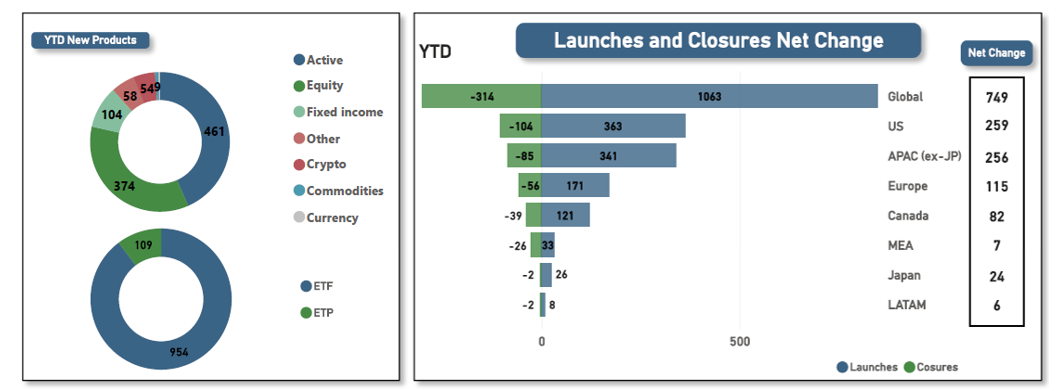

LONDON —August 20, 2024 — ETFGI, a prominent independent research and consultancy firm specializing in providing subscription research on trends in the global ETFs industry, reports that the global ETFs industry has shattered previous records with a record 1,063 new products listed in the first 7 months of the year. The 1,063 new product listings surpass the previous record of 988 new product listings in the first 7 months of 2021.

After accounting for 314 closures in the first 7 months there has been a net increase of 749 products. This surpasses the previous record of 988 new ETFs listed at this point in 2021.

The distribution of new launches is as follows: 363 in the United States, 341 in the Asia Pacific (excluding Japan), and 171 in Europe. The United States reported the highest number of closures at 104, followed by the Asia Pacific (excluding Japan) at 85, and Europe at 56.

A total of 281 providers have contributed to these new launches, which are spread across 39 exchanges globally. There have been 314 closures from 107 providers across 24 exchanges. The newly listed products include 461 Active, 374 Equity, and 104 Fixed Income asset classifications.

New product listings and closures in the Global ETFs industry in the first 7 months of 2024

Source: ETFGI, ETF issuers and exchanges.

The 1,063 new products are managed by 281 different providers. iShares listed the largest number of new products 56, followed by Global X ETFs with 41 new launches and First Trust with 29 new launches.

The 1,063 new products are managed by 281 different providers. iShares listed the largest number of new products 56, followed by Global X ETFs with 41 new launches and First Trust with 29 new launches.

Top 15 providers of new launches in the first 7 months of 2024

Source: ETFGI, ETF issuers and exchanges.

Looking at new product listing activity in the first 7 months of the year from 2020 to 2024, the global ETFs industry has seen a significant increase in the number of new launches going from 591 to 1,063. In 2024, the US and Asia Pacific (ex-Japan) have seen the largest launches reaching 363 and 341 respectively, while Latin America has seen the fewest launches only 8.

The US, Asia Pacific (ex-Japan), Canada and Japan have shown the launch peak in 2024 with 363, 341, 121 and 26 respectively. Europe achieved its highest number of launches in 2022 with 266, Latin America recorded 22 in both 2022 and 2021, while the Middle East and Africa reached 51 in 2021.

New listings in the first 7 months of the year in the Global ETFs industry: 2020 to 2024

Source: ETFGI, ETF issuers and exchanges.

The number of product closures YTD through end of July 2024 decreased in every region compared to the same period in 2023. In 2024, the US and Asia Pacific (excluding Japan) recorded the highest number of closures, with 104 and 85 respectively, while Japan and Latin America had the fewest, with only 2 closures each.

This report underscores the dynamic nature of the ETF industry and highlights the continued growth and diversification of the market. Contact ETFGI to learn about our subscription research services contact@etfgi.com

Closures in the Global ETFs industry YTD through end of July: 2020 to 2024

Source: ETFGI, ETF issuers and exchanges.

Assets invested in the global ETFs industry reached a record of US$13.61 trillion at the end of July 2024. The global ETFs industry gathered US$216.64 billion in net inflows in July 2024, bringing year to date net inflows to US$947.00 billion. At the end of July 2024, the Global ETF/ETP industry had 12,565 ETFs/ETPs, with 25,135 listings, assets of US$13.61 Tn, from 757 providers on 81 exchanges in 63 countries, according to ETFGI's July 2024 global ETFs and ETPs industry landscape insights report.

In the first 7 months of 2024, the ETF market has experienced a dynamic surge, with significant asset accumulation by newly launched ETFs. The Top 3 ETFs highlight the dominance of cryptocurrency ETFs, with iShares Bitcoin Trust (IBIT US) holding US$22.58 billion in assets, followed by Grayscale Bitcoin Trust (GBTC US) with US$15.74 billion and Fidelity Wise Origin Bitcoin Fund (FBTC US) with US$11.85 billion.

Reflecting the upswing in cryptocurrency investing since the approval of Bitcoin ETFs in the US in January 2024, the US Securities and Exchange Commission approved Ethereum ETFs for trading in July 2024. Grayscale Ethereum Trust (ETHE US) reached 4th place in the Top 25 by Asset with US$6.63 Bn and Grayscale Ethereum Mini Trust ETH (ETH US) ranked 14th with US$1.16 Bn, both launched by Grayscale Advisors on the NYSE.

In addition to cryptocurrency focused ETF, the Top 25 list includes ETFs from various sectors such as high dividend, equity, active, and climate-related ETFs, demonstrating the wide range of investment opportunities available to investors today.

Top 25 new products listed in the first 7 months of 2024 in the Global ETFs industry based on AUM

Source: ETFGI, ETF issuers and exchanges.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

📢 Register now to join the discussions and networking at our upcoming ETFGI Global ETFs Insights Summits!

- 5th Annual ETFGI Global ETFs Insights Summit - Asia Pacific – September 11th at Centricity – Concentric in Hong Kong and virtually on September 12th. Register at https://bit.ly/3HDBLD9

- 5th Annual ETFGI Global ETFs Insights Summit – U.S. – October 29th at The Yale Club in New York City. Register before September 20th for an early bird discount https://bit.ly/3vZ2R55

- 6th Annual ETFGI Global ETFs Insights Summit - Canada – November 27th at Borden Ladner Gervais’s office in Toronto. Register before October 18th for an early bird discount https://bit.ly/42jsIRc

The ETFGI Global ETFs Insights Summits are designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, product trends: active, bitcoin, crypto, ESG, thematic and trading developments that are impacting investors.

Why You Should Attend:

🥂 Exclusive Networking: Don't miss the networking lunch and drinks reception.

🌐 Global Leaders: Engage with ETF sponsors, exchanges, broker-dealers, institutional investors, regulators, and more.

🎧 On-Demand Access: All sessions will be recorded and accessible after the event. Register now

🆓 Free Registration: For CFA members, buy-side institutional investors, and financial advisors.

📚 CPD Credits: Earn educational credits for your professional development.

![]()

Can't attend in person? Register anyway and receive recordings of all sessions to watch at your convenience.

You can also catch a glimpse of the agenda, speakers, and topics from last year's successful ETFGI Global ETFs Insights Summits!

- 4th Annual ETFGI Global ETFs Insights Summits - #LatinAmerica - https://rb.gy/pcsp8n

- 4th Annual ETFGI Global ETFs Insights Summits - #Europe&MEA - https://rb.gy/29ti17

- 4th Annual ETFGI Global ETFs Insights Summits - #AisaPacific, Hong Kong - https://rb.gy/pclepm

- 4th Annual ETFGI Global ETFs Insights Summits - #US, New York - https://rb.gy/xwhtjr

- 5th Annual ETFGI Global ETFs Insights Summits - #Canada, Toronto- https://rb.gy/rremx7

ETFGI (www.ETFGI.com) has for over 12 years published monthly subscription research reports covering trends in the global ETFs ecosystem, created factsheets for every ETF listed globally, provided consulting services and educational events and ETF TV (www.ETFtv.net).

If you are interested in sponsoring or speaking at any of our upcoming events or have any questions, please contact us deborah.fuhr@etfgi.com and margareta.hricova@etfgi.com.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.