ETFGI reports assets invested in the Global ETFs industry reached a new record high of 14.46 trillion US Dollars at the end of September

Press Release

LONDON — October 15, 2024 — ETFGI, a prominent independent research and consultancy firm specializing in providing subscription research on trends in the global ETFs industry, reports assets invested in the Global ETFs industry reached a new record high of US$14.46 trillion at the end of September. During the month the global ETFs industry gathered US$164.74 billion in net inflows, bringing year to date net inflows to a record US$1.24 trillion, according to ETFGI's September 2024 global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted)

Highlights

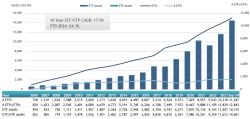

- Assets invested in the global ETFs industry reached a record of $14.46 Tn at the end of September beating the previous record of $13.99 Tn at the end of August 2024.

- Assets have increased 24.3% YTD in 2024, going from $11.63 Tn at end of 2023 to $14.46 Tn.

- Net inflows of $164.74 Bn during September.

- YTD net inflows of $1.24 Tn are the highest on record, while the second highest recorded YTD net inflows was of $923.09 Bn in 2021 and the third highest recorded YTD net inflows of $596.39 Bn in 2023.

- 64th month of consecutive net inflows.

“The S&P 500 index increased by 2.14% in September and is up by 22.08% year-to-date in 2024. The developed market index excluding the US increased by 1.26% in September and is up 12.53% YTD in 2024. Hong Kong (up 16.51%) and Singapore (up 7.43%) saw the largest increases amongst the developed markets in September. The emerging market index increased by 7.72% during September and is up 19.45% YTD in 2024. China (up 23.89%) and Thailand (up 12.43%) saw the largest increases amongst emerging markets in September.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Asset growth in the Global ETFs industry as of the end September

The Global ETFs industry had 12,843 products, with 25,590 listings, assets of $14.46 Tn, from 781 providers listed on 81 exchanges in 63 countries at the end of September.

During September, ETFs gathered net inflows of $164.74 Bn. Equity ETFs saw net inflows of $105.54 Bn over September, bringing YTD net inflows to $696.15 Bn, much higher than the $294.39 Bn in YTD net inflows in 2023. Fixed income ETFs had net inflows of $26.08 Bn during September, bringing YTD net inflows to $247.19 Bn, higher than the $196.72 Bn in net inflows YTD in 2023. Commodities ETFs reported net inflows of $2.36 Bn during September, bringing YTD net inflows to $1.08 Bn, higher than the $11.31 Bn in net outflows YTD in 2023. Active ETFs attracted net inflows of $26.85 Bn during the month, gathering YTD net inflows of $240.14 Bn, higher than the $113.80 Bn in net inflows YTD in 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $71.45 Bn during September. SPDR S&P 500 ETF Trust (SPY US) gathered $17.89 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows September 2024: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

588,640.89 |

(726.22) |

17,885.40 |

|

Vanguard S&P 500 ETF |

|

VOO US |

528,169.74 |

71,193.61 |

10,220.51 |

|

Huatai-Pinebridge CSI 300 ETF |

|

510300 CH |

56,644.25 |

28,533.96 |

5,910.39 |

|

iShares MSCI EAFE Value ETF |

|

EFV US |

19,856.38 |

840.73 |

4,230.67 |

|

E Fund CSI 300 ETF |

|

510310 CH |

37,334.77 |

23,702.54 |

3,158.49 |

|

Vanguard Total Bond Market ETF |

|

BND US |

118,754.15 |

11,743.04 |

2,952.82 |

|

iShares Core Total USD Bond Market ETF |

|

IUSB US |

33,213.01 |

8,679.27 |

2,814.43 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

437,999.88 |

23,822.98 |

2,745.29 |

|

China Southern CSI 1000 ETF |

|

512100 CH |

9,996.42 |

7,214.00 |

2,737.99 |

|

iShares Broad USD High Yield Corporate Bond ETF |

|

USHY US |

19,577.53 |

6,879.77 |

2,070.59 |

|

iShares Core S&P 500 ETF |

|

IVV US |

526,832.84 |

45,368.97 |

2,045.81 |

|

China CSI 500 ETF |

|

510500 CH |

17,655.60 |

8,767.79 |

1,930.55 |

|

iShares 7-10 Year Treasury Bond ETF |

|

IEF US |

33,998.77 |

5,736.45 |

1,829.49 |

|

Invesco S&P 500 Equal Weight ETF |

|

RSP US |

64,794.45 |

7,875.33 |

1,642.05 |

|

iShares Core € Corp Bond UCITS ETF |

|

IEBC LN |

18,992.88 |

833.73 |

1,631.42 |

|

Blackrock Flexible Income ETF |

|

BINC US |

5,692.48 |

5,102.51 |

1,584.14 |

|

ChinaAMC CSI 1000 ETF |

|

159845 CH |

4,891.15 |

3,881.73 |

1,537.47 |

|

iShares Core MSCI World UCITS ETF |

|

IWDA LN |

87,639.76 |

8,550.71 |

1,518.28 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

126,780.88 |

7,960.59 |

1,514.17 |

|

Harvest CSI 300 Index ETF |

|

159919 CH |

21,505.79 |

13,619.94 |

1,489.37 |

The top 10 ETPs by net new assets collectively gathered $1.21 Bn over September.

WisdomTree Brent Crude Oil (BRNT LN) gathered $239.75 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows September 2024: Global

|

Name |

|

Ticker |

Asset |

NNA |

NNA |

|

|

BRNT LN |

660.96 |

(1,081.09) |

239.75 |

|

|

SMO Physical Gold ETC |

|

BARS LN |

731.35 |

683.58 |

225.62 |

|

WisdomTree Copper |

|

COPA LN |

1,383.09 |

(212.15) |

176.24 |

|

Hashdex Nasdaq Crypto Index Europe ETP |

|

HASH SW |

350.59 |

329.21 |

143.34 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

|

GOLD FP |

5,264.43 |

173.27 |

94.27 |

|

ProShares UltraShort DJ-UBS Natural Gas |

|

KOLD US |

131.64 |

(88.08) |

81.95 |

|

Global X Physical Gold |

|

GOLD AU |

2,333.25 |

92.55 |

77.62 |

|

WisdomTree Industrial Metals |

|

AIGI LN |

606.97 |

104.99 |

77.29 |

|

WisdomTree Physical Gold - GBP Daily Hedged |

|

GBSP LN |

1,703.07 |

(19.18) |

63.87 |

|

WisdomTree WTI Crude Oil 3x Daily Leveraged |

|

3OIL LN |

64.64 |

22.22 |

31.42 |

Investors have tended to invest in Equity ETFs during September.

📢Speaker Lineup Announced, Register Now: Limited tickets remaining for the 5th Annual ETFGI Global ETFs Insights Summits – U.S. Join us at The Yale Club in New York City on October 29th.

The summit is designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being traded, selected, and used and hear about the most current regulatory, index, product trends: active, bitcoin, crypto, ESG, thematic and trading developments that are impacting investors.

Limited tickets are available, so we encourage you to register now and secure your spot at this exclusive gathering to network and connect with key industry leaders.

SPEAKERS WILL INCLUDE (check our website for updates):

- Scott Acheychek, COO, REX Financial

- Luis Berruga, Founder & Managing Partner, LBS Capital

- Eric Biegeleisen, CFA, Partner, Deputy CIO, 3EDGE Asset Management

- Jessica Clancy, ETF Strategist, Jane Street

- Deborah Fuhr, Managing Partner, ETFGI and a founder and board member of Women in ETFs and co-president Women in ETFs EMEA

- Sandy Kaul, Head of Digital Asset and Industry Advisory Services, Franklin Templeton

- Barry Pershkow, Partner, Chapman and Cutler LLP

- Rick Redding, CEO, Index Industry Association

- Bruce Saltzman, CFA, Managing Director, Head of Americas ETF Capital Markets, State Street Global Advisors

- Peter Shea, Partner, K&L Gates

- Ophelia Snyder, Co-Founder, President, 21.co

- Kim Tilley, Managing Director, Head of Investment Solutions, Lazard Asset Management

- Jim Toes, President & CEO, Security Traders Association

- Richard Vagnoni, Senior Economist, FINRA

- Morrison Warren, Co-Chair Investment Management Group, Chapman and Cutler LLP

TOPICS WILL INCLUDE (check our website for updates):

- Fireside Chat with Luis Berruga, Industry Veteran

- Understanding Market Trends and User Behavior in ETFs

- The Evolution and Future of Active ETFs

- Trends and Insights on FINRA’s Role in Shaping ETFs and Their Use

- Hot Regulatory Topics - SEC and the Future of ETFs

- What’s Next for Digital Assets Tokenization

- Emerging Trends in Model Portfolios and Future Opportunities

- International ETF Markets: Regional Insights

- Future Perspectives: Insights from Industry Leaders

- Future of ETFs: Trends and Analysis by ETFGI

ADDITIONAL HIGHLIGHTS:

🆓 Free Registration: For CFA members, buy-side institutional investors, and financial advisors.

📚 CPD Credits: Earn educational credits for your professional development.

🎧 On-Demand Access: All sessions will be recorded and accessible after the event.

🌐 Industry Leaders: Engage with ETF sponsors, exchanges, broker-dealers, institutional investors, regulators, and more.

🥂 Exclusive In-Person Networking: Networking lunch and a networking drinks reception sponsored by Waystone

![]()

You can also register for our 6th Annual ETFGI Global ETFs Insights Summits - #Canada – November 27th in Toronto. Register before October 18th for an early bird discount https://bit.ly/4bu7Mv8

If you are interested in sponsoring or speaking at any of our upcoming events or have any questions, please contact us deborah.fuhr@etfgi.com and margareta.hricova@etfgi.com.