ETFGI reports that assets invested in actively managed ETFs listed globally reached a new record of US$1.48 trillion at the end of June

Press Release

LONDON — July 22, 2025 — ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that assets invested in the actively managed ETFs industry globally reached a new record of US$1.48 trillion at the end of June. During June the actively managed ETFs industry globally gathered net inflows of US$46.77 billion, bringing year-to-date net inflows to a record US$267.02 billion, according to ETFGI's June 2025 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Global Actively Managed ETF Industry Update – June 2025

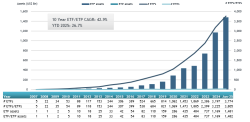

- Record-High Assets: Assets invested in the global actively managed ETFs industry reached a new all-time high of $1.48 trillion at the end of June 2025, surpassing the previous record of $1.39 trillion set in May 2025.

- Strong Year-to-Date Growth: Assets have grown by 26.7% year-to-date, rising from $1.17 trillion at the end of 2024 to $1.48 trillion by June 2025.

- Robust Monthly Inflows: The industry recorded $46.77 billion in net inflows during June 2025.

- Record-Breaking YTD Inflows: Year-to-date net inflows stand at $267.02 billion, the highest on record. This surpasses the previous YTD records of $153.46 billion in 2024 and $80.03 billion in 2021.

- Sustained Momentum: June marked the 63rd consecutive month of net inflows into actively managed ETFs.

The S&P 500 rose 5.09% in June, bringing its H1 2025 gain to 6.20%. Developed Markets (ex-US) increased 3.24% in June, and are up a strong 20.29% year-to-date. Top Performers in June: Korea: +16.12% and Israel: +11.60%. Emerging Markets gained 4.80% in June, with a year-to-date increase of 11.41%. Top Performers in June: Taiwan: +8.53% and Turkey: +8.49%, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in assets in the actively managed ETFs listed globally as of end of June

There were 3,805 actively managed ETFs listed globally, with 4,942 listings assets of $1.48 Tn, from 573 providers listed on 42 exchanges in 33 countries at the end of June.

Equity focused actively managed ETFs listed globally gathered net inflows of $24.65 Bn during June, bringing year to date net inflows to $148.98 Bn, higher than the $89.35 Bn in net inflows YTD in 2024. Fixed Income focused actively managed ETFs listed globally reported net inflows of $20.51 Bn during June, bringing YTD net inflows to $102.60 Bn, much higher than the $54.49 Bn in net inflows YTD in 2024.

Substantial inflows can be attributed to the top 20 active ETFs by net new assets, which collectively gathered

$19.70 Bn during June. JPMorgan Mortgage-Backed Securities ETF (JMTG US) gathered $5.78 Bn, the largest individual net inflow.

Top 20 actively managed ETFs by net new assets June 2025

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Mortgage-Backed Securities ETF |

JMTG US |

5,782.13 |

5,782.13 |

5,782.13 |

|

JPMorgan Active High Yield ETF |

JPHY US |

2,007.72 |

1,999.79 |

1,999.79 |

|

Direxion Daily TSLA Bull 2X Shares |

TSLL US |

6,170.93 |

3,971.67 |

1,059.36 |

|

YieldMax MSTR Option Income Strategy ETF |

MSTY US |

5,146.91 |

4,034.69 |

897.18 |

|

JPMorgan Nasdaq Equity Premium Income ETF |

JEPQ US |

28,053.12 |

7,852.70 |

877.55 |

|

Janus Henderson AAA CLO ETF |

JAAA US |

21,805.72 |

5,194.61 |

876.46 |

|

Capital Group Dividend Value ETF |

CGDV US |

18,604.79 |

4,524.17 |

835.90 |

|

iShares U.S. Equity Factor Rotation Active ETF |

DYNF US |

19,154.11 |

4,379.90 |

784.40 |

|

Neos Nasdaq-100 High Income ETF |

QQQI US |

2,605.42 |

1,818.96 |

779.40 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

31,897.10 |

3,665.51 |

751.97 |

|

KB RISE Short Term Specialized Bank Bond Active ETF |

0061Z0 KS |

674.53 |

674.53 |

674.53 |

|

MIRAE ASSET TIGER MONEY MARKET ACTIVE ETF |

0043B0 KS |

908.37 |

1,026.10 |

588.66 |

|

JPMorgan Limited Duration Bond ETF |

JPLD US |

1,769.05 |

798.74 |

556.72 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

40,993.10 |

4,508.56 |

549.50 |

|

Tortoise Energy Fund |

TNGY US |

536.61 |

533.81 |

533.81 |

|

Brown Advisory Sustainable Growth ETF |

BASG US |

489.29 |

473.72 |

473.72 |

|

Capital Group Growth ETF |

CGGR US |

13,512.71 |

3,106.54 |

470.61 |

|

Fidelity Total Bond ETF |

FBND US |

19,269.55 |

2,012.63 |

426.56 |

|

Blackrock Flexible Income ETF |

BINC US |

9,839.83 |

2,829.76 |

394.94 |

|

TCW Core Plus Bond ETF |

FIXT US |

389.41 |

383.69 |

383.69 |

Investors have tended to invest in Equity actively managed ETFs during June.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

Register now to attend our 6th Annual ETFGI Global ETFs Insights Summit - United States on November 5 in New York City at The Yale Club in New York.

The summit is designed as an educational event to foster deep, insightful discussions on the use, due diligence and selection and best trading practices for ETFs by financial advisors and institutional investors in the United States. Explore how regulatory changes are impacting product development including ETF and mutual fund share classes, Active ETFs, conversions Crypto, digital assets and tokenisation and market structure.

Topics will include:

- Trends in the ETFs Industry - ETFGI Research

- Global Macro Outlook

- Innovation, Growth and Changing Demographics: The ETF Story in US

- The Rise of Active ETFs in the US

- The Rise of Alternative Strategies in the ETF Wrapper

- Update on ETF and Mutual Fund Share Classes, Conversions

- Opportunities for Virtual Assets and Tokenization in US

- Outlook for ETFs and the Asset Management Industry – What's Next?

- Networking drinks hosted by Waystone

Don’t miss this opportunity to explore key trends and network with industry leaders driving the future of ETFs. Register now to join us!

📅 Event Date: November 5th

⏰Time: Full day event including a networking drinks reception hosted by Waystone

📍Location: The Yale Club, New York City

🆓 Free Registration: For CFA members, buy-side institutional investors, and financial advisors

🐤 Early Bird Discount: Ends September 28th, 2025

CPD Credits: Earn educational credits

📋View the agenda, speakers, and topics from last year's successful 5th annual ETFGI Global ETFs Insights Summit - U.S. : https://bit.ly/49sAa03

Upcoming 2025 ETFGI Global ETFs Insights Summits schedule:

- 6th Annual - Asia Pacific 2025 in Hong Kong on September 3rd and virtually on September 4th. Register now.

- 6th Annual - Middle East 2025 in Abu Dhabi on October 7 at ADGM. Register now.

- 7th Annual - Canada 2025 - Join us to Celebrate 35 Years of ETFs in Toronto, Canada on Dec 9th at Borden Ladner Gervais LLP (BLG)’s office! Register now.

ETFGI (www.ETFGI.com) is a leading independent firm which has for over 13 years provided subscription research services providing monthly reports covering trends in the global ETFs ecosystem, factsheets on all ETFs and ETPs listed globally, consulting services, ETF TV (www.ETFtv.net) and our Annual ETFGI Global ETFs Insights Summit educational events.

If you are interested in sponsoring or speaking at any of our upcoming events or have any questions, please contact us deborah.fuhr@etfgi.com and margareta.hricova@etfgi.com.

|

Disclaimer: This press release is published by, and remains the copyright of, ETFGI LLP ("ETFGI") or its licensors. The information and data in this press release is for information purposes only. ETFGI makes no warranties or representations regarding the accuracy or completeness of the information contained on this press release.

ETFGI does not offer investment advice or make recommendations regarding investments and nothing in the press release shall be deemed to constitute financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. Further, nothing in this press release shall constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any such activity based on information contained in this press release, you do so entirely at your own risk and ETFGI shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Our registered office is at 130 Jermyn Street, 2nd Floor, St James’s, London, SW1Y 4UR.