ETFGI reports that assets invested in the ETFs industry in Canada reached a new record of US$483.83 billion at the end of June

Press Release

LONDON — July 21, 2025 — ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that assets invested in the ETFs industry in Canada reached a new record of US$483.83 billion at the end of June. During June the ETFs industry in Canada gathered net inflows of US$6.61 billion, bringing year-to-date net inflows to a record US$47.10 billion, according to ETFGI's June 2025 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Canada’s ETF market continues to demonstrate robust growth and investor confidence:

- Record AUM: Assets under management reached a new high of $483.83 billion at the end of June, surpassing the previous record of $463.25 billion in May.

- Impressive YTD Growth: Assets have grown 21.8% year-to-date, up from $397.15 billion at the end of 2024.

- June Inflows: The industry attracted $6.61 billion in net inflows during June.

- Historic YTD Inflows: With $47.10 billion in net inflows so far in 2025, this marks the highest YTD total on record. The previous highs were $28.24 billion in 2024 and $26.32 billion in 2021.

- Consistent Growth: June marks the 36th consecutive month of net inflows, highlighting sustained investor trust and market resilience.

OSC Study & CSA Consultation on ETFs both published in June.

OSC Study: An Empirical Analysis of Canadian ETF Liquidity and the Effectiveness of the Arbitrage Mechanism - This study, provides an empirical analysis of the Canadian ETF market, focusing on liquidity and the arbitrage mechanism. Its findings informed the CSA's consultation paper.

CSA Consultation Paper 81-409 – Enhancing Exchange-Traded Fund Regulation: Proposed Approaches and Discussion - This consultation paper, outlines the CSA's views on potential gaps and proposes enhancements to the ETF regulatory framework. The comment period for this paper closes on October 17, 2025.

The S&P 500 rose 5.09% in June, bringing its H1 2025 gain to 6.20%. Developed Markets (ex-US) increased 3.24% in June, and are up a strong 20.29% year-to-date. Top Performers in June: Korea: +16.12% and Israel: +11.60%. Emerging Markets gained 4.80% in June, with a year-to-date increase of 11.41%. Top Performers in June: Taiwan: +8.53% and Turkey: +8.49%, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

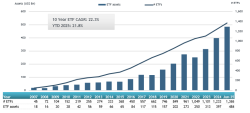

Growth in assets in the ETFs industry in Canada as of the end of June

The ETFs industry in Canada had 1,365 ETFs, with 1,712 listings, assets of US$483.83 Bn, from 45 providers on 2 exchanges at the end of June.

During June, ETFs gathered net inflows of $6.61 Bn. Equity ETFs reported net inflows of $2.57 Bn during June, bringing YTD net inflows to $16.50 Bn, higher than the $12.82 Bn in YTD net inflows in 2024. Fixed income ETFs gathered net inflows of $519.03 Mn during June, bringing YTD net inflows $6.19 Bn, higher than the $5.25 Bn in net inflows YTD in 2024. Active ETFs reported net inflows of $3.25 Bn during the month, gathering YTD net inflows of $22.81 Bn, much higher than the $10.27 Bn in YTD net inflows in 2024. Crypto ETFs reported net inflows of $80.97 Mn during June, bringing YTD net inflows to $269.69 Mn, higher than the $559.89 Mn in net outflows YTD in 2024.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $3.46 Bn during June. iShares Core S&P/TSX Capped Composite Index ETF (XIC CN) gathered $461.58 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets June 2025: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

XIC CN |

12,620.55 |

977.16 |

461.58 |

|

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

9,343.26 |

1,601.77 |

378.54 |

|

Fidelity All-in-One Balanced ETF |

FBAL CN |

2,662.47 |

1,019.89 |

232.05 |

|

BMO S&P 500 Index ETF |

ZSP CN |

15,654.37 |

(719.05) |

202.96 |

|

iShares Core Equity ETF Portfolio |

XEQT CN |

5,991.57 |

1,309.64 |

201.02 |

|

Global X S&P/TSX Capped Composite Index ETF |

HXCN CN |

1,182.10 |

25.15 |

161.01 |

|

iShares S&P 500 Index ETF |

XUS CN |

7,370.25 |

919.40 |

150.51 |

|

Fidelity All-in-One Equity ETF |

FEQT CN |

1,171.66 |

586.60 |

149.08 |

|

Scotia US Equity Index Tracker ETF |

SITU CN |

1,976.97 |

552.65 |

146.75 |

|

NBI Unconstrained Fixed Income ETF |

NUBF CN |

1,970.48 |

131.54 |

141.60 |

|

Invesco ESG NASDAQ 100 Index ETF |

QQCE CN |

360.41 |

200.99 |

138.73 |

|

Scotia Canadian Bond Index Tracker ETF |

SITB CN |

832.28 |

499.35 |

133.36 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

3,626.79 |

888.61 |

132.12 |

|

Vanguard FTSE Canada All Cap Index ETF |

VCN CN |

7,234.71 |

498.44 |

128.15 |

|

Vanguard All-Equity ETF Portfolio |

VEQT CN |

5,535.23 |

889.37 |

123.33 |

|

Fidelity Systematic Canadian Bond Index ETF |

FCCB CN |

1,396.88 |

493.97 |

123.03 |

|

Fidelity All-in-One Growth ETF |

FGRO CN |

1,404.54 |

514.83 |

121.61 |

|

Scotia Canadian Large Cap Equity Index Tracker ETF |

SITC CN |

294.68 |

179.93 |

115.45 |

|

iShares Core MSCI Canadian Quality Dividend Index ETF |

XDIV CN |

1,858.11 |

351.78 |

112.52 |

|

TD Canadian Long Term Federal Bond ETF |

TCLB CN |

639.38 |

43.69 |

110.81 |

Investors have tended to invest in Active ETFs during June.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

|

|

|

|

Register now to attend our 7th annual ETFGI Global ETFs Insights summit – Canada on December 9th at Borden Ladner Gervais LLP (BLG)’s office! The day will begin with an opening bell-ringing ceremony with the TMX Group to celebrate 35 years of ETFs in Canada, followed by a full-day of panel discussions featuring industry leaders and concluding with a networking drinks reception. Register now! The summit is designed as an educational event to foster deep, insightful discussions on the use, due diligence and selection and best trading practices for ETFs by financial advisors and institutional investors in Canada. Explore how regulatory changes are impacting product development including share classes, Active ETFs, conversions Crypto, digital assets and tokenisation and market structure.

Topics will include:

Don’t miss this opportunity to explore key trends and network with industry leaders driving the future of ETFs. Register now to join us!

|

||

|

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer: This press release is published by, and remains the copyright of, ETFGI LLP ("ETFGI") or its licensors. The information and data in this press release is for information purposes only. ETFGI makes no warranties or representations regarding the accuracy or completeness of the information contained on this press release.

ETFGI does not offer investment advice or make recommendations regarding investments and nothing in the press release shall be deemed to constitute financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. Further, nothing in this press release shall constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any such activity based on information contained in this press release, you do so entirely at your own risk and ETFGI shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Our registered office is at 130 Jermyn Street, 2nd Floor, St James’s, London, SW1Y 4UR.