ETFGI reports the global ETFs industry had a record 1308 new products launched in the first half of 2025

Press Release

LONDON — July 18, 2025 — ETFGI, a respected independent research and consultancy firm, has announced a significant milestone for the global Exchange-Traded Funds (ETFs) industry. As of the end of June 2025, a total of 1,308 new ETF products have been launched globally. After accounting for 266 closures, this results in a net increase of 1,042 ETFs, surpassing the previous record of 878 new listings by this time in 2024.

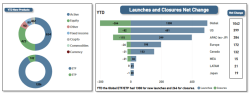

In the first half of 2025, the global ETF market saw a diverse regional distribution of new product launches. The United States led with 481 new ETFs, followed by the Asia Pacific region (excluding Japan) with 399, and Europe with 198. In terms of closures, Asia Pacific (excluding Japan) recorded the highest number at 115, while the United States and Europe saw 82 and 26 closures, respectively. A total of 326 providers contributed to the new listings, which were spread across 36 exchanges worldwide. Meanwhile, 98 providers were responsible for the 266 closures, which occurred across 24 exchanges. The newly launched ETFs were categorized across various asset classes, including 654 active ETFs, 425 equity ETFs, and 80 fixed income ETFs, reflecting the continued diversification and innovation within the industry.

New launches and closures in the Global ETFs industry in the first half of 2025

Source: ETFGI, ETF issuers and exchanges.

Of the 1,308 newly launched ETF products, 326 different providers were involved in their creation. Among them:

- iShares led the way with 42 new listings,

- Followed by Global X with 36 launches, and

- First Trust with 27 new products.

This highlights the continued leadership of major players in driving innovation and expansion within the global ETF market.

Top 15 providers of new launches in the first half of 2025

Source: ETFGI, ETF issuers and exchanges.

YTD through end of June from 2021 to 2025, the global ETFs industry has seen a significant increase in the number of new launches going from 808 to 1308. In 2025, the US and Asia Pacific (ex-Japan) have seen the largest launches reaching 481 and 399 respectively, while Japan has seen only 20 launches.

The US, Asia Pacific (ex-Japan), Canada and Latin America have shown their launch peak in 2025 with 481, 399, 153 and 21 respectively. Europe recorded 247 in 2022, Middle East and Africa reached 41 in 2021, and Japan recorded 22 in 2024.

New launches in the Global ETFs industry in the first half of each year: 2021 to 2025

Source: ETFGI, ETF issuers and exchanges.

The number of product closures YTD through end of June 2025 decreased in every region compared to the same period in 2024, except Asia Pacific (ex-Japan). In 2025, Asia Pacific (excluding Japan), the US and Europe recorded the highest number of closures, with 115, 82 and 26 respectively, while Latin America has not seen any closures.

Compared to the five years for closures, Asia Pacific (ex-Japan) recorded its most closures in 2025 with 115, while the US had its highest closures of 132 in 2023. Europe recorded its highest closures of 97 in 2023, Canada saw 44 closures in 2023 and Middle East and Africa recorded 46 closures in 2023.

This report underscores the dynamic nature of the ETF industry and highlights the continued growth and diversification of the market. Contact ETFGI to learn about our subscription research services contact@etfgi.com

Closures in the Global ETFs industry in the first half of each year: 2021 to 2025

Source: ETFGI, ETF issuers and exchanges.

Global ETF Industry Milestones – June 2025

- Record-High Assets: Assets invested in the global ETF industry reached a new all-time high of $16.99 trillion at the end of June, surpassing the previous record of $16.27 trillion set in May 2025.

- Strong Year-to-Date Growth: Assets have grown 14.5% year-to-date, rising from $14.85 trillion at the end of 2024.

- Robust Monthly Inflows: The industry attracted $158.78 billion in net inflows during June alone.

- Record-Breaking YTD Inflows: Year-to-date net inflows totaled $897.65 billion, marking the highest on record. This surpasses the previous highs of $730.18 billion in 2024 and $658.86 billion in 2021.

- Consistent Momentum: June 2025 marks the 73rd consecutive month of net inflows into ETFs globally.

The first half of 2025 has seen a dynamic surge in the global ETF market, marked by substantial asset accumulation among newly launched funds. This trend reflects growing investor appetite for innovative and diversified investment strategies.

The Top 5 ETFs were JPMorgan Mortgage-Backed Securities ETF (JMTG US) holding US$5.78 billion in assets, followed by WisdomTree Europe Defence UCITS ETF (WDEF IM) with US$3.38 billion, China Southern SSE Market-Making Corporate Bond ETF (511070 CH) with US$3.02 billion, ChinaAMC SSE Market-Making Corporate Bond ETF (511200 CH) with US$3.02 billion and E Fund SSE Market-Making Corporate Bond ETF (511110 CH) with US$2.97 billion.

The Top 25 new launches globally during the first half of 2025 includes ETFs from various sectors such as high dividend, equity, active, and climate-related ETFs, demonstrating the wide range of investment opportunities available to investors today.

Top 25 new launches globally in the first half of 2025 ranked by AUM as of end of June

Source: ETFGI, ETF issuers and exchanges.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

Register now to join us at our 6th Annual ETFGI Global ETFs Insights Summit - Middle East/ GCC on October 7th in Abu Dhabi at ADGM.

The summit is designed to be an educational event fostering discussions will address key trends shaping the wealth, private banking, and asset management landscape in the Middle East region including looking at the Exchange Traded Funds “ETFs”. We will discuss best practices in the due diligence, selection, and trading of local, US and UCITS ETFs by financial advisors and institutional investors in the GCC – with a specific focus on the UAE, Saudi Arabia and Qatar. Hear from industry leaders from ETF issuers, regulators, investors, exchanges, and trading firms who will share insights on product development, regulations, trading practices, and technological advancements shaping ETF innovation and usage.

Topics will include:

- Welcome Remarks

- Trends in the ETF Industry - ETFGI Research

- Macro Outlook

- Regulatory Framework in the UAE/GCC for Funds & ETFs

- Investor Trends

- Evolution of ETFs in the UAE & GCC

- How Investors are Using ETFs

- Best Practices for Selecting and Trading ETFs

- Future Outlook for Asset Management and ETS in a UAE & GCC

Part II: Celebrating Women in the ETFs and Financial Industry in the GCC

- Navigating a Successful Career in the GCC

- Networking Drinks Reception

Don’t miss this opportunity to explore key trends and network with experts driving the future of ETFs.

📅 Event Date: October 7th

📍Location: ADGM, Abu Dhabi

🆓 Free Registration: For CFA members, buy-side institutional investors, and financial advisors

🐤 Early Bird Discount: Ends August 26th, 2025

CPD Credits: Earn educational credits

📋View the agenda, speakers, and topics from last year's successful ETFGI Global ETFs Insights Summit - Middle East: https://bit.ly/3ZDwyoU

Upcoming 2025 ETFGI Global ETFs Insights Summits schedule:

- 6th Annual - Asia Pacific 2025 in Hong Kong on September 3rd and virtually on September 4th. Register now.

- 6th Annual - United States 2025 in New York on November 5 at The Yale Club. Register now.

- 7th Annual - Canada 2025 - Join us to Celebrate 35 Years of ETFs in Canada at Borden Ladner Gervais LLP (BLG)’s office on Dec 9th in Toronto! Register now.

|

|

|

|

Disclaimer: This press release is published by, and remains the copyright of, ETFGI LLP ("ETFGI") or its licensors. The information and data in this press release is for information purposes only. ETFGI makes no warranties or representations regarding the accuracy or completeness of the information contained on this press release.

ETFGI does not offer investment advice or make recommendations regarding investments and nothing in the press release shall be deemed to constitute financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. Further, nothing in this press release shall constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any such activity based on information contained in this press release, you do so entirely at your own risk and ETFGI shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Our registered office is at 130 Jermyn Street, 2nd Floor, St James’s, London, SW1Y 4UR.