ETFGI reports ETF industry in Canada hits Record US$615.85 billion as January Sees Highest‑Ever Monthly Inflows

Press Release

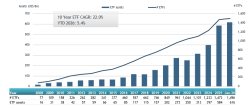

LONDON — February 13, 2026 — ETFGI, reported today that assets invested in the ETFs industry in Canada reached a new record of US$615.85 billion at the end of January. During January the ETFs industry in Canada gathered a record net inflows of US$19.49 billion, according to ETFGI's January 2026 Canadian ETFs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. ETFGI is a leading independent research and consultancy firm with 14 years of experience, recognized for its expertise in subscription research, consulting services, industry events, and ETF TV, covering global ETF industry trends. (All dollar values in USD unless otherwise noted.)

Highlights

- Canadian ETF assets reached a new record of $615.85 billion at the end of January, surpassing the previous high of $584.47 billion set in December 2025.

- ETF assets grew 5.4% year‑to‑date in 2026, rising from $584.47 billion at year‑end 2025 to $615.85 billion in January.

- January net inflows totaled $19.49 billion — the highest monthly inflows on record. This surpasses the previous January records of $7.43 billion in 2025 and $4.40 billion in 2022.

- January marked the 43rd consecutive month of net inflows into Canadian ETFs.

“The S&P 500 rose 1.45% in January. Developed markets excluding the US gained 6.15% in January and are up 6.15%, with Korea (+26.73%) and Luxembourg (+18.64%) posting the strongest increases among developed markets. Emerging markets climbed 5.50% in January, led by Peru (+26.23%) and Colombia (+23.24%).” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in assets in the ETFs industry in Canada as of the end of January

The ETFs industry in Canada has 1,496 ETFs, with 1,871 listings, record $615.85 Bn in AUM, from 49 providers listed on 2 exchanges at the end of January.

RBC iShares is the largest provider in Canada with US$168.44 billion in assets, representing a 27.4% market share. BMO Asset Management ranks second with US$124.43 billion and a 20.2% share, followed by Vanguard with US$100.21 billion and 16.3%. Together, the top three providers account for 63.8% of total Canadian ETF AUM. The remaining 46 providers each hold less than a 6% share of the market.

ETFs industry in Canada gathered a record $19.49 billion in net inflows during January.

Equity ETFs: $9.71 billion in inflows, up from $2.72 billion in January 2025.

Fixed Income ETFs: $2.33 billion in inflows, compared with $538.73 million in January 2025.

Active ETFs: $6.51 billion in inflows, higher than $3.86 billion in January 2025.

Crypto ETFs: $12.08 million in inflows, down from $73.59 million in January 2025.

Currency ETFs: $33.47 million in inflows, below the $61.73 million recorded in January 2025.

Investors have tended to invest in Equity ETFs during January.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

|

|