ETFGI reports Smart Beta ETFs and ETPs listed globally suffered net outflows of US$ 2.22 billion during July 2020

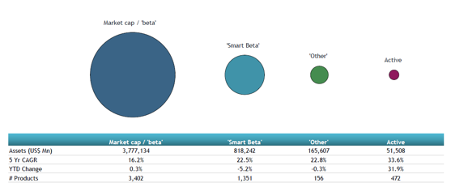

LONDON —August 27, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that equity-based Smart Beta ETFs and ETPs listed globally saw net outflows of US$2.22 billion during July bringing year-to-date net inflows to US$10.36 billion which is significantly lower than the US$52.90 billion gathered at this point last year. July marked the third consecutive month of net outflows for Smart Beta ETFs and ETPs listed globally. Year-to-date through the end of July, Smart Beta Equity ETF and ETP assets have decreased by 5.2% from US$863 billion to US$818 billion, with a 5-year CAGR of 22.5%, according to ETFGI’s July 2020 ETF and ETP Smart Beta industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Smart Beta ETFs and ETPs listed globally suffered net outflows of US$ 2.2 Bn during July

- YTD net inflows are $10.36 Bn which is significantly lower than the $52.90 Bn gathered at this point in 2019.

- YTD through the end of July, Smart Beta Equity ETF/ETP assets have decreased by 5.2% from $863 Bn to US$818 Bn.

“The S&P 500 gained 5.6% in July, aided by the U.S. Federal Reserve stimulus and strong earnings. International markets also gained, with Developed Ex-U.S. and Emerging up 3.0% and 8.5%, respectively. In the developed markets Scandinavian countries benefited most, led by Norway (up 10.8%) and Sweden (up 10.1%); while Japan (down 2.0%) was the sole negative performer among developed countries. Dollar weakness contributed toward the positive momentum in Emerging markets where 19 of 25 countries gained, led by Brazil (up 14.4%) and Pakistan (up 13.4%), while Taiwan (up 12.1%) neared an all-time high.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Comparison of assets in market cap, smart beta, other and active equity products

At the end of July 2020, there were 1,351 smart beta equity ETFs/ETPs, with 2,540 listings, assets of US$818 Bn, from 179 providers listed on 41 exchanges in 33 countries.

Substantial inflows can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $4.30 Bn during July. The iShares Edge MSCI USA Value Factor ETF (VLUE US) gathered $587.05 Mn alone.

Top 20 Smart Beta ETFs/ETPs by net new assets July 2020

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares ESG MSCI USA ETF |

ESGU US |

8036.15 |

5806.75 |

587.05 |

|

Cathay Taiwan Select ESG Sustainability High Yield ETF |

00878 TT |

497.15 |

493.20 |

493.20 |

|

WisdomTree U.S. Dividend Growth Fund |

DGRW US |

3791.51 |

522.01 |

318.98 |

|

iShares MSCI EAFE Growth ETF |

EFG US |

7994.45 |

3031.67 |

311.20 |

|

Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF - Acc |

GSLC US |

8967.30 |

1176.36 |

229.94 |

|

iShares ESG MSCI EAFE ETF |

ESGD US |

2719.61 |

1309.20 |

217.89 |

|

SPDR Portfolio S&P 500 Value ETF |

SPYV US |

5143.68 |

684.92 |

213.44 |

|

iShares Edge MSCI USA Momentum Factor ETF |

MTUM US |

10647.60 |

316.19 |

193.97 |

|

SPDR Portfolio S&P 500 Growth ETF |

SPYG US |

8642.73 |

2119.01 |

181.02 |

|

Invesco S&P SmallCap Low Volatility ETF |

XSLV US |

1419.63 |

(132.54) |

168.33 |

|

Manulife Multifactor Developed International Index ETF |

MINT/B CN |

294.20 |

166.17 |

167.82 |

|

Vanguard Mega Cap Growth ETF |

MGK US |

8663.63 |

1923.22 |

150.00 |

|

Amplify Online Retail ETF - Acc |

IBUY US |

766.54 |

287.91 |

149.40 |

|

CSIF IE MSCI World ESG Leaders Minimum Volatility Blue UCITS ETF |

CSY9 GY |

142.36 |

143.19 |

143.19 |

|

First Trust Capital Strength ETF |

FTCS US |

5613.80 |

1871.68 |

138.19 |

|

Manulife Multifactor Emerging Markets Index Etf |

MEME/B CN |

215.00 |

138.02 |

138.02 |

|

iShares Edge MSCI Europe Momentum Factor UCITS ETF - Acc |

IEFM LN |

411.52 |

138.37 |

126.98 |

|

Invesco S&P 500 Equal Weight Industrials ETF |

RGI US |

315.74 |

95.23 |

125.97 |

|

iShares Edge MSCI USA Momentum Factor UCITS ETF - Acc |

IUMO LN |

612.07 |

144.44 |

124.74 |

|

Schwab US Dividend Equity ETF |

SCHD US |

11868.58 |

863.96 |

122.32 |

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

###

The ETFGI Global ETFs Insights Summits are designed to facilitate substantive and in-depth discussions around the impact that market structure and regulations have on ETF product development, due diligence, suitability, the use and trading, and technological developments have on ETFs and mutual funds in the respective jurisdictions.

Attendees will have the opportunity to see and hear speakers via live video and audio of the keynote and panel discussions with audience Q&A, visit virtual event booths where you can meet and speak with our sponsors, attend virtual happy hours, virtual networking sessions and receive physical promotional items from our sponsors for qualified buy side investors.

Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors.

ETFGI has announced the dates for the upcoming events:

- Latin America - Oct 19

- Asia Pacific - Oct 28-29

- Europe - Nov 17-18

- Canada - Nov 30 - Dec 1

- ESG & Active - TBC

- Visit our website www.etfgi.com to register to receive our press releases

Upcoming Industry Events:

22nd September 2020 - Join us for our virtual event with leading women in finance: «How will current factors impact the future of investing?» The virtual event will be hosted by ETF pioneer Deborah Fuhr, Managing Partner & Founder of ETFGI. She will give her views on trends in the industry. This will be followed by an expert panel with Karin Russell-Wiederkehr, Institutional Sales and Trading at Jane Street, Anna Paglia, Global Head of ETFs & Indexed Strategies at Invesco and Maria Lombardo, Head of ESG Client Strategy EMEA at Invesco.

NEW ETF TV Episode 36 - July continues to see significant inflows into the ETF market

![]() ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

![]()

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com