ETFGI reports the ETF industry in Europe gathered net inflows of US$8.81 billion during March 2022

LONDON —April 29, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs industry in Europe gathered net inflows of US$8.81 billion during March, bringing year-to-date net inflows to US$49.71 billion. During the month of March assets invested in the ETFs industry in Europe increased by 1.9%, from US$1.55 trillion at the end of February to US$1.58 trillion, according to ETFGI's March 2022 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets of $1.58 Tn invested in ETFs industry in Europe at of Q1 are the second highest on record.

- During March assets invested in the ETFs industry in Europe increased by 1.9%.

- Assets decreased 1.2% during Q1 going from $1.60 Tn at end of 2021 to $1.58 Tn.

- ETF industry in Europe gathered net inflows of $8.81 billion during March.

- Q1 net inflows were $49.71 Bn lower, after YTD net inflows in 2021 of $59.29 Bn.

- $184.06 Bn in net inflows gathered in the past 12 months.

- 24th month of consecutive net inflows.

- Equity ETFs and ETPs listed in Europe gathered $34.58 Bn in YTD net inflows 2022.

“The S&P 500 increased by 3.71% in March but is down 4.60% in Q1. Developed markets excluding the US, increased by 1.10% in March and are down 5.57% in Q1. Australia (up 10.46%) and Portugal (up 6.50%) experienced the largest increases amongst the developed markets in March. Emerging markets decreased by 2.27% during March and are down 6.52% YTD in 2022. Egypt (down 14.31%) and China (down 8.34%) witnessed the largest declines among emerging markets in March, whilst Brazil (up 14.51%) and Colombia (up 11.98%) gained the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

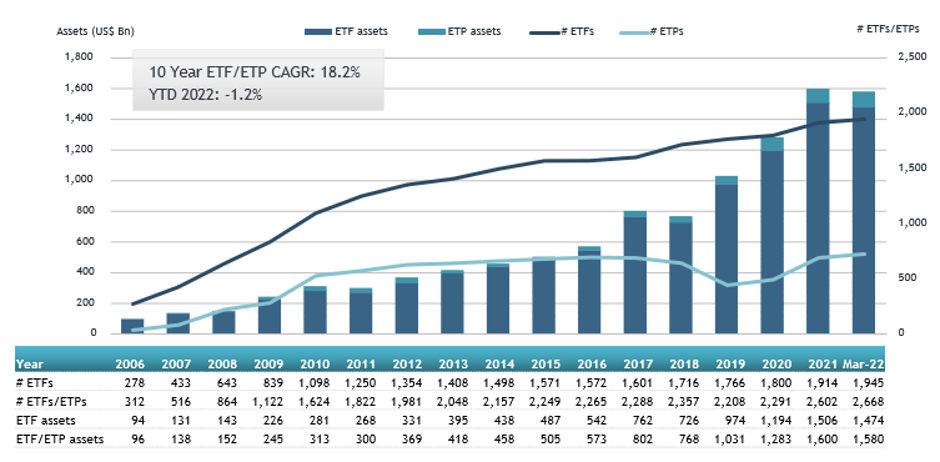

Europe ETFs and ETPs asset growth as at the end of March 2022

The ETFs industry in Europe had 2,668 products, assets of $1.58 Tn, from 88 issuers, listed on 29 exchanges in 24 countries at the end of March.

During March, the ETFs industry Europe gathered net inflows of $8.81 Bn. Equity ETFs/ETPs gathered net inflows of $2.50 Bn over March, bringing Q1 net inflows to $34.58 Bn, lower than the $51.45 Bn in net inflows equity products attracted in Q1 2021. Fixed income ETFs/ETPs had net inflows of $3.20 Bn during March, bringing net inflows for Q1 to $6.85 Bn, higher than the $5.40 Bn in net inflows fixed income products Commodities ETFs/ETPs reported net inflows of $3.72 Bn during March, bringing Q1 net inflows to $7.61 Bn, higher than the $559 Mn in net inflows commodities products had reported in Q1 2021. Active ETFs/ETPs attracted net outflows of $199 Mn over the month, gathering net inflows in Q1 in Europe of $675 Bn, higher than the $547 Mn in net inflows active products had reported in Q1 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $11.92 Bn during March. iShares Core S&P 500 UCITS ETF - Acc (CSSPX SW) gathered $1.35 Bn, the largest individual net inflow.

Top 20 ETFs by net inflows in March 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

CSSPX SW |

60,548.35 |

3,208.86 |

1348.65 |

|

|

iShares J.P. Morgan $ EM Bond UCITS ETF |

SEMB LN |

8,465.51 |

(80.83) |

878.62 |

|

Lyxor Core STOXX EUROPE 600 (DR) - UCITS ETF C-EUR - Acc |

MEUD FP |

4,990.54 |

1,220.11 |

854.20 |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

47,872.75 |

2,670.34 |

738.11 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

6,171.98 |

476.98 |

721.54 |

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

10,769.77 |

(557.70) |

692.38 |

|

Invesco US Treasury 7-10 Year UCITS ETF |

TREX LN |

1,927.12 |

1,536.54 |

688.36 |

|

iShares $ Treasury Bond 3-7yr UCITS ETF - USD D - Acc |

CSBGU7 SW |

4,045.48 |

1,182.37 |

602.13 |

|

UBS Irl ETF plc - S&P 500 ESG UCITS ETF - Dis |

S5SD GY |

3,018.28 |

586.60 |

516.62 |

|

iShares EURO STOXX 50 UCITS ETF |

EUN2 GY |

4,974.22 |

523.44 |

501.59 |

|

AMUNDI INDEX MSCI EUROPE UCITS ETF DR (C) - Acc |

CEU2 FP |

2,080.12 |

522.17 |

491.26 |

|

iShares MSCI World ESG Enhanced UCITS ETF |

EEWD LN |

2,860.77 |

767.53 |

484.65 |

|

iShares S&P 500 UCITS ETF |

IUSA LN |

14,721.40 |

291.92 |

461.13 |

|

Invesco S&P 500 ETF - Acc |

SPXS LN |

14,732.30 |

1,619.63 |

442.54 |

|

iShares MSCI EM UCITS ETF USD (Dist) |

IEEM LN |

4,058.87 |

437.79 |

437.79 |

|

AMUNDI MSCI SWITZERLAND UCITS ETF - EUR (C) - Acc |

CSW FP |

731.66 |

382.04 |

420.31 |

|

iShares $ Treasury Bond 20+yr UCITS ETF |

IBTL LN |

2,696.86 |

839.42 |

415.37 |

|

Invesco EQQQ Nasdaq-100 UCITS ETF |

EQQQ IM |

6,749.41 |

67.53 |

409.94 |

|

iShares MSCI ACWI UCITS ETF - Acc |

ISAC LN |

5,367.09 |

1,091.34 |

405.59 |

|

iShares MSCI China UCITS ETF - Acc |

ICHN NA |

792.89 |

459.67 |

405.18 |

The top 10 ETPs by net new assets collectively gathered $7.17 Bn during March. iShares Physical Gold ETC - Acc (SGLN LN) gathered $2.87 Bn the largest individual net inflow.

Top 10 ETPs by net inflows in March 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

17,362.49 |

3,467.73 |

2,869.46 |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

17,252.88 |

2,102.37 |

2,218.79 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

XGDU LN |

3,973.09 |

1,551.91 |

1,037.67 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

4,850.53 |

591.32 |

487.57 |

|

BTCetc - Bitcoin ETP - Acc |

BTCE GY |

884.42 |

72.45 |

147.46 |

|

Xetra Gold EUR - Acc |

4GLD GY |

15,110.22 |

207.24 |

116.68 |

|

CoinShares FTX Physical Staked Solana |

SLNC GY |

112.82 |

87.26 |

87.26 |

|

WisdomTree Agriculture - Acc |

AIGA LN |

371.43 |

94.67 |

77.42 |

|

GBS Bullion Securities - Acc |

GBS LN |

3,956.60 |

3.09 |

63.45 |

|

WisdomTree Carbon - Acc |

CARB LN |

322.83 |

143.76 |

59.82 |

Investors have tended to invest in Commodities ETFs and ETPs during March.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

If you are interested in hearing about the trends for ETFs in Latin America, Register Here to watch the session recordings from our 3rd annual ETFGI Global ETFs Insights Summit - Latin America on April 27th and 28th

DAY 1 TOPICS INCLUDE

- Trends in the Use of ETFs in Latin America

- How Investors are Using ETFs in Argentina

- How Investors are Using ETFs in Brazil

- How Investors are Using ETFs in Chile

- How Investors are Using ETFs in Colombia

- How Investors are Using ETFs in Mexico

- How Investors are Using ETFs in Peru

- Miami and the Future of Latin America Offshore Wealth

DAY 2 TOPICS INCLUDE

- Overview of Trends in the ETF industry

- Global Macro Outlook

- Overview of Regulations Impacting Investors and ETFs Product Development

- How Investors are Using Equity and Fixed Income ESG ETFs

- How Investors are Using Crypto and Digital Assets ETFs

- Designing Thematic ETFs and Rethinking Country ETFs

- Best Practices When Trading ETFs

? Free registration for buy side institutional investors and financial advisors

? CPD educational credits

? All sessions are recorded and you will also receive access to last year's session recordings

DAY 1 SPEAKERS

DAY 2 SPEAKERS

2022 ETFGI Global ETFs Insights Summits:

- 3rd Annual USA (Hybrid), May 17 - 18 Register Here

- 3rd Annual Europe & MEA (Hybrid), September 20 - 22 Register Here

- 3rd Annual Asia Pacific (Virtual), October 12 - 13 Register Here

- 4th Annual Canada (Hybrid), November 30 - December 1 Register Here

ETF TV News #111 Stacy Fuller, Partner at K&L Gates and Dave Nadig, Financial Futurist at ETF Trends discuss how FINRA rule 22-08 could limit retail investor access to many mutual funds, ETFs, and closed-end funds with Deborah Fuhr on ETF TV #PressPlay https://bit.ly/3uRSDQR

ETF TV News #111 Stacy Fuller, Partner at K&L Gates and Dave Nadig, Financial Futurist at ETF Trends discuss how FINRA rule 22-08 could limit retail investor access to many mutual funds, ETFs, and closed-end funds with Deborah Fuhr on ETF TV #PressPlay https://bit.ly/3uRSDQR

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

ETF TV News is sponsored by Syntax Advisors. For more information on ETF TV, contact Deborah.Fuhr@ETFtv.net and Oliver@ETFtv.net.

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.