ETFGI reports assets invested in global ETFs industry were 218 percent or 8.82 Tn US dollars larger than the global hedge fund industry at end Q2

Press Release

LONDON — October 21, 2024 — ETFGI, a prominent independent research and consultancy firm specializing in providing subscription research and annual events on trends in the global ETFs industry, reported today assets invested in the global ETFs industry were 218 percent or 8.82 trillion US dollars larger than the global hedge fund industry at the end of Q2 2024. Assets invested in the global ETFs industry first surpassed those invested in the global hedge fund industry nine years ago at the end of Q2 2015. (Source for hedge fund data is HFR. All dollar values in USD unless otherwise noted.)

Highlights

- Assets under management in the global ETFs industry were 218% or $8.82 trillion larger than those in the global hedge fund industry as of the end of Q2 2024

- Assets in the global ETFs industry were $13.14 trillion at the end of Q2 2024

- Assets in the global Hedge fund industry were $4.31 trillion at the end of Q2 2024

- The HFRI Fund Weighted Composite Index was up 0.67%, while the S&P 500 Index with dividends has increased 4.28% in Q2 2024.

- The global hedge fund industry gathered net outflows of $9.4 billion during Q2 2024 while ETFs/ETPs gathered net inflows of $332.85 billion.

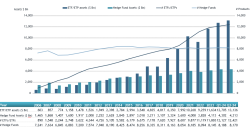

Assets invested in the global ETFs industry first surpassed those invested in the hedge fund industry at the end of Q2 2015, as ETFGI had forecasted. Growth in assets in the ETFs industry has outpaced growth in the hedge fund industry since the financial crisis in 2008. According to ETFGI’s analysis $13.14 trillion were invested in 12,421 ETFs listed globally at the end of Q2 2024, representing an increase in assets of 3.4% over the quarter. Over the same period assets invested in hedge funds globally increased by 0.3%, to $4.31 trillion in 8,170 hedge funds.

During the second quarter of 2024, ETFs listed globally gathered $332.85 billion in net inflows, according to ETFGI’s Global ETF and ETP industry insights report. At the same time, HFR notes that hedge funds reported net outflows of $9.4 billion.

Asset growth in global ETFs and global hedge fund industry, as at end of Q2 2024

Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources and data generated in-house and HFR for hedge fund data.

In Q2 2024 the performance of the HFRI Fund Weighted Composite Index was up 0.67%, while the S&P 500 Index with dividends increased by 4.28%.

Sources: HFR, ETFGI

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

📢One week to go! Register Now to secure your spot at the 5th Annual ETFGI Global ETFs Insights Summit – U.S. at The Yale Club in New York City, next Tuesday, October 29th.

The summit is designed to provide the opportunity for traders, portfolio managers, and advisors at buyside institutional investor and financial advisors to examine how ETFs are being used, selected and traded and hear about the most current regulatory, index, product trends: active, bitcoin, crypto, thematic and trading developments that are impacting investors.

Register now to join us at this exclusive gathering to network and connect with key industry leaders.

SPEAKERS WILL INCLUDE (check our website for updates):

TOPICS WILL INCLUDE (check our website for updates):

- Fireside Chat with Luis Berruga, Industry Veteran

- Understanding Market Trends and User Behavior in ETFs

- The Evolution and Future of Active ETFs

- Trends and Insights on FINRA’s Role in Shaping ETFs and Their Use

- Hot Regulatory Topics - SEC and the Future of ETFs

- What’s Next for Digital Asset Tokenization

- Emerging Trends in Model Portfolios and Future Opportunities

- International ETF Markets: Regional Insights

- Future Perspectives: Insights from Industry Leaders

- Future of ETFs: Trends and Analysis by ETFGI

ADDITIONAL HIGHLIGHTS:

🆓 Free Registration: For CFA members, buy-side institutional investors, and financial advisors.

📚 CPD Credits: Earn educational credits.

🎧 On-Demand Access: All sessions will be recorded and accessible after the event.

🌐 Industry Leaders: Engage with ETF sponsors, exchanges, broker-dealers, institutional investors, regulators, and more.

🥂 Exclusive In-Person Networking: Networking lunch and a networking drinks reception sponsored by Waystone

![]()

You can also register for our 6th Annual ETFGI Global ETFs Insights Summits - #Canada – November 27th in Toronto. Register before October 18th for an early bird discount https://bit.ly/4bu7Mv8

If you are interested in sponsoring or speaking at any of our upcoming events or have any questions, please contact us deborah.fuhr@etfgi.com and margareta.hricova@etfgi.com.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 6th Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.