Korean retail investors continue to be active purchasers of overseas listed ETFs in June

Press Release

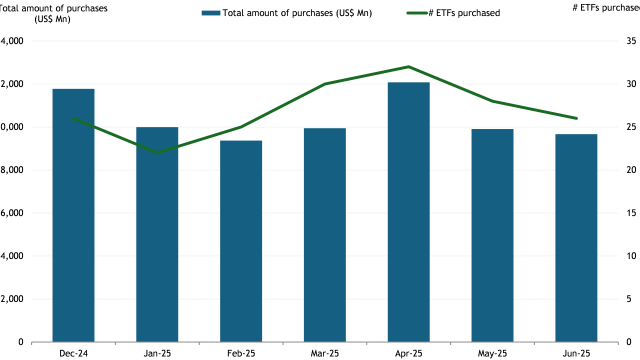

LONDON — July 24, 2025 —ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that in June 2025, 26 of the top 50 overseas securities purchased by Korean retail investors were U.S.-listed ETFs. This marks a slight decline from 28 ETFs in May, 32 in April, and 30 in March.

In terms of volume, Korean retail investors purchased US$9.66 billion in overseas ETFs in June. The peak month so far in 2025 was April, with a record USD 12.08 billion in ETF purchases. (All dollar values in USD unless otherwise noted)

Highlights

- Korean retail investors purchased $9.66 billion in overseas ETFs in June

- 26 of the top 50 overseas purchase were ETFs listed in the United States

- 17of the top 26 ETFs on the list provide leverage or inverse exposure.

- The largest purchase was $2.58 Bn of DIREXION DAILY TSLA BULL 2X SHARES listed in the U.S.

Total Amount of overseas ETFs purchased by Korean retail investors by month in 2025

|

Dec-24 |

Jan-25 |

Feb-25 |

Mar-25 |

Apr-25 |

May-25 |

Jun-25 |

|

|

# ETFs purchased |

26 |

22 |

25 |

30 |

32 |

28 |

26 |

|

Total amount of ETF purchases (US$ Mn) |

11,773 |

9,992 |

9,366 |

9,942 |

12,076 |

9,904 |

9,664 |

Source, Korea Securities Depository.

Top 10 overseas ETFs purchased in June

|

ETF Name |

Purchase Amount in USD |

|

DIREXION DAILY TSLA BULL 2X SHARES |

2,575,274,762 |

|

SPDR SP 500 ETF TRUST |

1,496,276,095 |

|

DIREXION DAILY SEMICONDUCTORS BULL 3X SHS ETF |

1,384,294,310 |

|

DIREXION SEMICONDUCTOR BEAR 3X ETF |

669,344,845 |

|

PROSHARES ULTRAPRO QQQ ETF |

307,390,839 |

|

VS TRUST 2X LONG VIX FUTURES ETF NEW SPLR 969626124 US92891H5072 |

307,313,667 |

|

VOLATILITY SHARES TRUST 2X ETHER ETF NEW SPLR 974476707 US92864M4006 |

276,134,549 |

|

PROSHARES TRUST ULTRAPRO SHORT QQQ NEW 2022 |

255,744,299 |

|

ISHARES 0-3 MONTH TREASURY BOND ETF |

234,753,243 |

|

GRANITESHARES 2.0X LONG NVDA DAILY ETF |

233,981,299 |

Source, Korea Securities Depository.

The ETF industry in Korea has 1,370 ETFs, with assets of $167.38 Bn, from 38 providers listed on the Korea Exchange at the end of June 2025. 23.07% of the ETFs provide leverage or inverse exposure which account for 7.74% of the assets in the ETF industry in Korea.

Asset Growth in Korea ETF industry as of the end of June

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

|

|

|

|

|

|

|

|

|

|

|

Disclaimer: This press release is published by, and remains the copyright of, ETFGI LLP ("ETFGI") or its licensors. The information and data in this press release is for information purposes only. ETFGI makes no warranties or representations regarding the accuracy or completeness of the information contained on this press release.

ETFGI does not offer investment advice or make recommendations regarding investments and nothing in the press release shall be deemed to constitute financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. Further, nothing in this press release shall constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any such activity based on information contained in this press release, you do so entirely at your own risk and ETFGI shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Our registered office is at 130 Jermyn Street, 2nd Floor, St James’s, London, SW1Y 4UR.