High Net Worth and corporate investor participation in the ETFs industry in India have more than doubled in the past five years

Press Release

LONDON — August 05, 2025 — ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, Corporate and high-net-worth investor participation in ETFs more than doubled between 2021 and 2025, with corporate investors rising from 39,358 to 94,042 and HNIs from 2,939 to 11,183.

Total assets invested in the ETFs industry in India reached a record high of $107.82 billion in June 2025. This surpasses the previous highs of $93.44 billion in 2024 and $68.36 billion in 2023. (source: the Association of Mutual Funds in India (AMFI), all values are in USD unless otherwise noted.)

Corporate Investors remain the dominant force, accounting for 87.22% of total ETF assets in June 2025.

Foreign Institutional Investors (FIIs) represent the smallest share, with just 0.00004% of the market.

Both corporate and high-net-worth investor AUM have shown steady growth from June 2021 through 2025, reflecting increasing institutional and affluent individual interest in ETFs.

Five year comparison of investors in ETFs in India by investor classification.

|

Investor Classification |

AUM ($ Mn) Jun-25 |

AUM ($ Mn) Jun-24 |

AUM ($ Mn) Jun-23 |

AUM ($ Mn) Jun-22 |

AUM ($ Mn) Jun-21 |

|

Corporates |

94,040 |

82,429 |

60,794 |

47,474 |

39,358 |

|

Banks/FIs |

261 |

286 |

599 |

129 |

329 |

|

FIIs |

0 |

3 |

9 |

7 |

8 |

|

High Networth Individuals* |

11,183 |

8,187 |

5,378 |

4,179 |

2,939 |

|

Retail |

2,334 |

2,534 |

1,580 |

1,198 |

734 |

|

Total |

107,817 |

93,438 |

68,360 |

52,987 |

43,368 |

*Defined as individuals investing Rs 2 lakhs and above

Source: Association of Mutual Funds in India

Nearly 40% of assets invested in Gold ETFs are held by high-net-worth and retail investors.

A total of 228,700 High-Net-Worth Investors (HNI) portfolios reported holding $2.38 billion in Gold ETFs, representing a 31.44% market share. This marks a significant increase from 2021, when only 43,319 HNI portfolios held Gold ETFs. SEBI defines a high-net-worth investor as an individual who invests more than ₹200,000 (approximately $2,388.86) per transaction.

Over 7.41 million retail investor portfolios held $605 million in Gold ETFs, accounting for 8.01% of the market. In comparison, only 1.78 million retail portfolios reported Gold ETF holdings in 2021.

16,761 corporate portfolios reported holding $4.58 billion, which represents 60.55% of the total assets invested in Gold ETFs.

Investment in Gold ETFs in India by investor type as of the end of June

|

Gold ETFs |

Investor |

Assets (US$ Mn) |

% to Total |

No of Folios |

% to Total |

|

|

Corporates |

4,576 |

60.55 |

16,761 |

0.22 |

|

Banks/FIs |

0 |

0.00 |

4 |

0 |

|

|

|

FIIs |

- |

- |

- |

- |

|

High Networth Individuals* |

2,376 |

31.44 |

228,727 |

2.99 |

|

|

|

Retail |

605 |

8.01 |

7,408,666 |

96.79 |

|

Total |

7,558 |

100 |

7,654,158 |

100 |

*Defined as individuals investing Rs 2 lakhs and above

Source: Association of Mutual Funds in India

Corporate Dominance in Non-Gold ETF Investments – June 2025

As of June 2025, corporates account for 89.23% of the $100.26 billion invested in ETFs excluding gold, according to the latest data.

Together, over 20.5 million retail and HNI portfolios represent 10.50% of the total assets invested in non-gold ETFs. Despite their smaller share of assets, they make up 99.43% of all portfolios in this segment.

This marks a significant increase from 2021, when fewer than 5.34 million such portfolios reported holdings in non-gold ETFs.

Investment in ETFs (excluding gold ETFs) in India by investor type as of the end of June

|

ETFs(other than Gold) |

Investor |

Assets (US$ Mn) |

% to Total |

No of Folios |

% to Total |

|

|

Corporates |

89,463 |

89.23 |

118,325 |

0.57 |

|

Banks/FIs |

261 |

0.26 |

42 |

0 |

|

|

|

FIIs |

0 |

0 |

4 |

0 |

|

High Networth Individuals* |

8,807 |

8.78 |

1,207,365 |

5.86 |

|

|

|

Retail |

1,729 |

1.72 |

19,288,132 |

93.57 |

|

Total |

100,259 |

100 |

20,613,868 |

100 |

*Defined as individuals investing Rs 2 lakhs and above

Source: Association of Mutual Funds in India

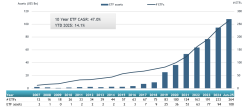

The ETF industry in India had 264 ETFs, with 264 listings, assets of $107.74 Bn, from 24 providers on 2 exchanges, at the end of June, source from ETFGI. During June, the ETFs industry in India gathered net inflows of

$161.20 Mn. Commodity ETFs gathered the largest net inflows with $489.91 Mn, while equity ETFs suffered the largest net outflows of $323.84 Mn, followed by fixed income ETFs with $4.88 Mn.

ETFs industry in India asset growth at end of June 2025

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

Register now to attend our 6th Annual ETFGI Global ETFs Insights Summit - Asia Pacific on September 3rd in Hong Kong, and virtually on September 4th.

Don’t miss the opportunity to hear from and network with industry leaders from ETF issuers, regulators, investors, exchanges, trading firms across the ETFs markets in the Asia Pacific region as they share key insights and explore the trends driving the future of the ETF landscape.

Speakers will include:

Topics will include:

Sept 3rd, Day 1 in Hong Kong

- Trends in the Global ETF Industry - ETFGI Research

- Fireside Chat - Regulatory Update

- Global Macro Outlook

- Innovation, Growth and Changing Demographics: The ETF Story in APAC

- How Investors are Using ETFs

- The Rise of Active ETFs in Asia Pacific

- Accessing India

- Rise of Alternative Strategies in the ETF Wrapper

- Understanding the Evolving Landscape of ETFs in Taiwan

- Understanding the Evolving Landscape of ETFs in China

- Understanding the Changing Fundamentals in Vietnam

- Opportunities for Virtual Assets and Tokenization in Asia Pacific

- Outlook for ETFs in Asia Pacific – What's Next?

- Networking drinks hosted by State Street

Sept 4th, Day 2 virtual sessions

- The Evolution and Outlook for ETFs in Australia

- Regulatory Update for India

- The Evolution and Outlook for ETFs in India

- The Evolution and Outlook for ETFs in Singapore

- The Evolution and Outlook for ETFs in Pakistan

- The Evolution and Outlook for ETFs in Korea

- The Evolution and Outlook for ETFs in Malaysia

- The Evolution and Outlook for ETFs in Thailand

- The Evolution and Outlook for ETFs in Indonesia

The summit is designed as an educational event to foster deep, insightful discussions on the evolving role of ETFs including Active and virtual assets for financial advisors and institutional investors in the ETF markets in the Asia-Pacific region. Explore how market structure, regulations, due diligence, trading practices, and technological advancements are shaping ETF product development, usage, and innovation across jurisdictions.

Secure your spot today and be part of the conversation shaping the future of ETFs in Asia-Pacific! Register now!

📅 Event Dates: September 3rd in Hong Kong and September 4th virtually

📍 Location: Centricity – Concentric, 2/F, Landmark Chater House, 8 Connaught Rd Central, Central, Hong Kong

🆓 Free Registration: For CFA members, Hong Kong Securities and Investment Institute, buy-side institutional investors, and financial advisors.

![]() CPD Credits: Earn educational credits

CPD Credits: Earn educational credits

📋Check out the agenda, speakers, and topics from last year's successful ETFGI Global ETFs Insights Summits - Asia Pacific: https://bit.ly/47GyfE1

|

|

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

![]()

Disclaimer: This press release is published by, and remains the copyright of, ETFGI LLP ("ETFGI") or its licensors. The information and data in this press release is for information purposes only. ETFGI makes no warranties or representations regarding the accuracy or completeness of the information contained on this press release.

ETFGI does not offer investment advice or make recommendations regarding investments and nothing in the press release shall be deemed to constitute financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. Further, nothing in this press release shall constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any such activity based on information contained in this press release, you do so entirely at your own risk and ETFGI shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Our registered office is at 130 Jermyn Street, 2nd Floor, St James’s, London, SW1Y 4UR.