Overseas ETF Investments by Korean Retail Investors Reach All-Time High of US$15.85 Billion in October

Press Release

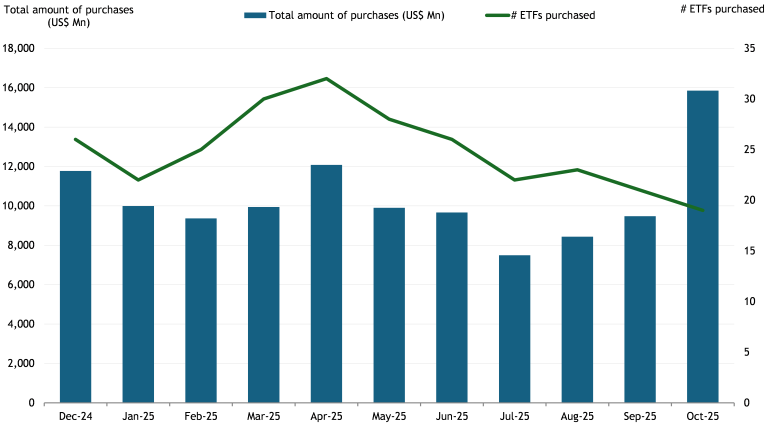

LONDON — November 19, 2025 — ETFGI, a leading independent research and consultancy firm recognized for its expertise in subscription research, consulting services, global industry events, and ETF TV, announced today that overseas ETF investments by Korean retail investors reached an all-time high of US$15.85 billion in October beating the previous record of US$12.49 billion in November 2024.

During the month, 19 of the top 50 overseas securities purchased by Korean retail investors were U.S.-listed ETFs, a slight decrease from 21 in September, 23 in August, and 22 in July. (All dollar values in USD unless otherwise noted)

Starting in December, the Financial Supervisory Service FSS will require individual investors in Korea who wish to trade overseas-listed derivatives, leveraged exchange-traded funds (ETFs), or exchange-traded notes (ETNs) will be required to complete mandatory pre-investment education and participate in simulated trading sessions.

Highlights

- Overseas ETF Investments by Korean Retail Investors Reach All-Time High of $15.85 Billion in October

- 19 of the top 50 overseas securities purchased were U.S.-listed ETFs

- 12 of the top 19 ETFs provided leveraged or inverse exposure

- Largest purchase: $4.90 billion in Invesco QQQ Trust Series 1 ETF (U.S.-listed)

Total Amount of overseas ETFs purchased by Korean retail investors by month in 2025

|

Dec-24 |

Jan-25 |

Feb-25 |

Mar-25 |

Apr-25 |

May-25 |

Jun-25 |

Jul-25 |

Aug-25 |

Sep-25 |

Oct-25 |

||

|

# ETFs purchased |

26 |

22 |

25 |

30 |

32 |

28 |

26 |

22 |

23 |

21 |

19 |

|

|

Total amount of ETF purchases (US$ Mn) |

11,773 |

9,992 |

9,366 |

9,942 |

12,076 |

9,904 |

9,664 |

7,489 |

8,433 |

9,478 |

15,846 |

|

Source, Korea Securities Depository.

Top 10 overseas ETFs purchased in October

|

ETF Name |

Purchase Amount in USD |

|

INVESCO QQQ TRUST SRS 1 ETF |

4,902,110,731 |

|

SPDR SP 500 ETF TRUST |

2,429,709,005 |

|

DIREXION DAILY SEMICONDUCTORS BULL 3X SHS ETF |

1,946,082,978 |

|

DIREXION DAILY TSLA BULL 2X SHARES |

1,573,555,092 |

|

VANGUARD SP 500 ETF SPLR 39326002188 US9229084135 |

952,356,117 |

|

VOLATILITY SHARES TRUST 2X ETHER ETF NEW SPLR 974476707 US92864M4006 |

538,014,314 |

|

T-REX 2X LONG BMNR DAILY TARGET ETF |

460,843,088 |

|

DIREXION SEMICONDUCTOR BEAR 3X ETF |

367,785,843 |

|

GRANITESHARES 2.0X LONG NVDA DAILY ETF |

320,324,771 |

|

SPDR GOLD SHARES ETF |

300,464,763 |

Source, Korea Securities Depository.

The ETF industry in Korea has 1,431 ETFs, with assets of $206.08 Bn, from 39 providers listed on the Korea Exchange at the end of October 2025. 21.94% of the ETFs provide leverage or inverse exposure which account for 6.61% of the assets in the ETF industry in Korea.

Asset Growth in Korea ETF industry as of the end of October

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

|

Register now to attend our 7th Annual ETFGI Global ETFs Insights Summit – Canada on December 9 in Toronto at Borden Ladner Gervais LLP (BLG)’s office! The summit is designed as an educational event to foster deep, insightful discussions on the use, due diligence and selection and best trading practices for ETFs by financial advisors and institutional investors in Canada. Explore how regulatory changes are impacting product development including share classes, Active ETFs, Alternative ETFs, Crypto, digital assets and tokenisation and market structure. |

|

|

|

|

|