ETFGI reports assets invested in ETFs and ETPs listed in Asia Pacific (ex-Japan) decreased by 4.53% during June 2018, the largest monthly decrease since January 2016 which had a decrease of 9.03%

LONDON — July 31, 2018 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in ETFs and ETPs listed in Asia Pacific (ex-Japan) decreased to US$176 billion at the end of June 2018. Assets decreased 4.53% from US$184 billion at the end of May, the largest monthly decrease since January 2016 which had a decrease of 9.03%. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs/ETPs listed in Asia Pacific (ex-Japan) decreased by 4.53% during June 2018 to $176 Bn.

- Year-to-date, assets have increased by 3.18% from $170 Bn at the end of 2017.

- In June 2018, ETFs/ETPs listed in Asia Pacific (ex-Japan) saw net inflows of $2.99 Bn.

The S&P 500 was up 0.62% in June and 2.65% in the first half of 2018. International markets (developed ex US) and Emerging markets posted losses during June and during the first half of 2018, down 1.48% and 3.40% in June and 2.45% and 6.05% in the first half, respectively, driven by a strong dollar, trade concerns, and rising interest rates.

According to ETFGI’s June 2018 Asia Pacific (ex-Japan) ETF and ETP industry insights report, an annual paid-for research subscription service, assets invested in ETFs/ETPs listed in Asia Pacific (ex-Japan) decreased by 4.53% from $184 Bn at the end of May. Year-to-date, assets have increased by 3.18% from $170 Bn at the end of 2017. At the end of June 2018, the Asia Pacific (ex-Japan) ETF/ETP industry had 1,275 ETFs/ETPs, with 1,419 listings, from 133 providers on 17 exchanges.

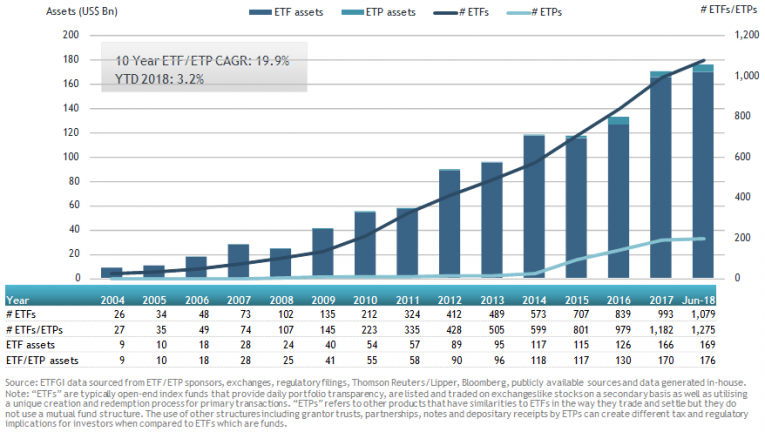

Asia Pacific (ex-Japan) ETF and ETP asset growth as at end of June 2018

In June 2018, ETFs/ETPs listed in Asia Pacific (ex-Japan) saw net inflows of $2.99 Bn. Equity products gathered the largest net inflows with $3.58 Bn, while fixed income ETFs/ETPs experienced the largest net outflows with $674 Mn. Year-to-date through end of June, ETFs/ETPs listed in the region have seen net inflows of $20.8 Bn. Equity products have gathered the largest net inflows during 2018 with $13.0 Bn, while currency ETFs/ETPs have experienced the largest net outflows with $28.7 Mn.

Investors have tended to invest in market cap ETFs during 2018, with the E Fund ChiNext Price Index ETF (159915 CH) and China CSI 500 ETF (510500 CH) capturing flows of $1.46 Bn and $1.45 Bn, respectively. A high proportion of net inflows year-to-date can be attributed to the top 20 ETFs by net new assets, which collectively gathered $14.3 Bn.

Top 20 ETFs by YTD net inflows: Asia Pacific (ex-Japan)

|

Name |

Country listed |

Ticker |

Assets |

ADV |

NNA |

|

E Fund ChiNext Price Index ETF |

China |

159915 CH |

1,967 |

133.4 |

1,462 |

|

China CSI 500 ETF |

China |

510500 CH |

3,641 |

92.0 |

1,450 |

|

Polaris Taiwan Top 50 ETF |

Taiwan |

0050 TT |

2,604 |

17.8 |

1,301 |

|

Bosera Gold Open-End ETF |

China |

159937 CH |

1,243 |

14.9 |

1,187 |

|

Samsung KODEX Leverage ETF |

South Korea |

122630 KS |

2,475 |

186.9 |

1,132 |

|

Huaan ChiNext 50 ETF Fund |

China |

159949 CH |

837 |

66.4 |

972 |

|

Pingan-UOB CSI 300 ETF Index Fund |

China |

510390 CH |

681 |

1.9 |

879 |

|

Huatai-Pinebridge CSI 300 ETF |

China |

510300 CH |

3,385 |

100.8 |

825 |

|

E Fund Hang Seng China Enterprises ETF |

China |

510900 CH |

1,441 |

258.4 |

651 |

|

Yuanta/P-shares CSI 300 2X Bull ETF |

Taiwan |

00637L TT |

1,418 |

64.6 |

631 |

|

iShares S&P Global 100 ETF |

Australia |

IOO AU |

1,040 |

1.3 |

534 |

|

BofA Merrill Lynch 15+ Year US Banking Index ETF |

Taiwan |

00724B TT |

547 |

7.8 |

449 |

|

BofA Merrill Lynch 15+ Year US Tech Index ETF |

Taiwan |

00723B TT |

464 |

11.3 |

395 |

|

UTI Nifty Exchange Traded Fund |

India |

UTNIFTY IN |

1,192 |

0.0 |

391 |

|

Samsung KODEX 200 Total Return ETF |

South Korea |

278530 KS |

513 |

2.7 |

366 |

|

Fuh Hwa 1-5 Yr High Yield ETF |

Taiwan |

00710B TT |

380 |

0.0 |

352 |

|

KB KBSTAR KTB 3Y Futures Inverse ETF |

South Korea |

282000 KS |

441 |

11.1 |

351 |

|

Fubon SSE180 Leveraged 2X Index ETF |

Taiwan |

00633L TT |

1,096 |

51.1 |

324 |

|

ChinaAMC Hang Seng Index ETF |

China |

159920 CH |

583 |

93.3 |

316 |

|

Fubon China Policy Bank Bond ETF |

Taiwan |

00718B TT |

564 |

6.2 |

310 |

Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources and data generated in-house. Note: This report is based on the most recent data available at the time of publication. Asset and flow data may change slightly as additional data becomes available.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

Featured Events

ETFs Global Markets Roundtable conference in Hong Kong will be on Oct 9th

The ETFs Global Markets Roundtable events are a series of conferences organised by ETFGI and Capital Markets Strategies. Our first event took place in June 2017 in New York City. In 2018 ETFs Global Markets Roundtable conferences were held in London on April 19 (covering EMEA), New York on May 15 (covering USA/Latin America), and Toronto on May 31 (covering Canada). The events offer an opportunity for a substantive and in-depth discussion about the liquidity, trading, technological and regulatory developments impacting ETFs in the respective jurisdictions.

The links to our prior events are below:

London

New York

Toronto

The events are designed to provide the opportunity for buyside traders and portfolio managers from the institutional investor community, as well as other market participants and professionals involved in the ETF space, to hear current thoughts from industry leaders on ETF trends, market structure and regulation, and obtain a better understanding of how to trade and use ETFs, and of the impact that ETFs have on the markets and market structure.

Free registration for qualified institutional buyside portfolio managers and traders and for financial advisors.

If you are interested in sponsorship or participation at the conference, please contact Deborah Fuhr at deborah.fuhr@etfgi.com

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in London offering consulting services and paid for research subscription services. Deborah Fuhr is the Managing Partner and a founder of ETFGI. Our services are unique in their breadth and depth of coverage in monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFs Global Markets Roundtable events 2018

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include she was the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” a not for profit organization to connect, support and inspire Women and Men in the ETF ecosystem. WE has over 4,200 members in chapters around the world. www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs